The government has unveiled the address validation form as per the FORM INC-22A (ACTIVE) included in the Companies (Incorporation) Rules, 2014, after rule 25, which has to be further followed.

Form INC-22A, also known as the ACTIVE (Active Company Tagging Identities and Verification) Form, all the companies that incorporated on or before December 31, 201, which are under Active status as on the date of filing, shall submit the required particulars in web form INC-22A on or before 15 June 2019.

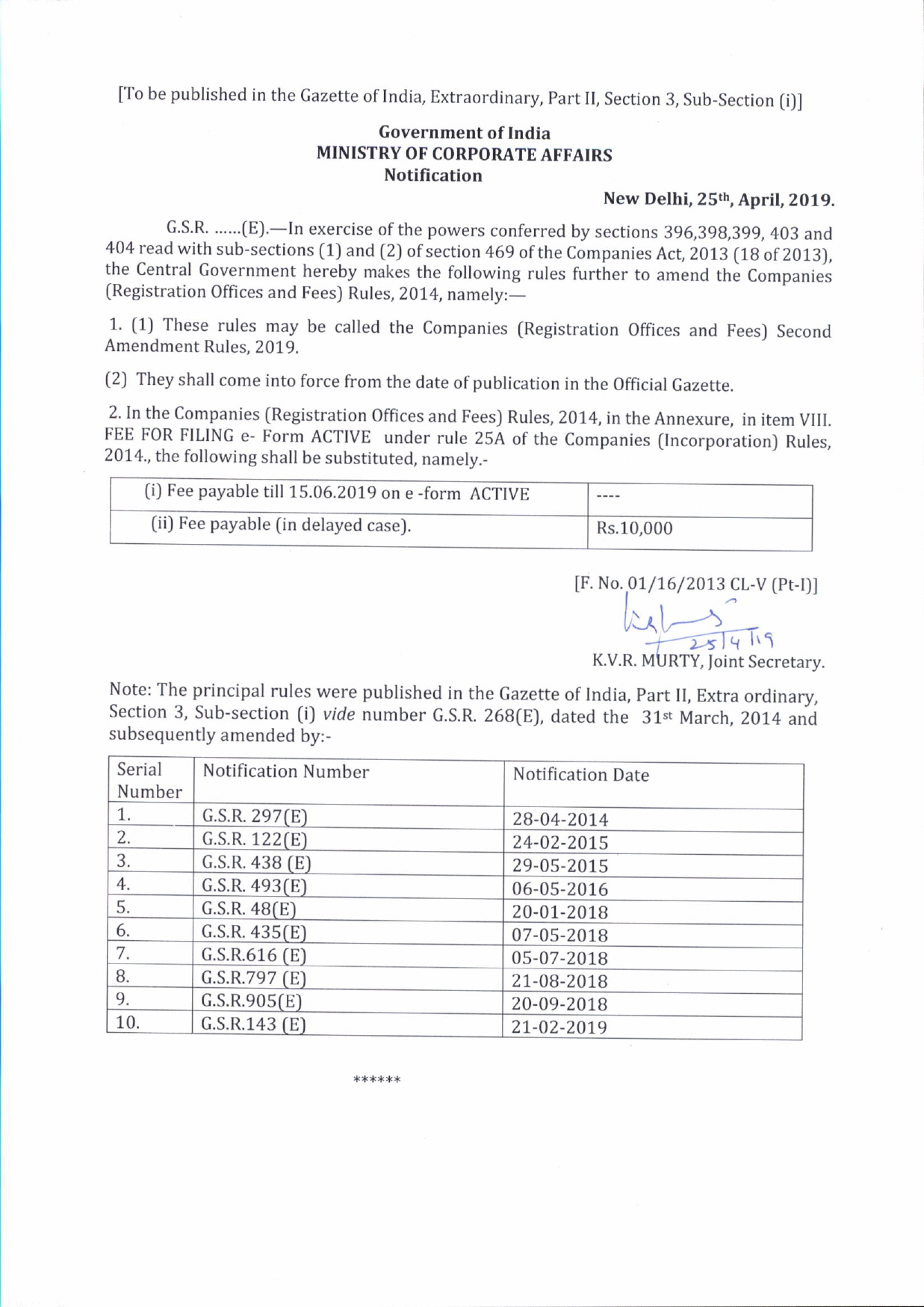

In the case the company does not file the web form INC-22 A within the time limit, filing of the web form shall be allowed with a fee of rupees 10,000.

