The Madras High Court in a case held that the GST obligation confirmed for non-providing of documents not asked in the SCN ( Show Cause Notice ) is not valid. The court remanded the case for reconsideration.

The bench of Justice Senthilkumar Ramamoorthy noted that concerning the second issue, the tax proposal was confirmed on the ground that the applicant did not establish the movement of goods by producing lorry receipts, weighment slips, and payments made to the supplier. No documents were asked in the SCN (Show Cause Notice) which proceeded on a completely different basis. Thus, the impugned order cannot be upheld.

The taxpayer Slitina Metal Sales LLP, argued that the GST order was on various grounds. The taxpayer obtained a SCN, addressing two major issues.

The initial problem related to the claim of the ITC on the commodities allegedly not eligible under sub-section (5) of Section 17 of the applicable GST statutes. The second issue is the ITC claims for the supplies from the cancelled dealers who did not remit the tax dues.

The taxpayer in response furnished a detailed response along with the invoices and GST e-way bills pertinent to the supplies from M/s. VK Impex, along with proof of the GST return filings of the supplier. It was explained by the taxpayer that MS Scrap was purchased from three suppliers for business objectives.

The impugned order was unable to address the first problem related to the ITC claims on MS scrap, furnished via the legal representative of Slitina Metal.

The counsel for the second issue remarked that the taxpayer was not directed to furnish the information on the goods movement. The SCN cited that the registration of the supplier has been rejected and taxes were not paid, however, the taxpayer has furnished the tax payment proof via the supplier. The counsel of the GST department argued that as per GST Sections 16 and 155, the evidence burden for the ITC rests with the assessee.

As the applicant has not furnished the additional documents such as lorry receipts and weighed slips, the assessing officer was forced to keep the tax proposal. The SCN has been analyzed via the High Court and it clears that it addressed two problems ITC on allegedly ineligible commodities u/s 17(5) of GST law and input tax credit (ITC) claims associated with a supplier who had not paid taxes.

To both concerns, the taxpayer has answered claiming that the materials under HSN Code 7204 were used in business and did count under the ambit of Section 17(5). The taxpayer has shown that the supplier even after having a cancelled registration, had filed the taxes, reinforced by appropriate invoices, e-way bills, and returns.

It was noted by the High Court that the impugned order verified the tax proposal on the second issue, quoting the absence of proof for the goods movement, like lorry receipts and weighed slips. Such documents were not needed via the original GST SCN that is concentrated on a distinct problem, the court mentioned.

The case was remanded back for reconsideration without any pre-deposit and allowed the taxpayer to provide an additional response with all pertinent documents associated with the movement of goods within 15 days of receiving the order of the court.

As per that the department was asked to furnish a reasonable chance for the personal hearing and furnish the fresh order within 3 months from obtaining the additional response.

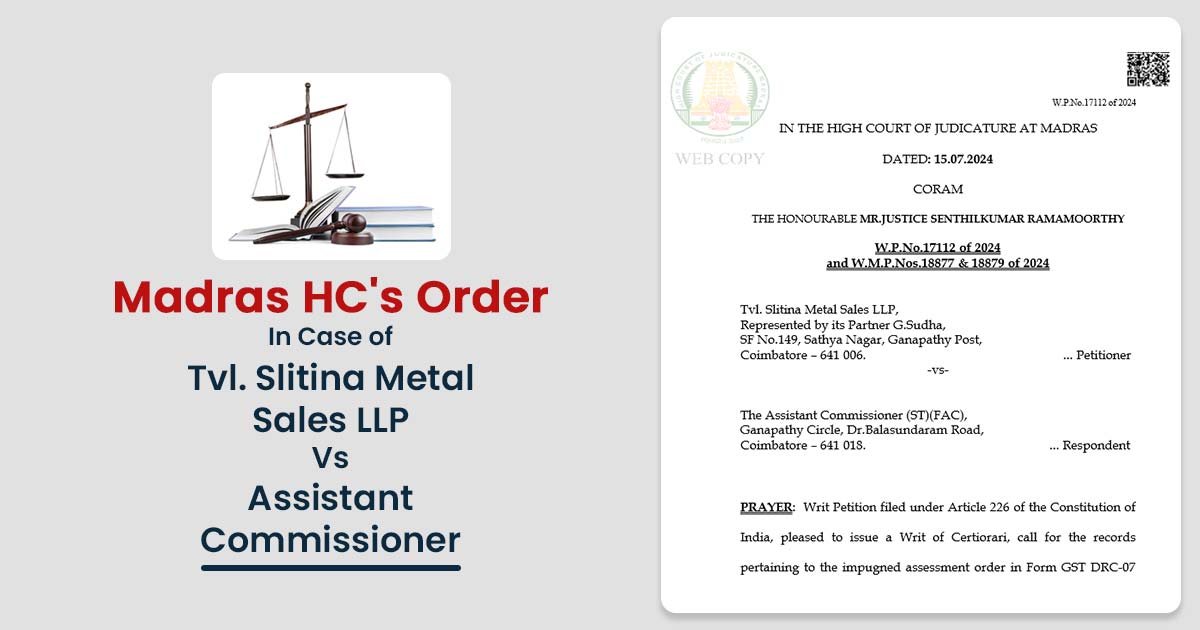

| Case Title | Tvl. Slitina Metal Sales LLP Vs Assistant Commissioner |

| Citation | W.P.No.17112 of 2024 |

| Date | 15.07.2024 |

| Counsel For Appellant | Mr.C.Derrick Sam |

| Counsel For Respondent | Mrs.K.Vasanthamala, GA (T) |

| Madras High Court | Read Order |