High Court of Madras in an updated GST judgment, the problem of assessment orders issued before the deceased person was addressed. The matter engaged Munusamy Nagabushanam who was represented by his legal heir, Nethaji Nagabushanam.

The same blog will examine the essential attributes of the judgment and discuss its implications concerning Goods and Services Tax (GST) law. The applicant argued that the assessment orders were issued after the demise of his father, and thus, were non-sustainable.

The counsel of the applicant mentioned that the assessment orders were not valid since they were issued to a deceased person. He carried his contention by presenting the death certificate and legal heirship certificate, indicating that the impugned orders were after his demise.

The Honourable Justice post acknowledging the contentions put forth by both parties furnished an order. The applicant’s argument has been accepted by the court which ruled that the AO issued before the deceased person could not be sustained. Therefore, on 19.09.2023, the impugned orders were set aside.

The court in its order left the same open for the respondent to execute the proceedings against the legal heirs. The same implies that the tax authorities could seek the recovery of any outstanding tax liabilities from the legal heirs of the deceased.

Read Also: Delhi HC Directs GST Dept to Cancel GSTIN from Death Date of the Proprietor Instead Retrospectively

High Court of Judicature at Madras in its judgment emphasizes the importance of ensuring that assessment orders are issued to the correct and legally acknowledged entities.

In this matter, the court set aside the assessment orders issued before a deceased person. However, the tax authorities need to initiate proceedings against the legal heirs to recover any outstanding tax liabilities.

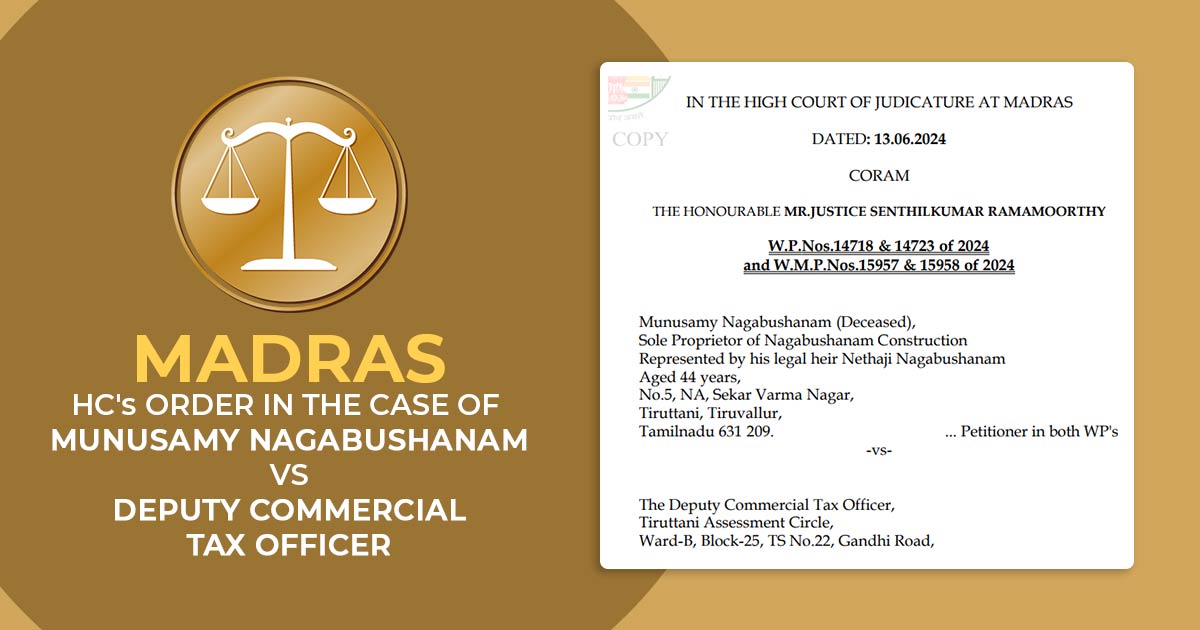

| Case Title | Munusamy Nagabushanam Vs Deputy Commercial Tax Officer |

| Order No | W.P.Nos.14718 & 14723 of 2024 |

| Date | 13.06.2024 |

| For Petitioner | Mr.L.Dinesh |

| For Respondent | Mr.T.N.C.Kaushik, AGP (T) |

| Madras High Court | Read Order |