What is MCA New Web Form INC 22A (Active)?

The Ministry of Corporate Affairs, under the company law, requires companies to fill out the web form INC-22A for address validation, while the form has the name tag applicable to tagging identities and verification (ACTIVE). This new form applies to all the registered companies under the Companies Act 2013.

Applicability of Form INC-22A (Active) by MCA

MCA has launched a new web–based form INC-22A under the Companies (Incorporation) Amendment Rules, 2025

Through a notification dated 27th June 2025, the Ministry of Corporate Affairs (MCA) amended Rule 25A of the Companies (Incorporation) Rules 2014 by introducing the Companies (Incorporation) Amendment Rules, 2025. The existing E- Form replaced with a new web-based form.

As per Rule 25A: All companies incorporated on or before the 31st December, 2017 shall file the details of the company and its registered office, in web-based Form.

Important Point Under Notification for INC 22A

- Notification Date: 21st February 2019

- Effective Notification Date: 25th February 2019

- Companies Applicability: Companies incorporated on or before 31st December 2017

- Web Form Applicability: INC-22A (Also known as e-Form ‘ACTIVE’)

- DIN Status: The Status of DIN of directors must be ‘Approved’ at the time of filing

- Last date of Filing of Form: 15th June 2019

- Form Filing Fees: NIL

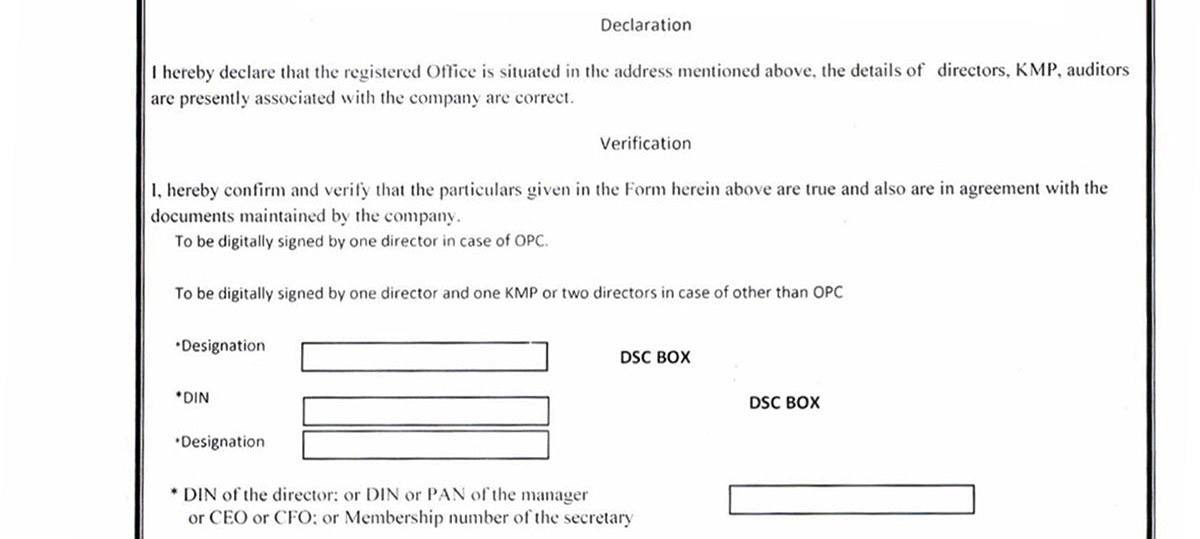

- DSC (OPC): One director

- DSC (Other than OPC): Two Directors / One Director and One KMP

- Rule Applicability: Rule 25A of Companies (Incorporation) Rules, 2014

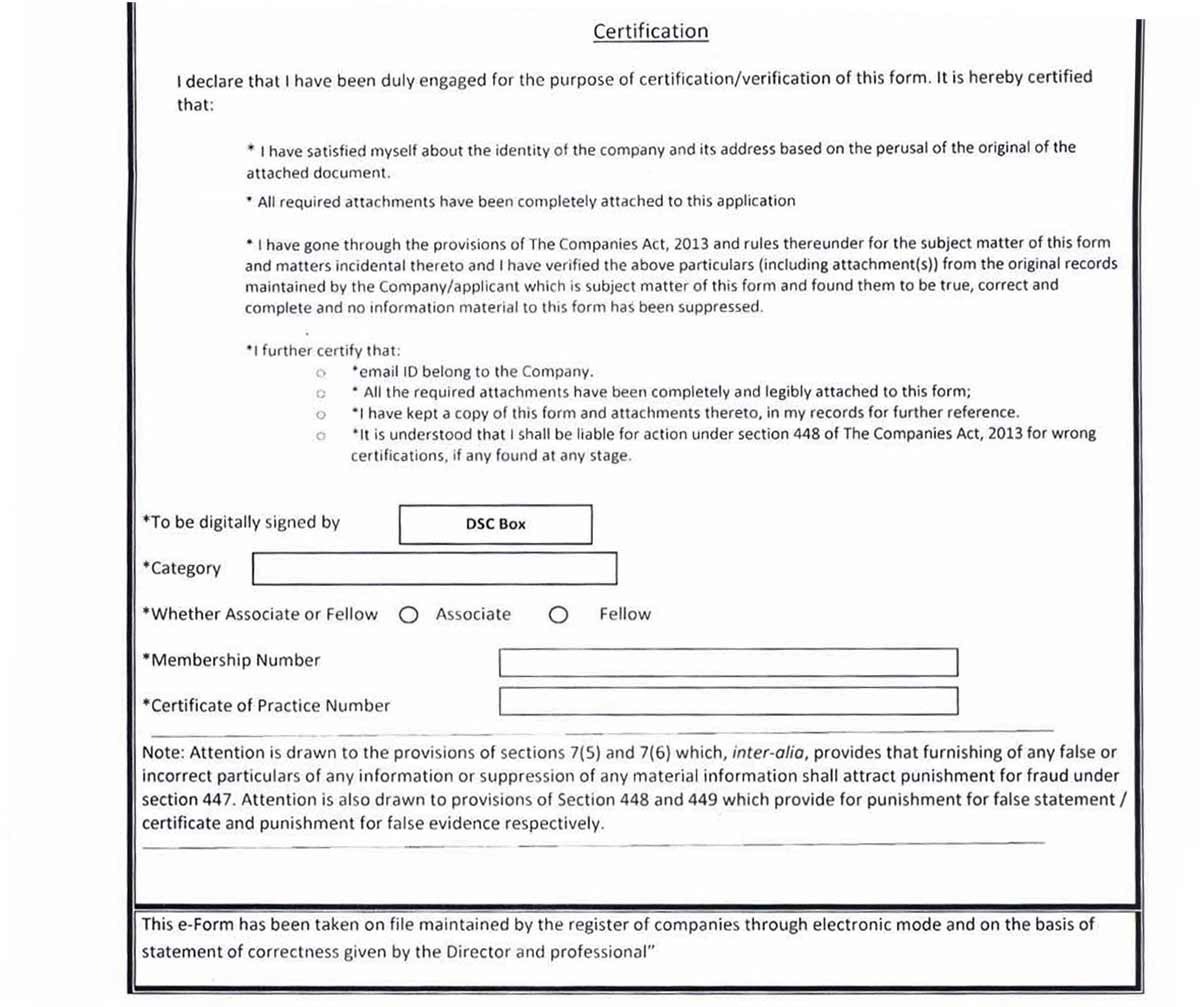

- Certification: Professionally certified form necessary

Repercussion of Not Filing Form INC-22A (Active)

