The GST portal has enabled a new invoice management system (IMS) to facilitate invoice corrections and revisions from October 14th, 2024. The IMS enables recipients to review and approve or reject invoices submitted by vendors in GSTR-1, IFF, or 1A.

Need IMS GST Software

What is an Invoice Management System Under GST?

Recipients can accept, reject, or hold invoices in IMS. In their GSTR-2B, the accepted invoices would be prompted, and the rejected or due invoices shall not. If there is no measure opted, then the invoices are considered accepted.

The suppliers would be required to address any revisions or corrections before filing GSTR-1 or GSTR-1A. The supplier’s GSTR-3B obligation shall be affected when the recipients reject invoices or credit notes in the forthcoming durations.

The system would have the objective to rectify the precision and compliance in the GST reporting, mandating the recipients to opt for the timely measures and maintain the records. The automated and manual measures, along with compliance with section 16(4) of the CGST Act, are important for accurate tax management.

Latest Update

- GST department issues an advisory regarding the importing of goods through the IMS. read more

- The new advisory relates that there is no change in ITC auto-population, which remains the same despite the implementation of IMS. View More

- The new GST IMS advisory, effective from October, aims to simplify the taxation system and reduce the compliance burden. View more

- The new Advisory No. 613 provides guidance on managing inadvertently rejected records in IMS. View more

- 55th GST Council Meeting – A new CGST Act, 2017 amendment in respect of the functionality of the GST Invoice Management System (IMS), read more

- New Advisory on Supplier View Functionality under IMS (Invoice Management System). Read more

- The new advisory from the Invoice Management System (IMS) is related to the implementation of the system during the initial phase. View more

- More important FAQs on the Invoice Management System (IMS), click to read

- GSTN new advisory for the Draft Manual on Invoice Management System to keep pending invoices. Read PDF

- IMS would allow taxpayers to accept, reject, or keep invoices pending straight via the portal.

Invoice Management System Features

Manage Invoices in Real Time: The assessee can view and choose action on invoices uploaded by suppliers in real time. The system permits businesses to handle their invoices efficiently, ensuring that no ITC entitlement is absent or claimed erroneously.

Supplies of Inbound and Outbound: Two sections are being furnished by the IMS dashboard, one to manage the inward supplies (invoices from suppliers) and the other for the outward supplies (invoices issued to the customers). The outward supplies section will be available, and the inward supplies can be handled quickly.

Improve ITC Accuracy: IMS furnishes a chance to scrutinise invoices before they are processed for ITC claims. The accepted invoices shall contribute to the ITC computation in GSTR-2B, while rejected invoices shall not be included in the ITC pool.

Decisions on invoices:

- Accept: In GSTR-2B, the invoice is valid and shall be regarded for ITC

- Reject: The invoice is wrong, and no ITC shall be claimed

- Pending: Thereafter, the invoice shall be analysed, and no measure shall be opted till then

Deemed Acceptance: If no action has been undertaken by the assessee, the system automatically considers the invoices as accepted on the generation of GSTR-2B dated the 14th of every month.

Flexible Calculating of GSTR-2B: The assessee can carry on to edit their measures on invoices even after the draft GSTR-2B is generated. If a taxpayer modifies any information after the 14th of the month, they need to recalculate GSTR-2B before submitting GSTR-3 B.

Functionality in Bulk Action: To streamline extensive transaction volumes, IMS enables taxpayers to simultaneously accept, reject, or flag multiple invoices as pending. A bulk selection feature guarantees efficient handling of numerous invoices.

Tax Payment Deadline for Quarterly GST Return Filers

Under the QRMP scheme, quarterly filers are mandated to pay their GST liabilities on a monthly basis, even though they file returns quarterly.

- First Two Months: Payment by the 25th of the subsequent month

- Quarter-End Month: Last date of Filing of GSTR-3B for the entire quarter

Tax Payment Methods for a Quarterly Basis Under GST

Two methods for GST payment are being proposed by the QRMP scheme:

Fixed-Sum Method

For the Quarterly GST return filers, the Fixed-Sum Method is a simpler method for paying their tax. They are enabled to pay a pre-determined amount based on their earlier tax obligation rather than computing the exact tax every month.

