What is the MCA ADT-2 Form?

Companies use Form ADT-2 when they ask for approval from the Central Government for the removal of an auditor before the expiry of their term, u/s 140(1) of the Companies Act, 2013. A statutory auditor removal is not a simple internal decision; it needs a special resolution passed by the company and subsequent approval of the Regional Director (RD) via ADT 2.

Under the serious reasons like misconduct, conflict of interest, or breach of duties, filing Form ADT-2 is obligatory. It ensures that the process of removal is fair, transparent, and supervised under the law. Within 30 days from the passing date of the resolution of the board for removal, the companies are mandated to file the form. Rejection or delays can occur from the failure of adherence.

Objective of ADT-2 Form

Form ADT 2 keeps accountability and regulatory oversight when a company plans to remove its appointed auditor before the end of their term. Under the Companies Act, 2013, without prior approval from the Central Government, an auditor once appointed cannot be removed, and that approval request is routed via ADT-2.

The same form serves as a formal petition that assures the company delivers a valid basis for removal, a copy of the board resolution, and details of the concerned auditor. The application shall be evaluated by the Registrar of Companies (RoC) and the Regional Director.

Using ADT 2 assists in preventing arbitrary removals and keeps the integrity of the audit process, which makes it a crucial part of corporate compliance.

Who Should File ADT-2?

- Private and Public Companies: After the Board of Directors appoints an auditor in a Board Meeting.

- Small Companies and OPCs: Must file ADT-2 when an auditor is appointed.

- Companies Changing Auditors Mid-Term: Whenever there is a modification in the appointment of auditors, Form ADT-2 needs to be filed.

How to Remove an Auditor Before the Completion of Their Term

Compliance is required for filing Form ADT 2 under the Companies Act, 2013.

An easier procedure is cited below:

- Carry a Board Meeting to propose the removal of the auditor and pass a resolution.

- Send notice of an EGM (Extraordinary General Meeting) to shareholders with an explanatory statement.

- Perform the EGM and pass a special resolution approving the removal.

- Prepare Form ADT 2 with critical attachments:

- Certified copy of Board and shareholder resolutions

- Reasons for auditor removal

- Auditor’s representation (if any)

- Submit ADT 2 to the Regional Director (RD) through the MCA portal, within 30 days of the special resolution.

- File set fee as per the company’s capital.

Details Required for Filing ADT-2

The following details must be ready before filing the form-

- Company CIN (Corporate Identification Number).

- Date of Board Meeting in which the Auditor was appointed.

- Details of the Auditor (Name, Membership Number, Firm Registration Number).

- Period of Appointment.

- Auditor’s Consent Letter and Board Resolution for appointment.

- DSC (Digital Signature Certificate) of the Director or Company Secretary.