The company will be marked as “ACTIVE-non-compliant” on or after 26th April, 2019 and be liable for action under section 12(9) of the Act. But by paying a fee of Rs. 10,000/-, the company can again gain the status of “ACTIVE Compliant”.

If the INC-22A (ACTIVE) form is not filed, then the government will not accept the following forms:

- SH-07 (Change in Authorised Capital)

- PAS-03 (Change in Paid-up Capital)

- DIR-12 (Changes in Director except for cessation)

- INC-22 (Change in Registered Office)

- INC-28 (Amalgamation, de-merger)

Ineligible Companies Under the INC-22A Form

- Struck off companies

- Companies under the process of striking off

- Companies under liquidation

- Amalgamated or Dissolved companies

- Companies that were incorporated on or after 1 st January 2018.

Scenarios Where Form INC-22A (Active) cannot be filed

Companies are restricted from filing Form INC-22A in the following cases:

- The company has not filed its financial statements under section 137 or due annual returns under section 92 or both with the Registrar, except if such company is under management dispute and the Registrar has recorded the same on the register.

- Companies that are struck off or are in the process of striking off, or are under liquidation or amalgamated or dissolved as recorded in the register.

Step-by-Step Process to File MCA Web Form INC-22A with Format

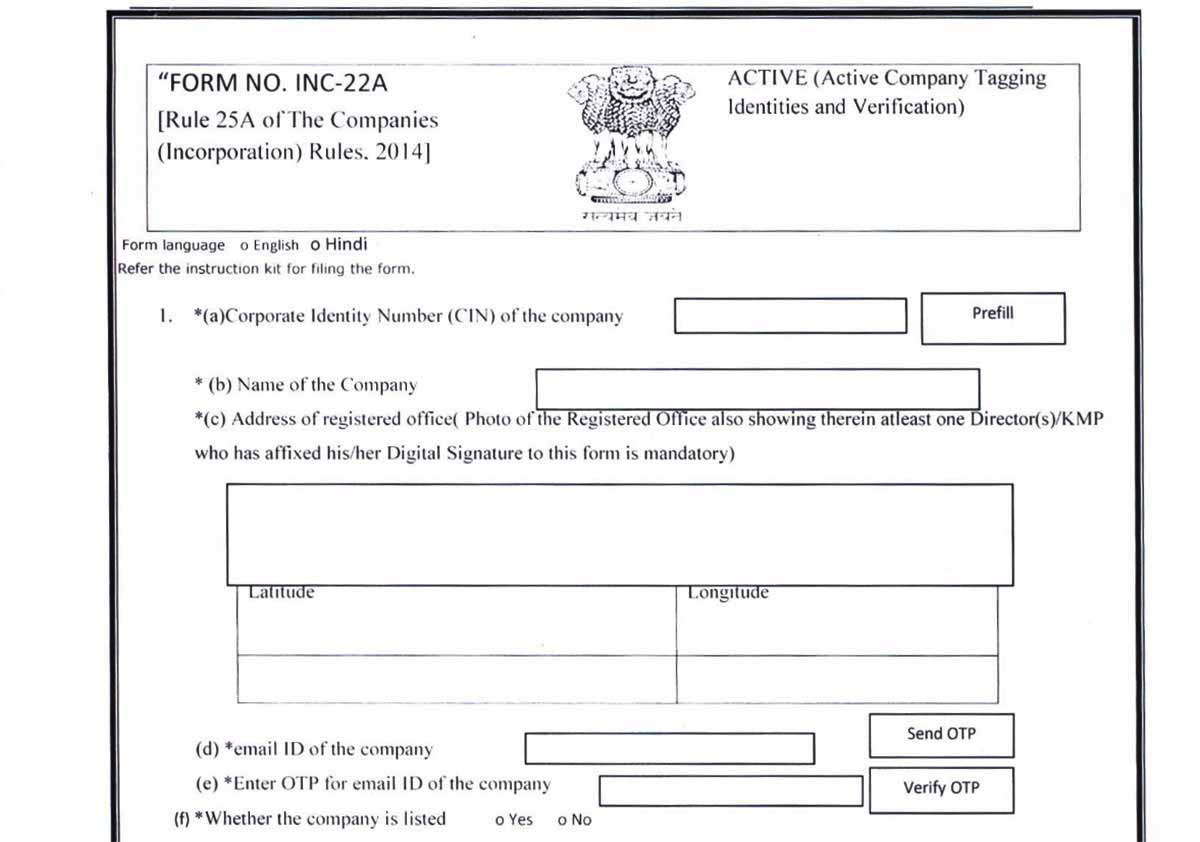

The INC-22A (ACTIVE) form includes various sections and is described in the sequence. Procedure to file and content of the INC-22A (ACTIVE) form are as follows:

Step 1: Fill in CIN once entered, other related details such as the name of the company, registered address will be auto-populated, fill in latitude and longitude, and after that, enter the registered email ID for OTP verification.

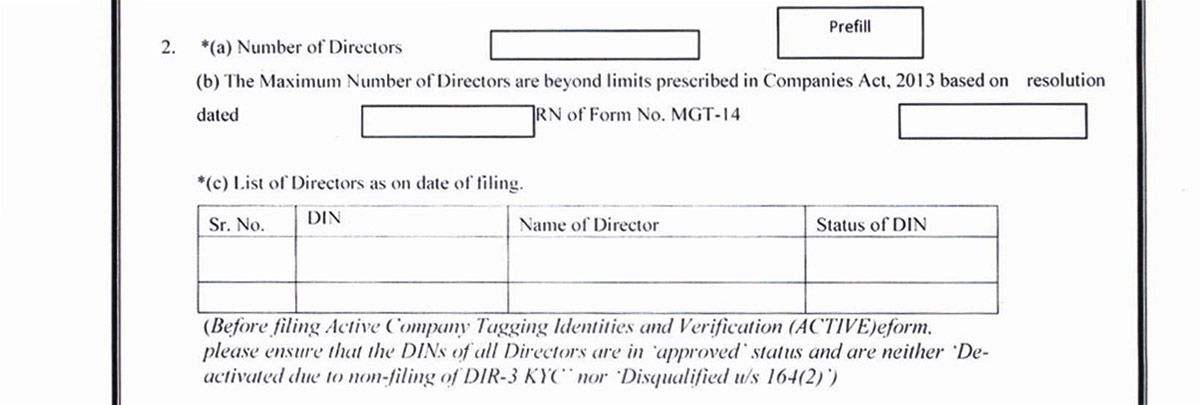

Step 2: The number of directors, along with the name and status of DIN, shall be prefilled and non-editable based on the number of active associations of all the director roles associated with CIN.

