The Maharashtra Authority for Advance Ruling (AAR) in an order ruled that the work that has been completed as a part of the Jal Jeevan Mission conducted by the Government of India (GoI) before the year 2022 is to be waived from Goods and Service Tax (GST).

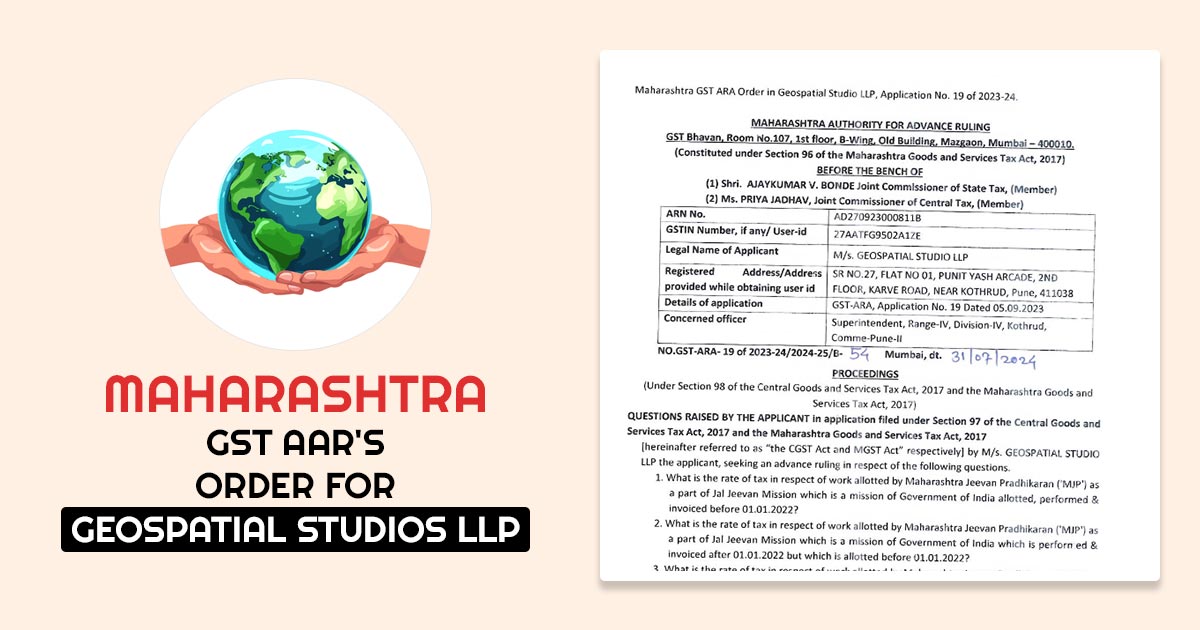

The petitioner Geospatial Studios LLP is a partnership firm, and it is registered under the Center Goods and Service Act, 2017 CGST and State Goods and Service Act, 2017 (SGST).

The applicant raised the issue of the tax that would be imposed on concerning work allotted by Maharashtra Jeevan Pradhikaran (‘MJP’) as a part of the Jal Jeevan Mission before January 2022.

Read Also: Delay Payment Interest on Services Included in GST Supply & Liability Valuation

In Maharastra, supply/drainage/sanitation/stormwater schemes were executed via the Maharashtra Jeevan Authority Act in 1976. A revision was brought to the Act in the year 2022, and there is a perception that the applicant’s activity is no longer exempted.

18% GST tax rate is to be charged. Still, the issue faced here is that for some Zilla Parishads, some state governments add GST obligated to be paid at 18% to the invoice liable to get paid for pure service activity performed by tax persons identically located to that performed by the petitioner.

Will tax be charged concerning the work performed before the amendment?

The bench noted that from the agreement between the petitioner and MJP, the petitioner has provided technical consultancy for project development and management support services for the water supply scheme at various locations implemented by the MJP for the supply of water, which are the functions stated in articles 243G and 243W.

The bench Ajaykumar V. Bonde (Joint Commissioner of State Tax) and Priya Jadhav (Joint Commissioner of Central Tax) ruled that no tax will be imposed concerning work allotted by Maharashtra Jeevan Pradhikaran (‘MJP’) as a part of the Jal Jeevan Mission, which is a mission of the Government of India allotted, performed, and invoiced before 01.01.2022.

| Name of Applicant | M/s. Geospatial Studios LLP |

| Order No | No.GST-ARA-19 of 2023-24/2024-25/B-54 |

| Date | 31.07.2024 |

| GSTIN | 27AATFG9502A1ZE |

| Maharashtra AAR | Read Order |