The Income Tax Appellate Tribunal ( ITAT ) has held that the assessing officer cannot skip the examination of the source of funds just because of the error in the income tax return (ITR) due to technical issues.

Relief was provided by the tribunal to a woman who sold her property for Rs 94 lakh and kept a cash deposit of Rs. 13L in the bank, which was subsequently ministered as unexplained income.

‘Once the registered sale deed itself confirms the receipt of cash, then the same amount cannot be regarded as unexplained income,’ the tribunal cited.

The taxpayer (woman) sold her property for Rs 94.06 lakh. She deposited Rs. 13L in her ICICI bank account. But no ITR was submitted by her initially. The Assessing Officer (AO), while observing that no Income tax return was submitted, moved to reopen the assessment by issuing a notice u/s 148 on 28 April 2022.

The taxpayer, thereafter, in May 2022, submitted her ITR showing a total income of Rs. 6,95,000. But the system shows the return as invalid. AO considered the return submitted u/s 148 as no return filed. It does not recognise the return.

Also Read: ITAT Jaipur Remands ₹76.31 Lakh Addition Case, Grants Taxpayer Another Chance

Taxpayer, in the proceedings, provided the computation of income, a copy of the purchase deed, a registered sale deed, a bank statement of ICICI Bank, and detailed replies dated 25 April 2023 and 19 May 2023.

Such responses, which have a complete narration of the transaction including receipt of consideration via cheque and cash, were reproduced in the assessment order. AO does not consider it and treats the whole amount of Rs. 94L as unexplained income only because he regarded the return filed u/s 148 as invalid.

Before the Commissioner of Income Tax (Appeals), the taxpayer appealed, where she received partial relief. ITAT was left with the fact that the adjudication regarding the addition of Rs. 13,00,500 was classified as unexplained u/s 69A.

As per the taxpayer, from the total consideration of Rs 61,00,000 obtained in the year from the purchaser, Rs 38,15,000 was received in cash, and the same was deposited into the ICICI Bank account. She cited that the sale deed itself includes a clear recital acknowledging these cash receipts.

The bench of Girish Agarwal (Accountant member) and Amit Shukla (Judicialmember) said that “The statutory mandate under section 69A requires that where the explanation furnished by the assessee is supported by credible evidence and is not shown to be false, no addition is warranted.”

“Non acceptance of the assessee’s return on account of a system-generated technicality cannot eclipse the fundamental obligation of the Assessing Officer to examine the source of funds when tangible evidence is placed before him”, the bench added.

Hence, the tribunal declared that u/s 69A, the addition of Rs. 13,00,500 is wholly not sustainable. The bench said that a record is there to recommend that the taxpayer has any income source apart from the sale consideration in question.

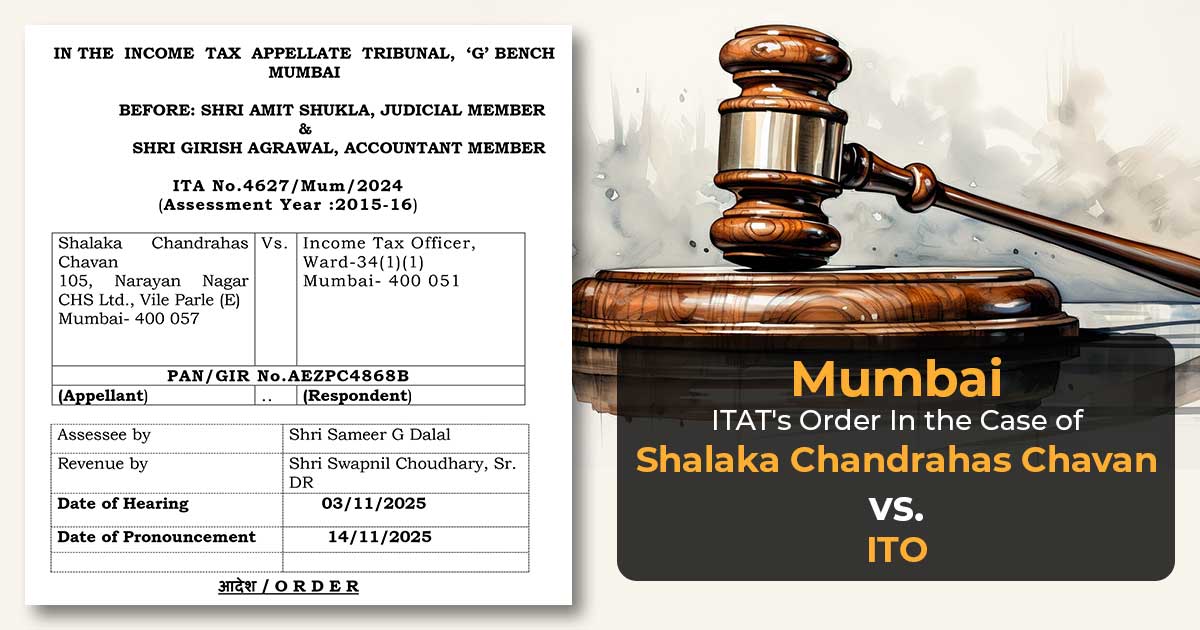

| Case Title | Shalaka Chandrahas Chavan vs. Income Tax Officer |

| GSTIN of the applicant | ITA No.4627/Mum/2024 |

| Assessee by | Shri Sameer G Dalal |

| Revenue by | Shri Swapnil Choudhary |

| Mumbai ITAT | Read Order |