The Madras High Court explained that Section 65 of the Central Goods and Services Tax ( CGST Act ), 2017 does not need the audit report to show the ‘Fraud or Misstatement or Suppression of Facts’ for Demand u/s 74 under the GST Act.

A single bench of Justice Senthilkumar Ramamoorthy remarked, that nothing is there in the language of Section 65 to demonstrate that the audit report should include such findings. Opposite to that, subject to the audit report revealing the aforementioned, sub-section (7) of Section 65 stipulates that the proper officer may initiate action u/s 73 or 74.

The applicant, a public limited company engaged in the supply and servicing of light vehicles and parts, contested the notices on April 17, 2024, and April 29, 2024, issued via the respondent.

The books of account of the company for FY 2017-2018 to 2020-2021 were audited, resulting in a draft audit report, a revised draft, and ultimately, an audit report in Form GST ADT-02 on September 7, 2023. Thereafter, SCNs were issued u/s 73 and Section 74 of the CGST Act.

The applicant argued the Section 74 notice on three foundations: The audit report did not record findings of fraud, willful misstatement, or suppression of facts.

No issuance of the Intimation in Form GST DRC-01A

The SCN does not consider the unit-specific expenditure and was founded on the consolidated numbers.

The counsel of the applicant furnished that without findings of fraud or misstatement in the audit report, the proper officer does not have the jurisdiction to proceed u/s 74. It was argued that the revision to Rule 142(1) of the CGST Rules was prospective and not appropriate to the present proceedings. The applicant claimed that the expenditure for merely the unit in question must have been regarded.

Answering that the senior standing counsel for the respondent claimed that Section 65 of the CGST Act does not need the audit report to show the fraud for measure u/s 74. Hence the proper officer issued the SCN as per the law.

Interruption with the SCN is wanted merely when issued without jurisdiction or if no matter is made for the threatened measure.

The audit report exhibited unpaid or short-paid tax, fulfilling legal requirements. The court said that Section 65 does not require findings of fraud or misstatement in the audit report. The allegations of the proper officer of fraud were included within the show cause notice, meeting the required legal norms.

The court for the second ground noted that show case notice was issued post-revision to rule 142(1) creating the argument of the applicant on the revision prospective nature moot.

Concerning the third ground, the court dismissed the objection for the consolidated expenditure numbers as inadequate grounds for interruption under Article 226 of the Constitution of India.

The court subsequently dismissed the writ petition, permitting the applicant to answer to the SCN. Concerning costs no order was made and the related miscellaneous petition was closed.

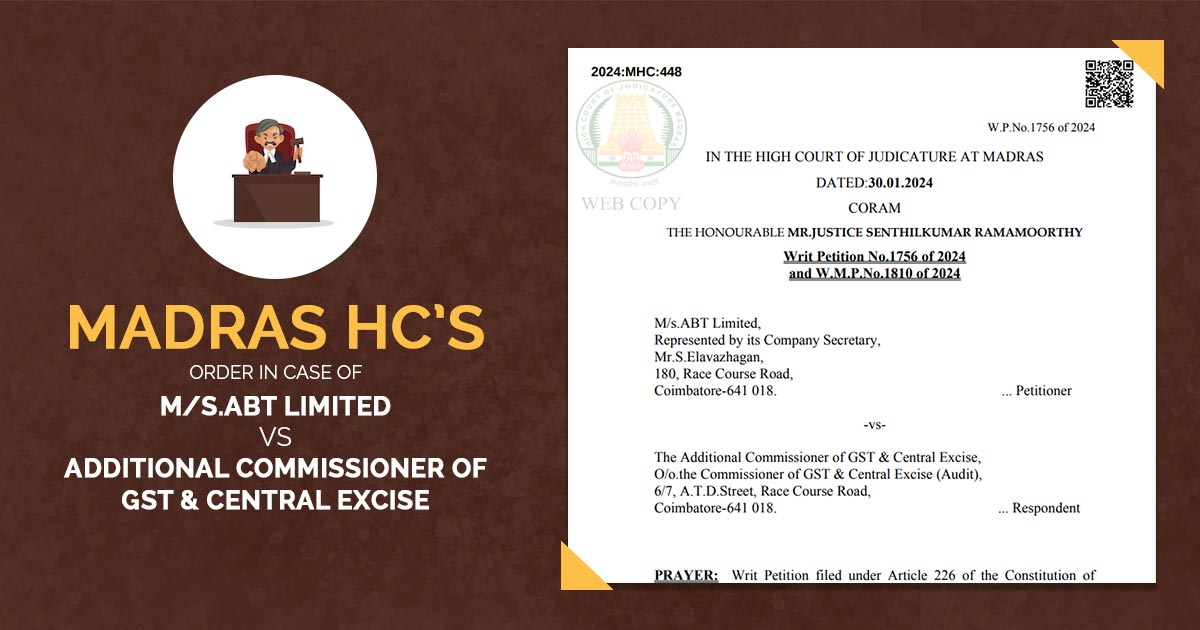

| Case Title | M/s.ABT Limited VS Additional Commissioner of GST & Central Excise |

| Citation | Writ Petition No.1756 of 2024 W.M.P.No.1810 of 2024 |

| Date | 30.01.2024 |

| For Petitioner | Mr.I.Dinesh for Mr.Baskar G |

| For Respondent | Mr.A.P.Srinivas, Senior Standing Counsel |

| Madras High Court | Read Order |