Working Method

- The system calculates 35% of the tax you paid in cash for that quarter if you filed your GST return last quarter.

- This amount is proposed as your monthly tax for the first two months of the current quarter.

For Example

Let’s say in the earlier quarter, you paid ₹20,000 as tax using cash.

As per the Fixed-Sum Method, you file 35% of ₹20,000, which is ₹7,000, as your tax for each of the first two months of the current quarter.

In the third month, you shall file your quarterly GSTR-3B, reconcile your tax liability, and pay any balance amount, if needed.

The same method is easier and lessens the annoyance of the monthly computations. But it is important to assure your final payment at the finish of the quarter matches your actual obligation.

Self-Assessment Method

The Self-Assessment Method permits the quarterly GST filers to compute and file their tax based on the actual sales and purchases incurred at the time of each month. The assessee, rather than laying on a fixed amount, determined their exact GST obligation for the month.

Working Method

- Compute the GST collected on your sales (output tax)

- Subtract the GST paid on your purchases (input tax based on GSTR 2B)

- The amount left is your GST obligation for that month

For Example

Imagine you made sales worth ₹1,00,000 in a month, and the GST on these sales is ₹18,000 (output tax). During the same month, you purchased goods worth ₹80,000, and the GST on these purchases is ₹14,400 (input tax).

Now, calculate your monthly GST liability: ₹18,000 (output tax) – ₹14,400 (input tax) = ₹3,600. You’ll need to pay ₹3,600 as GST for that month.

You will pay the exact amount of tax through this method based on your transactions, making it factual, but directing proper record-keeping and calculations.

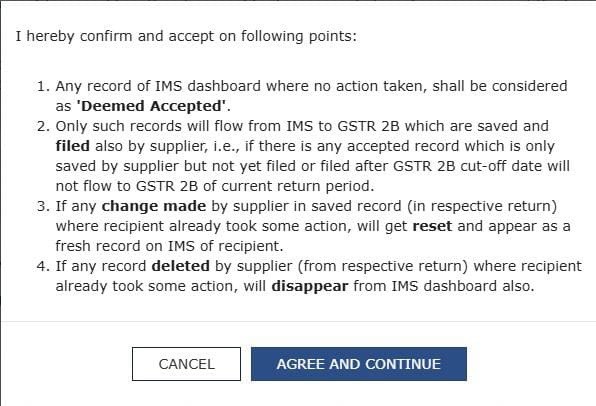

IMS Dashboard New Guidelines for Deemed Acceptance and Record Handling

Updated guidelines for managing the records on the Invoice Matching System (IMS) dashboard have been introduced by the Goods and Services Tax (GST) framework to rectify the clarity and facilitate the GSTR-2B reconciliation procedure.

All New Highlights

- Flow of Records to GSTR-2B: Merely the records that are saved and filed via the supplier would flow from IMS to GSTR-2B. The accepted records would not be included in the current return period. GSTR-2B have been saved but not filed via the supplier or filed after the GSTR-2B cut-off date. The same measures ensure that merely the whole processed records are comprised in the final reconciliation.

- Deemed Acceptance: Any IMS record where the recipient does not take any action will now be considered as ‘Deemed Accepted.’ For the users who do not answer the records listed on the dashboard, the same automatic acceptance is applicable.

- Deleted Records: When a record has been removed by the supplier from their return after the recipient has acted on the same before then, the record will indeed disappear from the IMS dashboard of the recipient, ensuring an updated and precise record display.

- Handling of Supplier Changes: If a supplier amends a saved record in their respective return and the recipient has taken action before on the record, then it will reset in the IMS. The same revised record will appear as a new entry for the recipient, permitting a fresh review of any updated data.

Such measures can decrease discrepancies in GST compliance, which makes it simpler for businesses to handle the ITCs and facilitate their tax filing process. The tax professionals suggest analyzing the IMS dashboard records to prevent the Deemed Acceptance and ensure precise record-keeping.

What is The Way to Use the IMS?

Access the GSTN Official Portal: Log in to the GST portal (www.gst.gov.in), navigate to Services > Returns > Invoice Management System (IMS), and view the available invoices.

