The Madras High Court in a ruling addressed the problem of the rejection of the response of the assessees in the GST proceedings. The case of Jupiter & Co. versus the Deputy State Tax Officer emphasized differences in how tax authorities regulated the explanations of the applicant under the Tamil Nadu Value Added Tax Act, 2006.

The applicant, Jupiter & Co., a dealer under the VAT regime, obtained a Show Cause Notice (SCN) for the differences in their GST returns. Even after the timely answers describing mismatches attributed to transactions with government departments, the Deputy State Tax Officer issued an order dated April 30, 2024, dismissing the explanations of the applicant without furnishing substantive reasons.

In the course of proceedings, Jupiter & Co. stressed that the payments for the services rendered before the departments of the government were late which caused the differences in their GST returns. They contended that such transactions were precisely shown in GSTR 7 filings, even after the temporal mismatch shown via the tax authorities.

Opposite to that it was argued by the Additional Government Pleader that Jupiter & Co. failed to confirm such claims with adequate proof of payments at the time of the VAT period. The court discovered the order of the Deputy State Tax Officer that does not hold the reasoned examination, only citing the rejection of the applicant’s responses without substantive justification.

On 30th April 2024, the Madras HC set aside the impugned order and remanded the case before the Deputy State Tax Officer for reconsideration. The court asked the respondent to provide Jupiter & Co. a reasonable chance, including a personal hearing, and to issue a fresh order within 3 months from the date of receipt of the court’s directive.

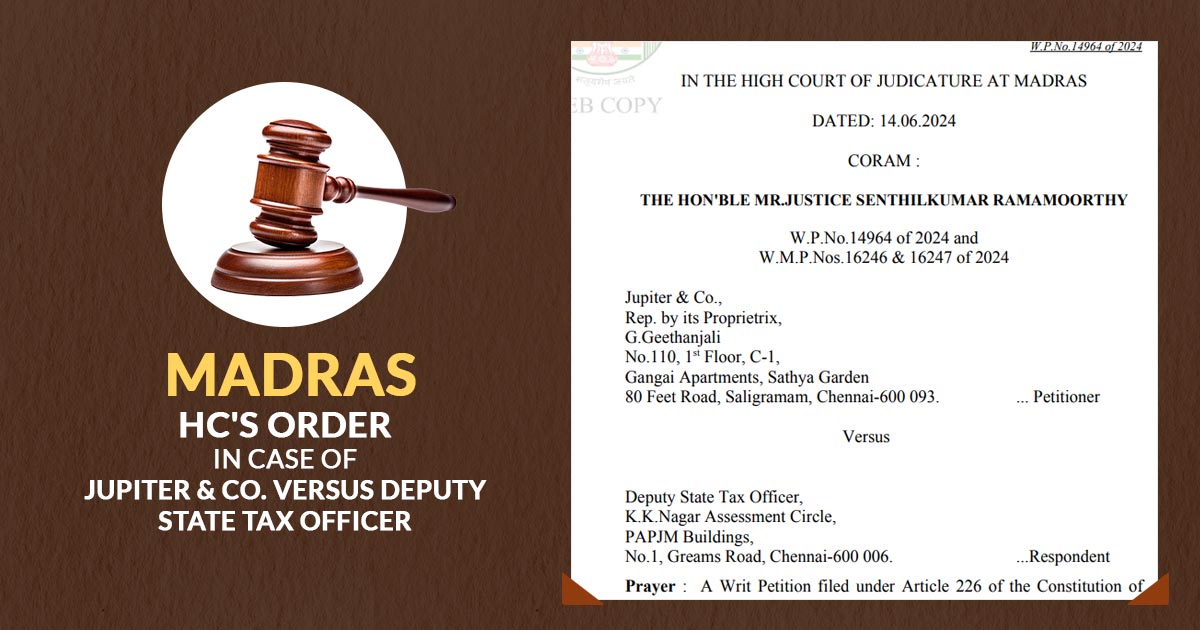

| Case Title | Jupiter & Co. Versus Deputy State Tax Officer |

| Case No.: | W.P.No.14964 of 2024 and W.M.P.Nos.16246 & 16247 of 2024 |

| Date | 14.06.2024 |

| Counsel For Appellant | Mr. N.Murali |

| Counsel For Respondent | Mr. V. Prashanth Kiran, Government Advocate (Taxes) |

| Madras High Court | Read Order |