Under the Goods and Services Tax (GST) regime, a tax of 18% is to be imposed on the activity of shifting or raising the height of transmission towers or lines, when carried out through a contractor for a dedicated consumer such as the National Highways Authority of India or Indian Railways, the Maharashtra Authority for Advance Ruling (AAR) has ruled.

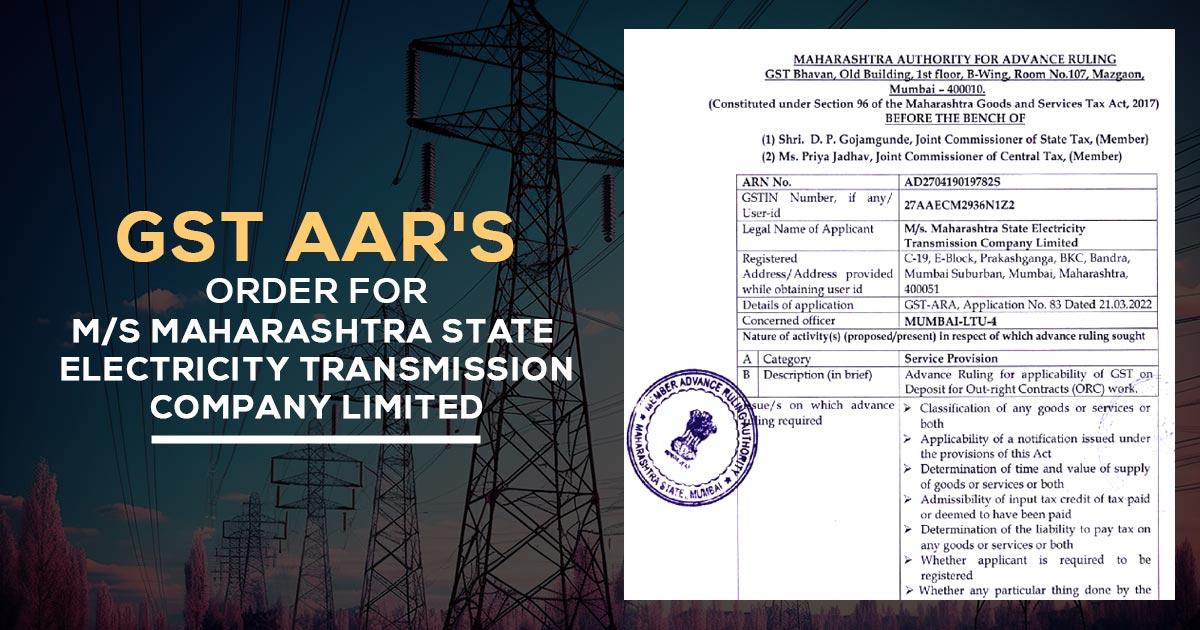

Against an application of Maharashtra State Electricity Transmission Company Limited (MSETCL), a wholly owned Maharashtra Government enterprise and the state transmission utility, the query was answered.

MSETCL asked for clarification on the taxability of distinct works performed on behalf of the devoted consumers, along with the shifting or height raising of existing transmission infrastructure.

Via advance adjustable deposits and supervision charges filed by the consumers, the related works are funded.

The applicant, represented by Arpit Jain, noted that relocating or elevating existing transmission towers and wires is frequently required as a result of construction operations such as road widening or railway infrastructure extension carried out by public sector entities. The expense of these improvements is borne by the relevant entities, while MSETCL completes the work through third-party contractors.

Read Also: PB AAR: Electricity Transmission Lines Would Attract 18% GST on Shifting

The asset is capitalised in the books of MSETCL at a nominal value of Rs 1 on completion, without transferring ownership.

For the revenue, Sudarshana J. Patil appeared

The Bench of D.P. Gojamgunde, Joint Commissioner of State Tax, and Priya Jadhav, Joint Commissioner of Central Tax, said that the activity in question does not come under the waiver for the transmission and distribution of electricity under Entry 25 or the ancillary services under Entry 25A of Notification No. 12/2017.

As per the authority, the service is not furnished to consumers of electricity and does not comprise any activity of power transmission per se. Instead, it is a contractual service furnished before the entities asking to relocate transmission assets for their requirements of project.

The Authority, relying on Circular No. 178/10/2022-GST dated 03.08.2022, categorised the activity as one of “agreeing to do an act” under SAC 999792 and therefore drawing 18% GST.

Also, the authority stated that the input tax credit eligibility shall rely on whether the resultant asset entities as plant and machinery u/s 17 of the CGST Act.

Section 13 of the Act controls the time of supply, and Section 15 specifies the value of supply.

As per that AAR carried that, the activity of MSETCL of shifting or height-raising of transmission lines/towers through a contractor for devoted users includes a taxable service under GST at 18%.

| Name of Applicant | M/S Maharashtra State Electricity Transmission Company Limited |

| GSTIN Number | 27AAECM2936N1Z2 |

| ARN No. | AD270419019782S |

| Date | 21.03.2022 |

| Maharashtra GST AAR | Read Order |