Procedure to file ADT-2 via software

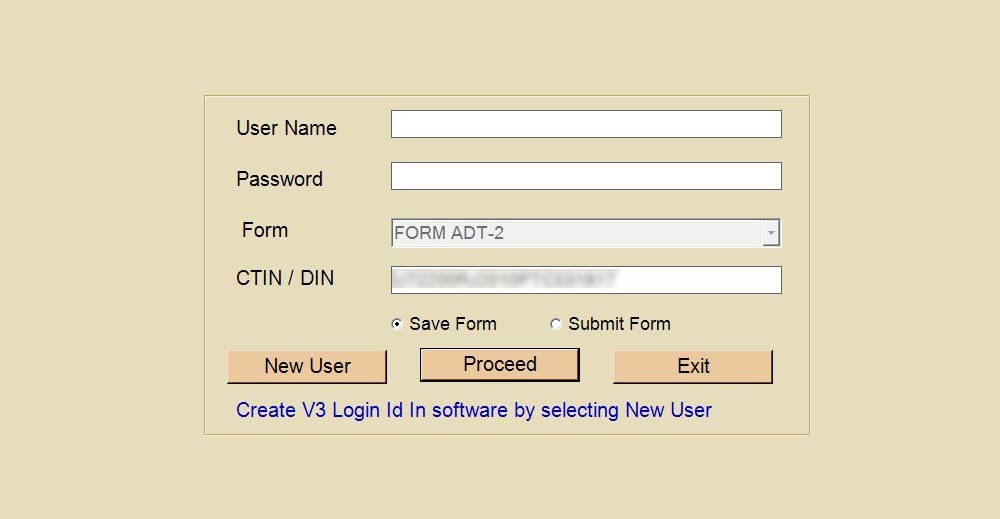

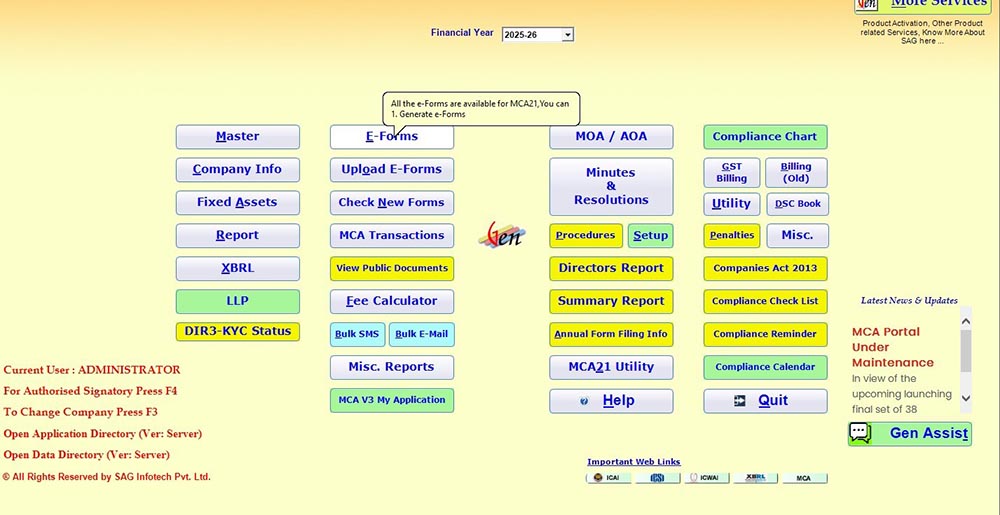

Step 1: Firstly, install the SAG Infotech ROC software on your desktop and laptop

Step 2: After installing the software, select the company and financial year for which the client wants to file the ADT-2 form.

