What is the MCA LLP 3 Form for Agreement?

The purpose of furnishing the LLP Form No.3 is to give the data for the Limited Liability Partnership Agreement for the case of a newly incorporated LLP and to give the details for the amendments in the LLP agreement in the case of a current LLP.

The same form is needed to get furnished within 30 days of incorporated of the Limited Liability Partnership or within 30 days of issuing the resolution for the modification in the LLP agreement. Prior to furnishing Form 3, an LLP agreement is needed to be executed. The LLP Agreement would be printed on stamp paper of the mentioned value and notarized.

Latest Update

- The LLP Act 2008 condones the filing of Form-3, Form-4, and Form-11 under section 67. Read Circular

- Stakeholders will notice that in order to provide an easy filing experience for Form 3 LLP, a new Excel upload and download functionality has been included in the form that will pre-fill all the information of the selected partner and existing partner. Please read the instruction kit before submitting the form to stakeholders.

File MCA V3 LLP Form 3 by Gen Complaw Software, Get Demo!

MCA Form LLP 3 Content

LLP Form 3 is available on site of MCA. It has the following content.

- Date of LLP agreement

- Place

- Capital Contribution

- Obligation to contribute

- Mutual Rights and Duties of Partners

- Restrictions, if any, on the partner’s authority

- Procedure for calling, holding, and conducting meetings,

- Details of the indemnity clause, if any

- Clause for Admission / retirement / cessation/ expulsion / resignation of partner

- Duration of Limited Liability Partnership

- LLP Registration number

- Mode of Contribution

- DPIN of Signing Partner

Read Also: Simple Guide to Form LLP 8 Filing with Due Date & Penalty

Required Documents to Furnish MCA LLP 3 Form

LLP Form 3 is demanded to be furnished with the mentioned below list of documents.

- LLP Agreement ( PDF Format )

- Supplementary/ amended LLP ( PDF Format )

- Other optional attachment

LLP 3 Agreement Form Due Date

LLP is required to file Form LLP-3 within 30 days of its incorporation, and in case of any changes made in the LLP agreement, it needs to file within 30 days of such change.

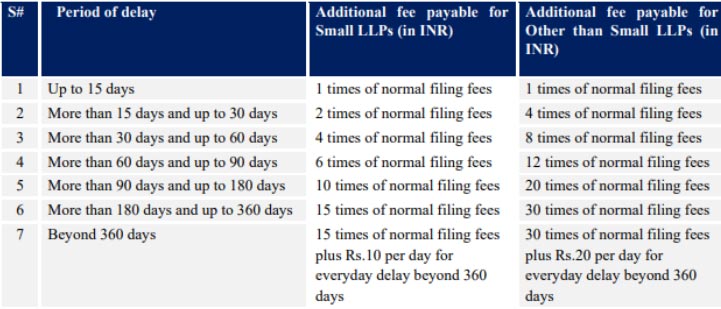

Penalty for MCA LLP 3 Non-Filing

Post to LLP agreement execution, Form 3 is required to furnish within 30 days of the LLP incorporation date. Under LLP Act 2008 form is required to furnish. For non-filing of Form 3 penalty is given below in a table format.

Recommended: Simple Tips to File LLP Form 11 Annual Return

Value of LLP Stamp Duty for Agreement in a Table Format

LLP agreement required to be implemented on Stamp paper. The ground for settling the stamp paper value will be the LLP capital contribution.

The Stamp Duty payable of the LLP Agreement is different for different States and the same is paid as per the rate specified in the State Stamp Act. Till the time-specific Stamp Duty is prescribed in the respective Stamp Act, the Stamp duty on the LLP Agreement may be paid as per the stamp duty payable on the partnership agreement in view of the Finance Bill, 2009.

