Overview

The Madras High Court in a judgment addressed the legality of the provisional property attachment u/s 83 of the CGST Act 2017. The same blog explores the court’s decisions for the matter of TVL Maxtile AAC Block Vs State Tax Officer, stating key aspects of tax demand and recovery procedures.

Context

We know about Section 83 of the CGST Act,2017 about the provisional attachment of the property, in which a course of demand and recovery, the authorities begin the provisional attachment of property to prevent the evasion of tax by the taxpayer. In this case, the Madras High Court kept one of the substantial aspects concerning the attachment of the property.

Factual Overview

- In favour of the taxpayer the Demand order had been issued for a mismatch of ITC declared in GSTR-3B vs the amount reflected in GSTR-2A. On issuance of the Order, the tax administrations should stay the proceedings concerning the provisional attachment of property for 3 months until the taxpayer files a plea. Opposite to that if the appeal is not filed, proceedings should be started.

- In this matter, the provisional attachment was made dated 22.08.2023 at the time when the due date for filing the petition was 30.08.2023. While the taxpayer via paying the pre-deposit of 10% has filed an appeal on 24.08.2023. Therefore the taxpayer had approached the Madras High Court for the breach of the provisions and inappropriate attachment of the property.

- The high court ruled, “Such attachment is contrary to the statutory prescription and cannot be sustained” and remanded back to the authorities to stay the proceedings.

Conclusion

The ruling of the Madras High Court declared the provisional attachment of immovable properties as disobedient to legal provisions. It asked for the release of the attachment and the removal of corresponding entries from encumbrance certificates. The very decision forms a precedent for compliance with specified procedures in tax-related cases.

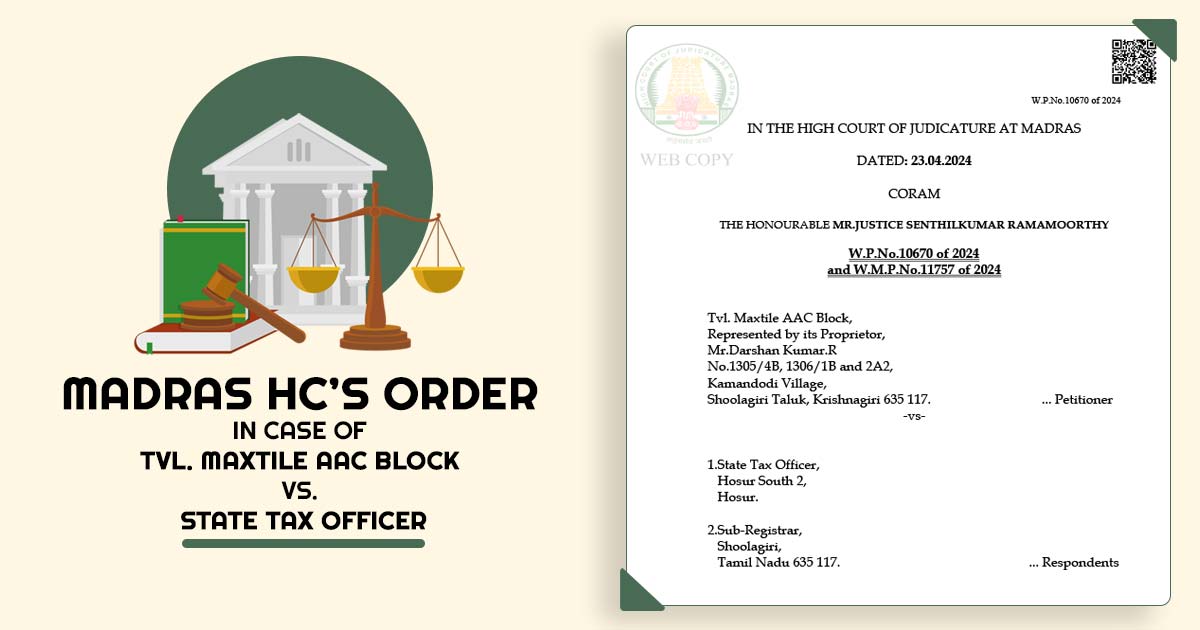

| Case Title | Tvl. Maxtile AAC Block Vs. State Tax Officer |

| Appeal Number | W.P .N o.10670 of 2024 and W.M.P.No.11757 of 2024 |

| Date | 23.04.2024 |

| For Petitioner: | Mr G.Derrick Sam, Mr Adithya Reddy |

| For Respondent 1 | Mr.T.N.C.Kaushik |

| For Respondent 2 | Mr.P.Anantha Kumar |

| Madras High Court | Read Order |