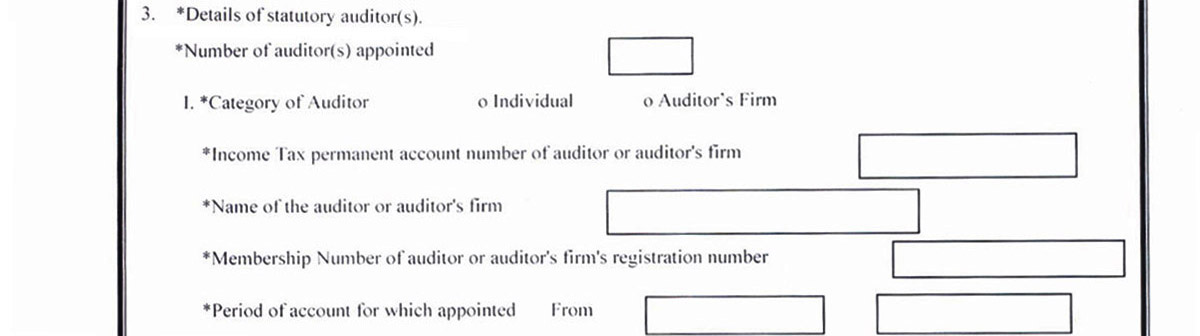

Step 3: Details of the statutory auditors shall be prefilled and non-editable based on the ADT-1 web form approved for the latest period of account for which the auditor is appointed for this CIN.

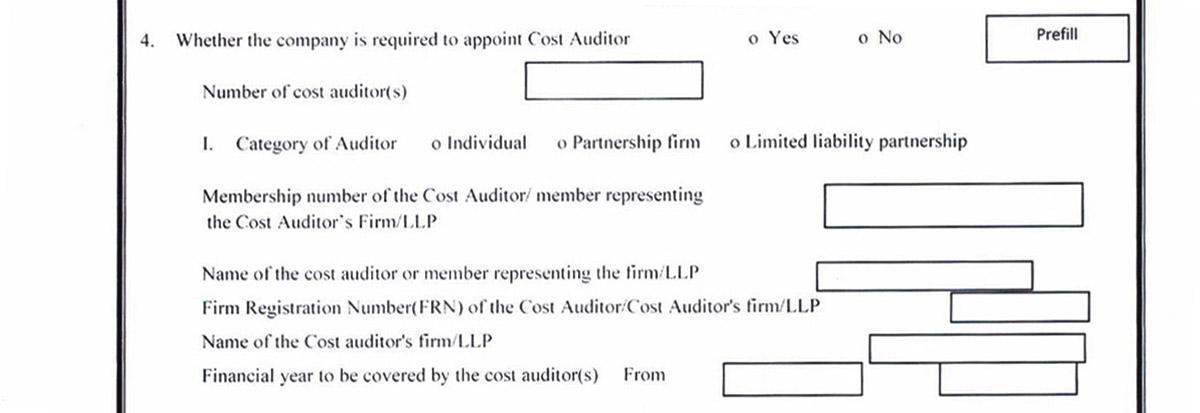

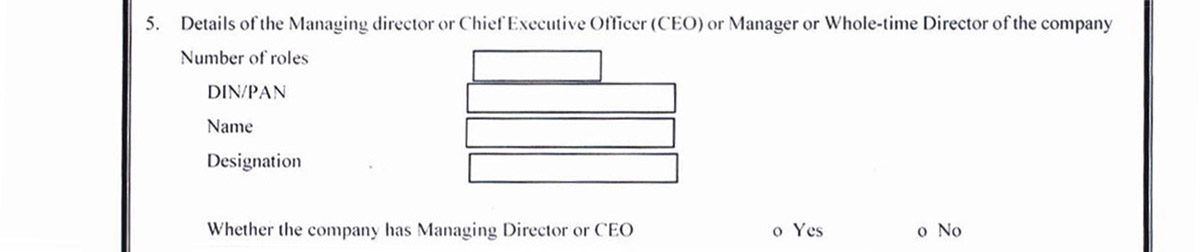

Step 4: Fill cost auditor appointment requirement and details based on the applicability of the company and such other Details of the managing director or the chief executive officer, or whole-time manager, along with DIN/PAN, Name and designation, which is prefilled and not editable as based on roles associated with the designation.