Consider Inbound Supplies: The inward supplies notified from the suppliers are classified into accepted, rejected, pending, or no-action-taken invoices. The assesses are authorized to filter such records based on distinct criteria like GSTIN or invoice date.

Take Action: Choose the invoices you want to act on. You can individually or in bulk accept, reject, or keep them pending. Tap on the save button to finalize your decision after selecting the action.

Download Records and Documents: IMS furnishes a typical Excel download option for the assesses to analyze their invoices offline.

In What Way Does the IMS (Invoice Management System) Work Under GST?

Once a supplier saves an invoice in their GSTR-1, then the same would appear in the IMS dashboard of the recipient assessee.

The recipient could choose to accept, reject, or leave the invoice pending.

Accepted invoices would automatically become a portion of the receiver’s GSTR-2B as eligible ITC, which would then populate in their GSTR-3B for the respective tax duration.

When there has been no measure towards an invoice, the same would be regarded as accepted and comprised in GSTR-2B.

This system would ensure that merely the genuine and verified invoices would contribute to the ITC claims, lessening the errors and discrepancies in tax filings.

Major Points

- Exclusively, the accepted invoices via the recipients shall become part of GSTR-2B and the flow in distinct tabs of GSTR 2B

- Based on the action that the recipient has taken, a draft GSTR-2B will be made available to the recipient on the 14th of the forthcoming month

- The recipient can take measures of accept/reject or keep pending even after the generation of GSTR-2B till the filing of GSTR-3B, and when the recipient has proceeded with the measures on any invoice post-14th of the month, he shall be required to again calculate the GSTR-2B. Therefore GSTR 2B recomputing facility would be enabled.

- After the filing of GSTR-3B for a certain month, the recipient can not take measures on an invoice

- GSTR 2B for the following month can be generated merely after filing the previous GSTR 3B

- The taxpayers can claim the invoices that shall be kept pending at any forthcoming point in time; however, not after the set limits by Section 16(4) of the CGST Act, 2017

- Obligation measure to be taken: Original ‘Credit note’, ‘Upward amendment of the credit note’, and ‘Downward amendment of the credit note if the original credit note was not accepted by the recipient’

- It is feasible for the supplier to see what measure has been opted for by the recipient on the invoices in IMS

- On the original record, it is important to take action and furnish the respective GSTR 3B before taking action on the amended record (amended through GSTR-1A/GSTR-1) when the original and amended records are of two different GSTR 2B return periods. If both the records are of the same period’s 2B, merely revised records would be regarded for the ITC computation of GSTR 2B

- The records/invoices saved or filed via IFF by a QRMP taxpayer will flow to IMS for the recipient

- GSTR-2B for a QRMP taxpayer will be generated every quarter

- Inward RCM supplies where the supplier has been notified in Table 4B of IFF / GSTR 1 or GSTR 1A, and supplies where ITC is not suitable due to section 16(4) of the CGST Act or on account of the POS rule, both such supplies will not move to IMS and will be directly populated in the GSTR 3B

IMS Provides Numerous Benefits for GST Taxpayers

Let’s follow a few important new Invoice Management System (IMS) offers, which provide several advantages to taxpayers.

- Through the analysis of each invoice, before it becomes part of their ITC claims, the assessee can ensure precision and prevent issues during audits.

- Before filing their GSTR-3B, the assessee must act on the invoices.

- In the forthcoming tax periods, the pending invoices can be addressed.

- The IMS for those who use the quarterly return monthly payment (QRMP) scheme will integrate with their existing processes, which generate the GSTR-2B quarterly, in line with their filing schedule.

IMS Impact in GSTR-2B and GSTR-3B

Draft GSTR-2B Generation: The system on the 14th of March of each month shall generate a draft GSTR-2B for the taxpayer along with all the accepted and no-action chosen invoices. The same draft could be regarded as the final GSTR=2B if no additional measures are opted.

Recomputing GSTR-2B: If on the invoices any measure is taken after the draft is generated, then the assessees are required to recompute their GSTR-2B before GSTR-3B filing to show the updated ITC information.

Implementation Issues in New GST Invoice Management System

The GST portal generates GSTR-2B quarterly for taxpayers filing quarterly GST returns with the introduction of the Invoice Management System (IMS). But, GSTR-2B is not generated for the first two months of the quarter.

