The Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) has allowed Schindler India Private Limited, a leading elevator and escalator manufacturer, to exclude ₹1,09,72,163 written off as bad and doubtful debts from its book profits while computing Minimum Alternate Tax (MAT) under Section 115JB of the Income Tax Act, 1961.

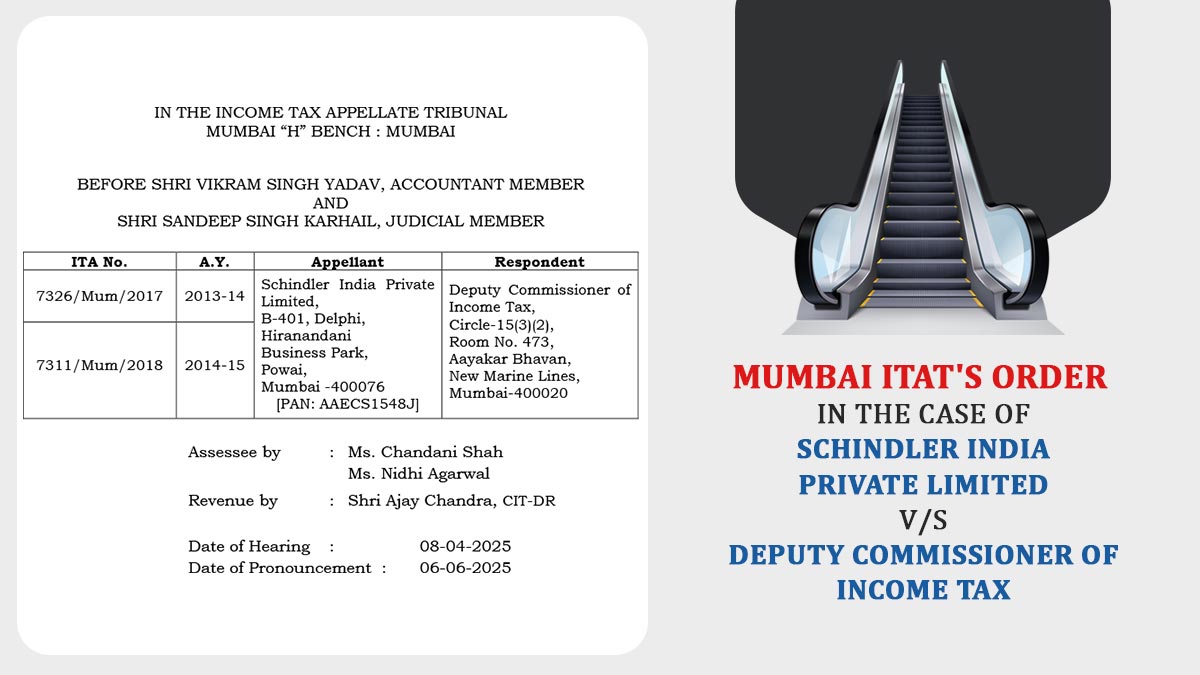

Before the ITAT, Schindler India has instituted two appeals related to the assessment years (A.Y.) 2013-14 and 2014-15.

Appellant has raised grounds before the Tribunal, but not all of them were pressed, and some were dismissed. The issue is for the addition made via the Assessing Officer (AO) because bad and uncertain debts were to be added back to the book profits as per clause (i) of the Explanation to Section 115JB, which requires the addition of provisions for diminution in the value of any asset to net profits for MAT calculation.

On the order of the AO Ajay Chandra, appearing for the revenue, it was reasoned that the amount constituted a diminution in the value of sundry debtors and therefore must be deemed a provision addition in book profits.

Chandani Shah and Nidhi Agarwal, who are representing the applicant, claim that the amount represented an actual write-off from the balance of the debtors, the audited financial statements kept the claims where the provision was debited to the profit and loss account, and with that reduced from the gross trade receivables in the balance sheet, showing an actual write-off instead of a mere provision.

On the decision of the Karnataka High Court reliance was placed in case of CIT vs. Kirloskar Systems Ltd. (2013) and the decision of the Gujarat High Court in CIT vs. Vodafone Essar Gujarat Ltd. (2017), all of which relied on the Supreme Court decision in Vijaya Bank vs. CIT (2010) where it was noted that bad and doubtful debts which amount to an actual write off would not be hit by clause (i) of the Explanation to section 115JB of the Act and therefore could not be added while computing book profits.

The ITAT Bench, comprising Accountant Member Vikram Singh Yadav and Judicial Member Sandeep Singh Karhail, determined that the disputed amount was a genuine write-off. They noted that the amount was not only debited as an expense but also reduced from the debtors’ balance in the balance sheet.

Read Also: Kerala HC: An Income Tax Assessing Officer Cannot Ignore a Taxpayer’s Claims Without Proper Inquiry

The Bench, the definition of “provision” under Schedule VI of the Companies Act, comprises amounts written off, and the book profits u/s 115JB are calculated under the Companies Act; the decisions of the higher courts have been admired by the Bench that such actual write-offs are excluded from additions to book profits u/s 115JB.

Therefore, Mumbai ITAT ruled that the addition of Rs 1,09,72,163 to book profits for MAT was unexplained and permitted the appeal on this ground.

| Case Title | Schindler India Private Limited vs. Deputy Commissioner of Income Tax |

| Case No. | ITA Nos. 7326/Mum/2017 & 7311/Mum/2018 |

| Assessee by | Ms. Chandani Shah, and Ms. Nidhi Agarwal |

| Revenue by | Shri Ajay Chandra |

| Mumbai High Court | Read Order |