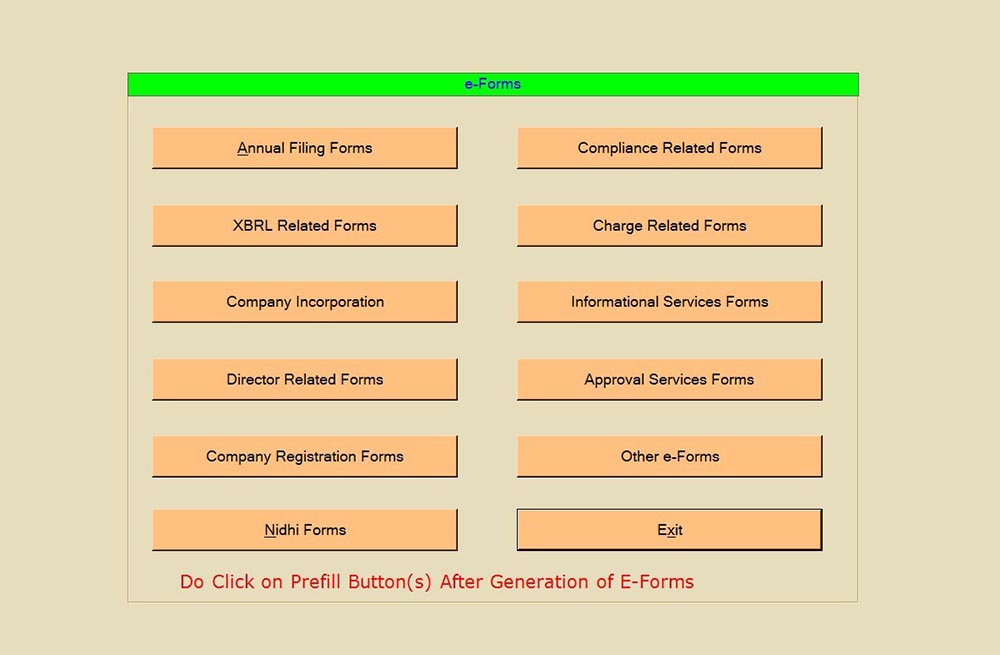

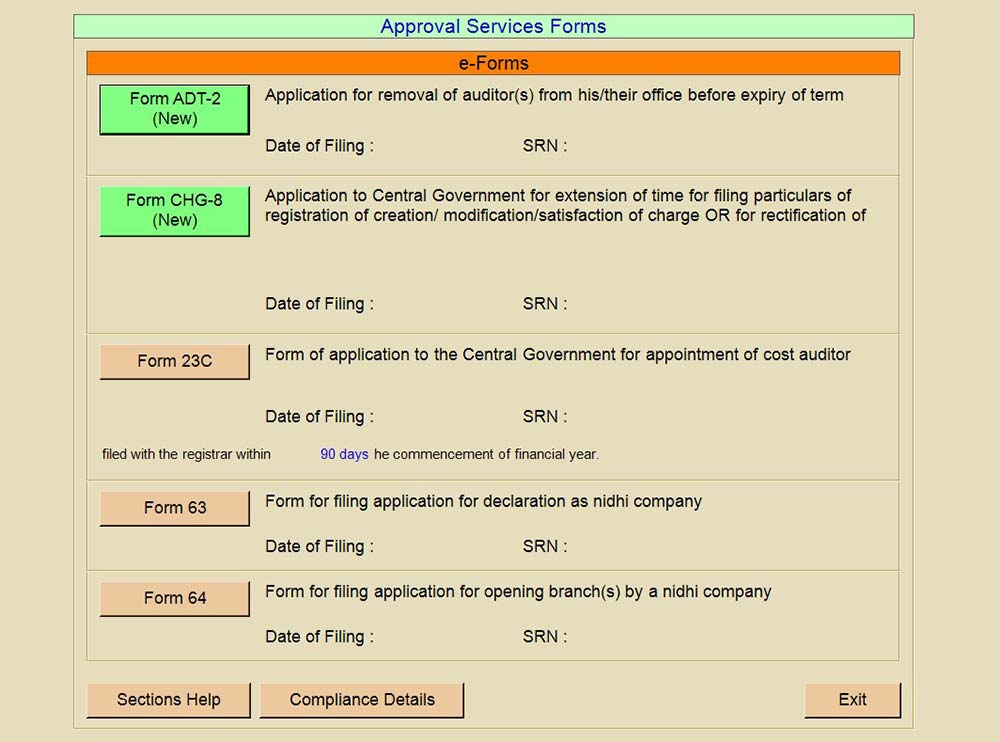

Step 3: After that, navigate to the e-form option, then go to the ‘Approval Services Form’ section and select the ‘ADT-2 Form’.

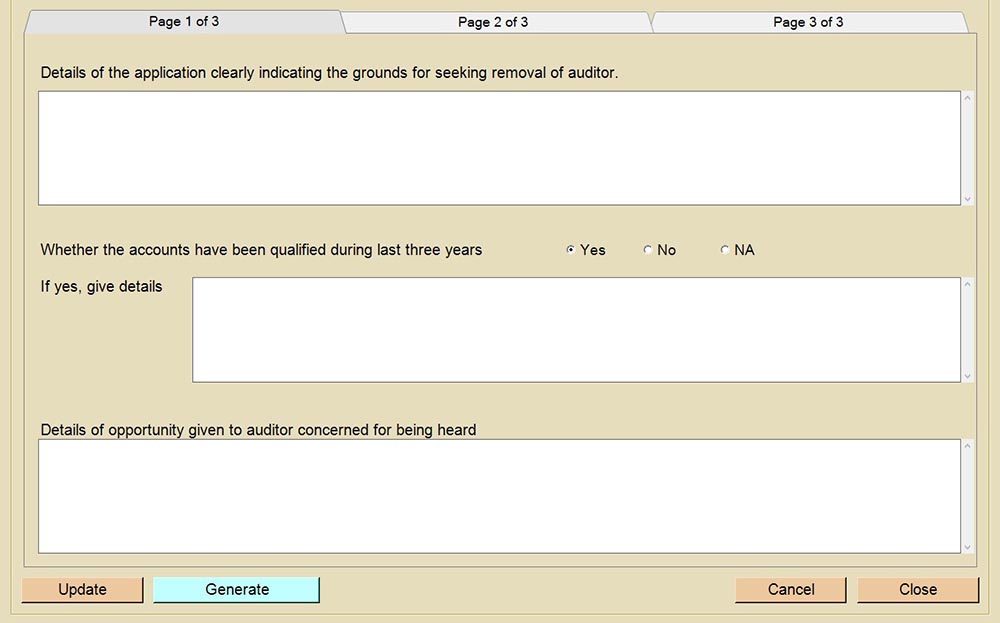

Step 4: Next is to fill in details as mentioned on page no. 1, such as grounds for seeking removal of the auditor, whether the accounts have been qualified during the last three years, if the yes option is selected, then mention the details for such qualification, after that, mention if the concerned auditor was allowed to be heard.