A Challenge for the Assessee

- Delay in GST Input Tax Credit (ITC): The taxpayers without GSTR-2B struggle to precisely compute the ITC they could claim for the first two months.

- Issues in Releasing the GST Obligation: The assessee should lie on manual reconciliation or estimations, increasing the risk of errors.

- Surged Submission Load: The businesses that face other hurdles in monitoring the invoices and reconciling data manually.

The same problem is not easy for small businesses that do not have the advanced tools or resources for efficient reconciliation.

GST IMS Impact on Small and Medium Enterprises (SMEs)

SMEs with restricted resources might face additional compliance costs. Non-presence of automated tools makes the manual reconciliation time-consuming and error-prone.

Steps Quarterly Filers Need to Follow

- Maintain an updated record of all transactions

- Reconcile ITC manually in the absence of GSTR-2B

- Communicate with vendors to ensure timely reporting of invoices

GSTR-2B Problem Solution

- Utilize IMS Actually: Utilize the IMS to keep precise, real-time data of invoices.

- GST Reconciliation Manual: Reconcile the invoices regularly with the supplier to prevent mismatches.

- Policy Guidance: Request the authorities to furnish the provisional GSTR-2B for the first two months.

- Technology Investment: Utilise the GST software to automate reconciliation.

- Hire Experts: Ask for assistance from the GST consultants to lessen the errors.

- Vendor Contact: You must ensure that the suppliers upload the invoices.

What Does the Same Mean for the Software Companies and GST Authorities?

The IMS depicts a transformation in the tax filing process that requires software companies to adapt their systems to align with the same new operationality.

The IMS for the tax authorities furnishes a clear and reliable system to track the ITC claims, which is directed to future automation opportunities.

AI-driven analysis and automated dispute resolution features can be feasible.

Tax experts remarked that the new advisory from GSTN shows a complete overhaul of the tax filing procedure.

It is tough to have a transition; however, it is important to adapt to the rising statutory environment.

Tax experts stressed that the same move can make the way for the forthcoming advancements in the GST system, along with AI integration and rectified fraud detection.

GSTN Clarifies ITC and Liability for Rejected IMS Records

On the treatment of rejected records accidentally in the Invoice Matching System (IMS), the Goods and Services Tax Network (GSTN) has issued a detailed advisory on June 19, 2025, proposing the needed relief and procedural clarity to taxpayers navigating Input Tax Credit (ITC) and supplier liability intricacies.

As per the clarifications, it cited the way both the receiver and suppliers must manage the cases where the valid invoices, debit notes, or credit notes are inadvertently rejected by the receiver in IMS despite filing the related GSTR-3B return.

Advisory Highlights

- How Recipients Can Reclaim ITC: If a valid document (invoice, debit note, or ECO-document) in IMS has been rejected by a receiver incorrectly, then they can take the ITC by asking the supplier to rereport the same documents unchanged in either the GSTR-1A of the identical tax period or via the revision table in a forthcoming GSTR-1 or IFF.

The full ITC shall be available in the period where the revised documents are shown after the receiver accepts the re-reported document on IMS and recomputes their GSTR-2B.

- No Additional GST Liability on Supplier: In such cases where the supplier re-furnishes on an already reported document without any amendments, there is no rise in their tax obligation. It is due to the revision tables in GSTR-1/IFF merely fetch the delta value, and as the document values stayed the same, no differential obligation is there.

- Input Tax Credit Reversal for Rejected Credit Notes: Concerning the credit notes incorrectly rejected via the receiver, GSTN mentioned that the receiver should reverse the ITC taken earlier after the supplier re-furnishes the identical credit note, and the same is accepted through IMS. In the GSTR-2B of the receiver, this triggers a reduction on recomputation, ensuring correct ITC reporting.

- Impact of Credit Notes on Supplier Liability Under GST: The obligation of the supplier surges when a credit note is rejected by the receiver. But once the supplier re-reports the identical credit note again, then without any revision in GSTR-1A or the amendment table, their obligation is lessened. Merely a one-time adjustment has been ensured by the net effect, keeping neutrality.