Section 249(4)(b) of the Income Tax Act, 1961 does not apply when there is no question of advance tax payment in the income tax reassessment proceedings, the Mumbai bench of the Income Tax Appellate Tribunal (ITAT) held.

The taxpayer M/s. Nine Globe Industries Pvt. Ltd. furnished its income return dated 29.09.2012 for AY 2012-13 declaring a total income of Rs.51,80,800. The matter was taken up for investigation and no additions were made. Thereafter, the matter was reopened based on information received from DDIT (Inv.)-2, Surat.

The taxpayer did not furnish its income return within 30 days of the notice issued and therefore, by order on 12.11.2019 the taxpayer was needed to show cause why an addition of Rs.14,31,25,612/- be not made u/s 144 of the Income Tax Act, 1961 for the sale and purchase made through accommodation entries.

Answering the said notice, the taxpayer has furnished the income return u/s 148 of the Act on 19.11.2019 declaring a total income of Rs.51, 80,796. The appellant was demanded to provide the requisite information and upon consideration of it, the AO by an order on 23.12.2019 made an addition of Rs.14,31,25,612 for the unexplained expenditure u/s 69C of the Income Tax Act.

The bench discovered that the case was chosen for scrutiny, which on 29.03.2015 was finished, and there was no change in the returned income of Rs.51,80,800 in the absence of any additions being made.

It is a case of record that originally the return was furnished for the pertinent year under consideration on 29.09.2012. It was not disputed during the hearing that the advance tax per the assessed income of Rs.51, 80,800/- has been filed.

For the benefit of Revenue here was the case of reassessment which was undertaken. Therefore, the two-member bench of the tribunal including B.R. Baskaran (Accountant member) and Justice C.V Bhadang (President) noted that clause (b) of Section 249(4) of the Income Tax Act. will not apply since there was no question of filing the advance tax in reassessment proceedings, even though the taxpayer does not furnish the income return.

The ITAT bench discovered that on the foundations of non-compliance with Section 249(4) of the Income Tax Act, the impugned order dismissing the appeal could not be sustained and deserved to be set aside.

On 14.09.2023 the impugned order was set aside. The taxpayer’s petition is restored to the file of CIT (A) for disposal under the law.

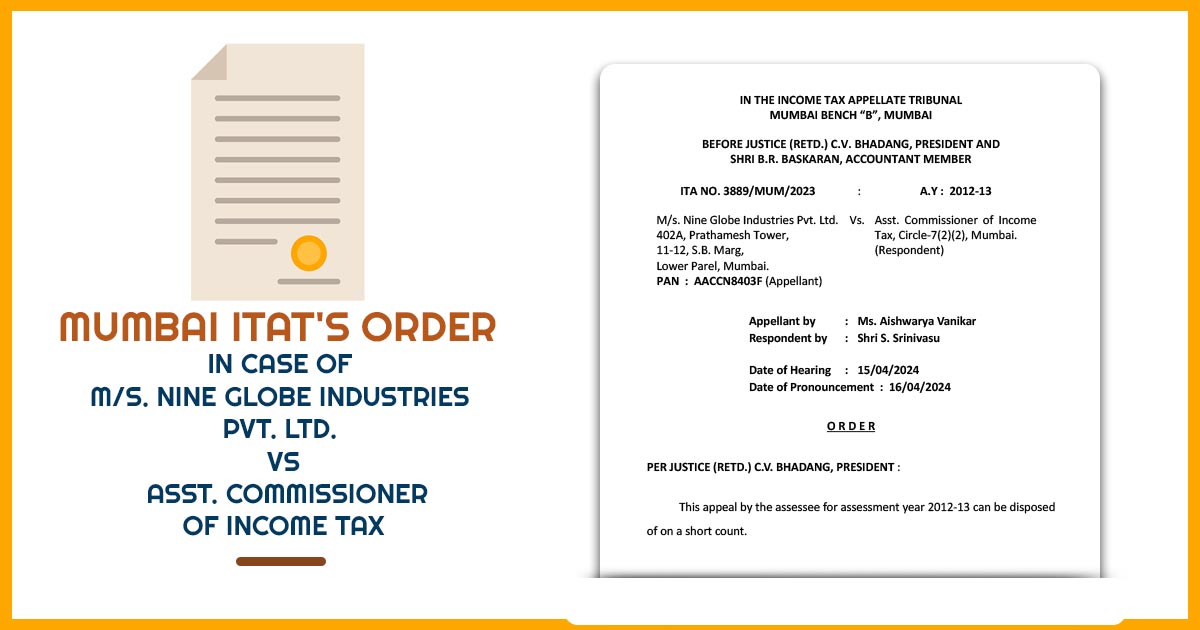

| Case Title | M/s. Nine Globe Industries Pvt. Ltd. vs Asst. Commissioner of Income Tax |

| Case No.: | ITA NO. 3889/MUM/2023 |

| Date | 16.04.2024 |

| Counsel For Appellant | Ms. Aishwarya Vanikar |

| Counsel For Respondent | Shri S. Srinivasu |

| Mumbai ITAT | Read Order |