The Madras High Court in a significant verdict, carried the authority of the State Goods and Services Tax (GST) authorities to restrict the electronic credit ledger (ECL) of firms discovered incorrectly claiming GST input tax credit (ITC) until investigations are concluded.

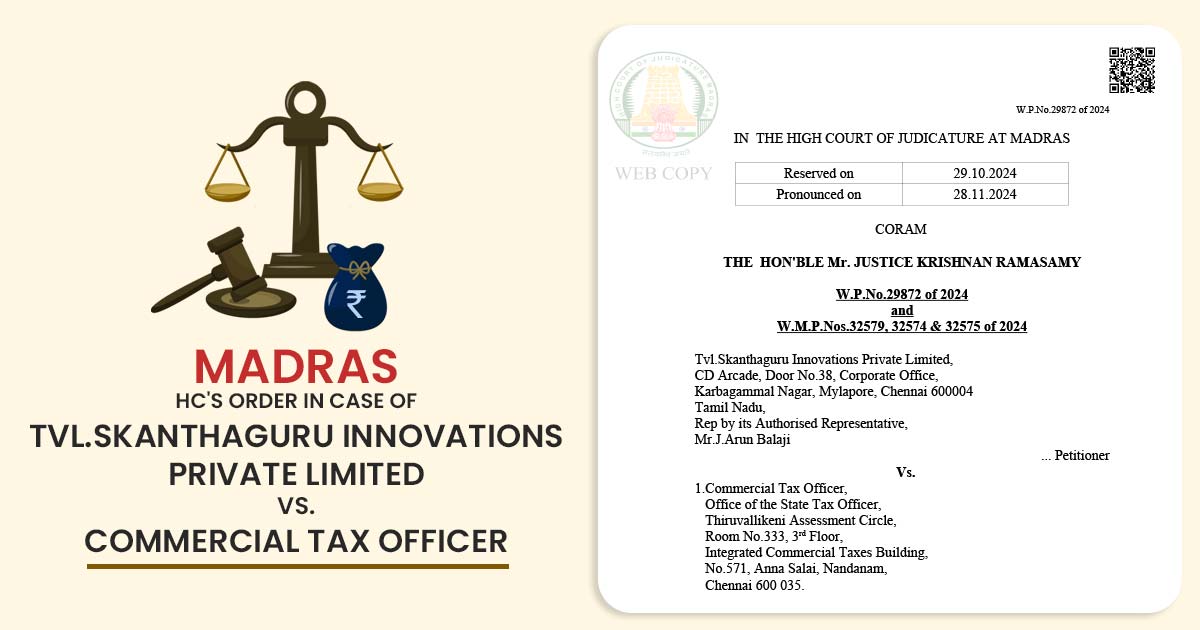

“This Court is of the considered view that the negative blocking is well within the scope of provisions of Rule 86A of GST Rules,” Justice Krishnan Ramasamy cited in an order, dismissing writ petitions filed by Chennai-based Skanthaguru Innovations Private Limited.

The petitions, furnished by J. Arun Balaji, the company’s authorized representative, asked to quash the notice in Form ASMT-10 issued dated 26 September 2024 by the Commercial Tax Officer, Thiruvallikeni Circle. The notice restricts the electronic credit/cash ledger and asks the ledger be unblocked.

Proceedings have been initiated by the Central GST authorities against the company for bogus claims of ITC of Rs 6.8 crore for the period of up to March 2024. Parallel to that the State GST authorities have seen the incorrect claim of ITC of Rs 13.10 crore for the period up to September 2024.

The applicant’s representative Senior Advocate Sathish Parasaran claimed that the restricting of the ECL without the availability of any credit was opposite to the provisions of Rule 86A.

He claimed the concurrent jurisdiction of the state authorities, stating that the central authorities had started the proceedings before for the exact issue, along with performing the searches and arresting one of the directors of the company.

The Additional Government Pleader C. Harsharaj, representing the State GST authorities claimed that the measures of the state were true as the period and quantum of the incorrect credit in question varies from that addressed via the Central authorities.

He asserted that no restriction is there in any law or any ruling of the High Court or Supreme Court against the state authorities for the same concern.

He also mentioned that State authorities are empowered to block the credit in the electronic credit ledger (ECL) if it is claimed incorrectly and is either available at the time of blocking or used thereafter.

The same opinion is been supported by Justice Ramasamy, ruling, “The State authorities are empowered to pass blocking orders to the extent of credit which was fraudulently availed and available in ECL for discharge of output tax liabilities either at the time of blocking or subsequently, in the event the same was already utilized.”

As per the Madras High Court, the central and state authorities raised issues that may appear identical, both authorities and qualified to start their proceedings if they relate to distinct periods.

| Case Title | Tvl.Skanthaguru Innovations Private Limited vs. Commercial Tax Officer |

| Citation | W.P.No.29872 of 2024 and, W.M.P.Nos.32579, 32574 & 32575 of 2024 |

| Date | 28.11.2024 |

| For Petitioner | Mr.Satish Parasaran, and Mr.Karthik Sundaram |

| For the Respondent | Mr.C.Harsha Raj, and Mr.R.P.Pragadish |

| Madras High Court | Read Order |