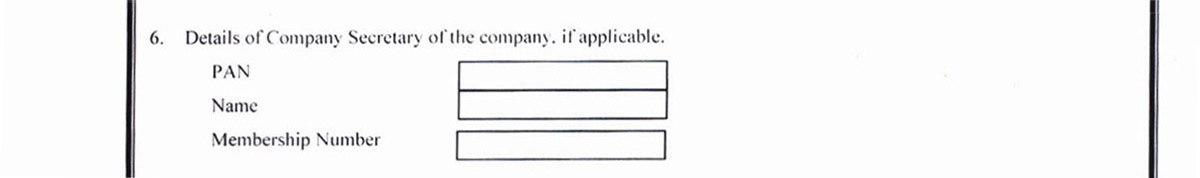

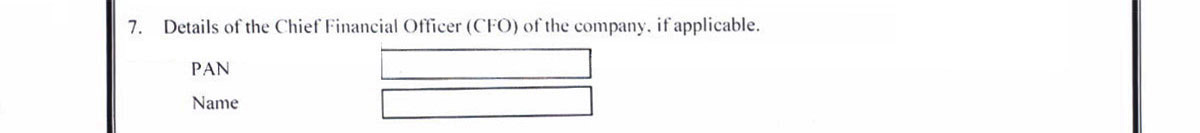

Step 5: Details for the company secretary of the company, in case it is applicable, along with PAN name and membership number and Details of the chief financial officer of the company, in case it is applicable.

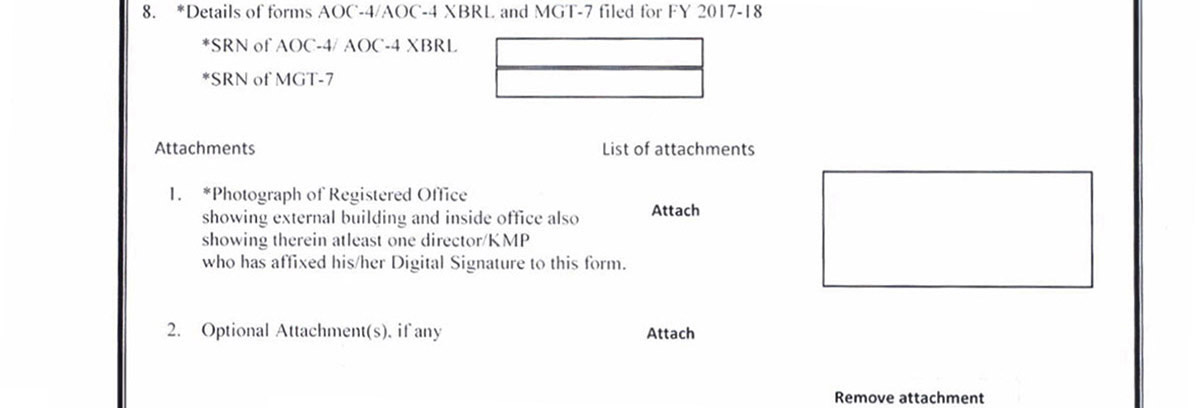

Step 6: SRN of forms, including AOC-4-AOC-4 XBRL and MGT-7 filed for the FY 2017-18, shall be prefilled and non-editable based on CIN.

Declaration & Verification: After including all the above-given details, one has to Upload mandatory attachment such as a Photograph of the Registered Office showing the external building and inside office, also showing therein at least one director/ KMP who has affixed his/her Digital Signature to this form, along with any optional documents if needed, after that get the form digitally signed.

Certification: After which, there is a declaration. The web form shall be certified by a practising professional by digitally signing the web form, and after signing, submit the form.

A company incorporated in April 2019 whether it has required to file the Active Form or covered fresh filing scheme 2020 otherwise it has not covered as per the circular issued by MCA.

No if company is incorporated after 31st December 2017 it is not required to file inc-22A Active form as it is not applicable on companies incorporated after 31st December 2017

How to I get MSME certificate.and what document I need to apply this

What is Due Date For Filing of this form For F.Y 20-21

The due date for filing INC-22A as per the CFSS scheme 2020 is 30th Sept 2020. Basically, INC-22 A is a one-time form if you have filed earlier you are not required to file it again

Nice, useful Post