Registration Fee for LLP-3 Form

In case of an increase in the total contribution of the LLP, the Registration fee shall also be calculated based on the difference in the slab in addition to the form filing fee as shown in the table below:

| LLP Capital Contribution | Stamp Duty |

| up to Rs 100000 | Rs. 500 |

| Rs 1,00,001 to Rs 5,00,000 | Rs. 2,000 |

| Rs 5,00,001 to Rs 10,00,000 | Rs. 4,000 |

| Rs 10,00,001 to Rs 25,00,000 | Rs. 5,000 |

| Rs 25,00,001 to Rs 1,00,00,000 | Rs. 10,000 |

| Rs 1,00,00,001 and Above | Rs. 25,000 |

DSC Of Designated Partner

Limited Liability Partnership is required to pass a resolution for authorizing one of the partners to act on behalf of the LLP for the LLP name change. The digital signature of the designated partner is essential for filing Form 3. Mention the DPIN number and affix the DSC of the partner.

Professional LLP 3 Form Certificate

The webform LLP 3 must be digitally certified by a practising professional, such as a Practising Company Secretary or Practising Chartered Accountant or Practising Cost Accountant, by affixing a valid DSC associated with the MCA V3 portal.

Procedure to file LLP Form No. 3 on MCA V3

- Log in with the MCA V3 portal with registered user Id and Password⇒MCA Services⇒LLP e-Filing⇒ Form 3 – Information for LLP agreement and changes.

- Select the relevant option, i.e. ‘Filing information with regard to initial LLP Agreement’ is selected, then Part A of the webform shall be enabled for the user and in case option 2 i.e. ‘For information with regard to changes in LLP Agreement’ is selected, Part B shall be enabled. Enter the LLPIN of the LLP

- Provide details related to Information with regard to the initial LLP Agreement, such as the place where such agreement is made, business activities, details of the total no. of partner and their profit sharing ratio % of profit sharing ratio shall be prefilled based on the LLPIN entered in the form.

- Enter all the details in points no. 6 to 15 as per the LLP agreement, in case of filing information with regard to the initial LLP Agreement is selected.

- Provide information regard to changes (addition, omission or alteration) in the LLP Agreement if information with regard to changes in the LLP Agreement is selected.

- Enter details regard to date of modification of the agreement, no. of amendments/ changes made in LLP till date SRN of Form 4 or Form 5 of last one year from the date of filing this form, tick on the reason of such changes such as Change in business activities, Change in partner(s), Change in partner’s contribution and % of profit sharing, Change due to other reasons and fill information according to such changes in point no. 18 to 20.

- Attach the initial LLP agreement in case of ‘Filing information with regard to initial agreement’ is selected, Supplementary/amended agreement containing changes in case For information with regard to changes in LLP agreement’ is selected or optional attachment, if the user wants to provide any other information.

- Webform shall be digitally signed by the Designated Partner (DP) of the LLP and shall be digitally certified by the professional, and thereafter submit the form.

Limited Liability Partnership Form 3 and 4 FAQs

Q.1 What are LLP form 4 and LLP form 3?

Form LLP-4 is interlinked to form LLP-3, all the information concerned with the Limited Liability Partnership agreement as well as amendments which are necessitated to be included in the form 3 while all the cessation, appointment and modification in the name/address/designation of the designated partner must be mentioned in the form 4.

Q.2 Objective of filing LLP form 3?

The objective of the LLP form 3 filing is to give necessary information of the Limited Liability Partnership Agreement when there is a fresh formed LLP (Limited Liability Partnership) and to make available all the details of the modifications of the existing LLP’s LLP Agreement.

Q.3 Is filing form 3 necessary for the Limited Liability Partnership?

The obligations as well as the mutual rights of the partners and the LLP & partners must be authorized by the LLP agreement. The LLP agreement of the form 3 has to be submitted online via the MCA portal and also within the stipulated time of the 30 days of its incorporation. The filed LLP form 3 agreement has to be filed and the stamp paper should be used to authorize the LLP agreement print copy.

Q.4 What is the LLP form 3 non filing fees?

If the form 3 LLP havent been filed within the stipulated time, there will be penalty as per the table stated above.