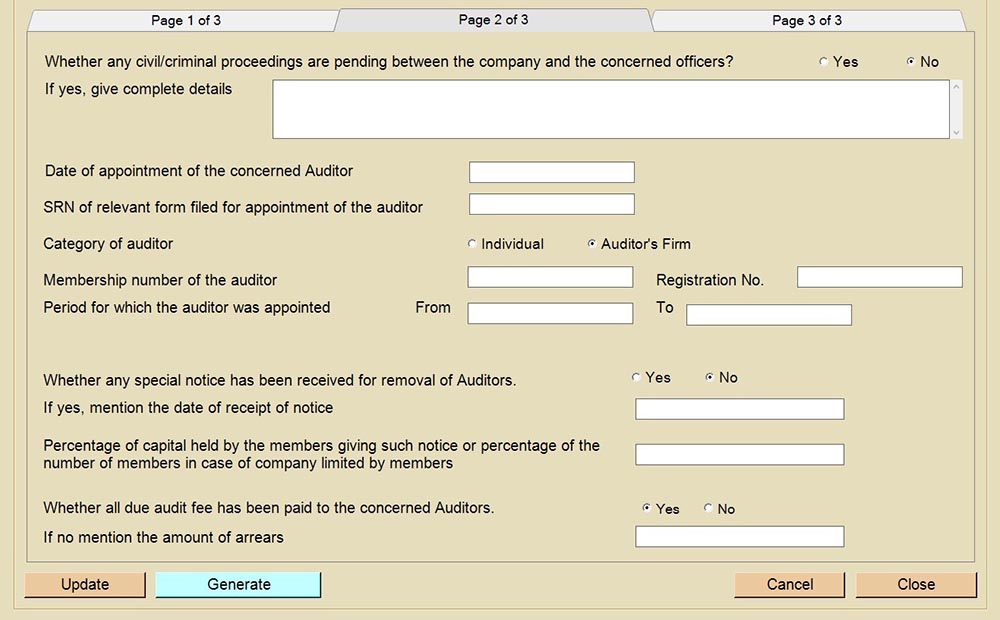

Step 5: On page no. 2, provide information regarding whether any civil/ criminal proceedings are pending. If yes is selected, then provide the details of such proceedings.

Provide the details of the appointment of the concerned auditor, such as date of appointment, SRN of the relevant form filed, category of auditor, membership no., and period of appointment.

Mention yes or no whether any special notice has been received for removal of auditors, if yes is selected then mention the date of receipt of notice, provide details of percentage of capital held by the members giving such notice or percentage of the number of member in case of company limited by members and also mention if the audit fees has been paid if not mention arrear amount.

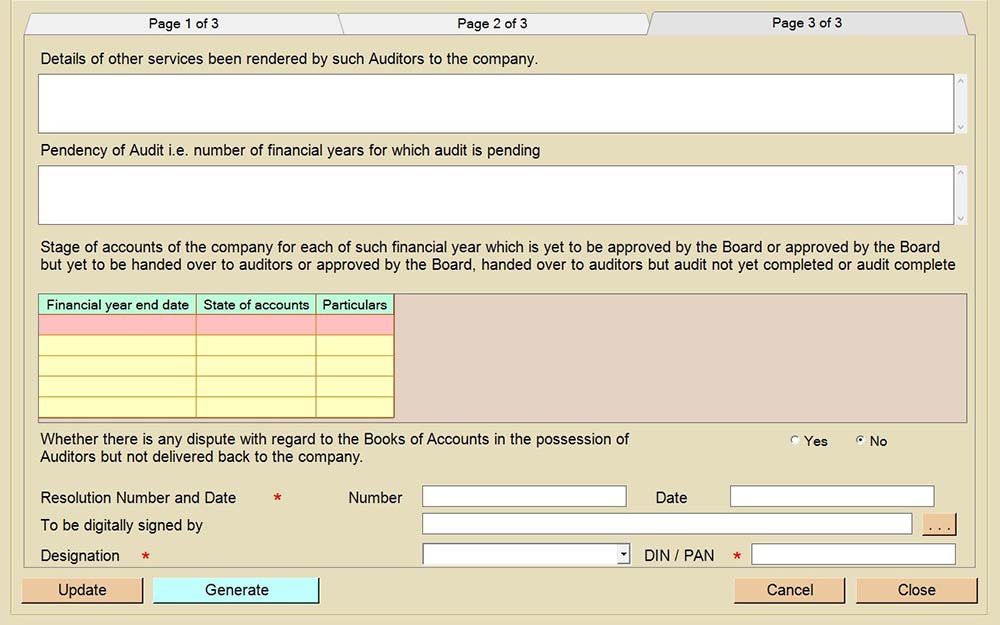

Step 6: On page no. 3 mention details of other services rendered by such auditor to the company, pendency of audit and the details of the stage of accounts of the company for each of such financial year, which is yet tobe approved by the board, but to be handed over to auditors or approved by the board, handed over to auditors but audit not yet completed or audit complete.

State whether there is any dispute regarding the book of accounts in the possession of auditors but not delivered back to the company.

Select the directors whose DSC is required to be attached to the form, click the update option to save the details, attach the required attachment by selecting the attachment option, and click the generate option to upload the form details on the MCA portal.

Step 7: Select the MCA login ID from whom you want to upload the form. It will upload all the details of the relevant form on the MCA portal.