The addition on the interest income received out of the fixed deposits has been deleted by the Mumbai Bench of Income Tax Appellate Tribunal (ITAT).

The bench of Kavitha Rajagopal (Judicial Member) and B R Baskaran (Accountant Member) has marked that Assessing Officer (AO) is unable to corroborate the fact that the FD made by the taxpayer is out of the surplus funds held by the taxpayer in a case where the taxpayer has borrowed huge advances from banks and has also availed of an overdraft facility for its business, consequently expending a higher rate of interest than that received out of the FD.

The respondent/taxpayer company is engaged in the business of real estate development and construction of residential and commercial premises and had filed its return on 30.09.2015, declaring a loss of Rs. 4,84,78,892/-. The case of the taxpayer was selected for limited scrutiny, and notice was duly issued and served upon the taxpayer to verify the interest income received out of fixed deposits, which has not been offered to tax by the taxpayer in its income return.

The assessment order has been passed by the assessing officer in which the total loss was determined after making an addition to the interest income and on the delayed deposits of employees’ contributions to PF.

The petition filed a plea to the first appellate authority. The first appellate authority has deleted the addition on the interest income obtained out of the FDs on the basis that the FDs were not out of the surplus fund.

Read Also: Mumbai ITAT Quashes Addition Due to Lack of Proof About Money Receipt from Seized Documents

It was argued by the taxpayer that the taxpayer company has a total term loan of Rs 675.81 crores and has indeed claimed the bank overdraft facility against such FD for the objective of the banking needs in the year under consideration. The bank overdraft interest exceeded the interest obtained on the FDs by 1% and the term loan is indeed at a more elevated rate compared to that of the bank overdraft facility.

FDs were merely made for the banking provisions where the contribution of the promoter to the business was a pre-requisite. For availing banking facilities, the FDs are not out of the surplus funds and are just an arrangement. The interest out of the said FDs has a direct nexus to the taxpayer’s business, and the taxpayer had rightly netted off the interest income with the interest expenses.

The decision of CIT(Appeals) was kept by the court and ruled that the taxpayer has stated that the mentioned funds were incidental to the business activity of the taxpayer and, thus, it cannot be said to be ‘income from other sources’.

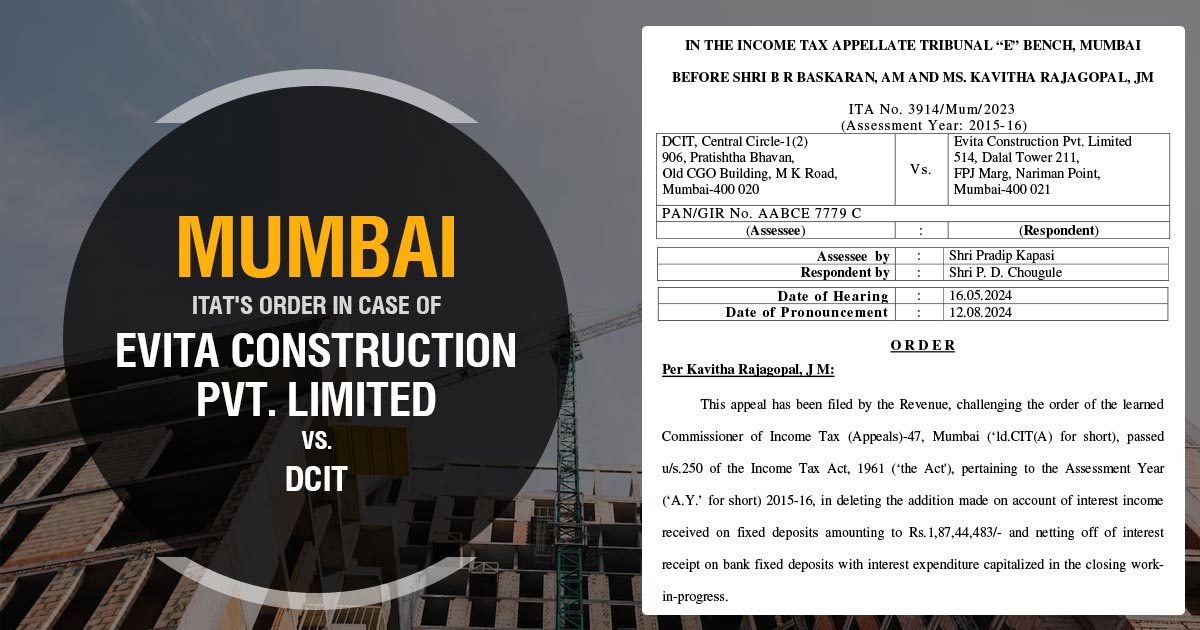

| Case Title | Evita Construction Pvt. Limited Vs. DCIT |

| Citation | ITA No. 3914/Mum/2023 |

| Date | 12.08.2024 |

| Assessee by | Shri Pradip Kapasi |

| Respondent by | Shri P. D. Chougule |

| Mumbai ITAT | Read Order |