A GST demand order has been set aside by the Madras High Court under Section 73(9) of the TNGST (Tamil Nadu Goods and Services Tax) /CGST (Central Goods and Service Tax) Acts, 2017 as of the rejection of the response of SCN without furnishing the sufficient causes, breaching the norms of natural justice and asked the respondent to pass a fresh order addressing each of the grounds that the applicant has raised.

The applicant, Ella Tea Industry is in the tea industry and registered under the Tamil Nadu Goods and Services Tax (TNGST) Act encountered scrutiny from tax authorities for the FY 2018-2019. During the assessment under Section 61 of the Act, discrepancies were uncovered in the tax returns of the company.

A SCN has been furnished by the respondent dated November 25, 2021, asserting the company has not shown its correct tax obligation at the time of filing GSTR-3B and has asserted the excess ITC beyond what was in the inward data. Before the notice, the company has answered dated December 19, 2022, furnishing the related documents. The respondent pleased with the explanation dropped the proceedings in an order on 3rd January 2023.

Even after the case closure, a second SCN was furnished dated December 28, 2023, again alleging excess Input tax credit claims for the year 2018-2019 and asking for the credit reversal. On February 15, 2024, the company answered by uploading its detailed response including the pertinent documents to the common portal.

The respondent confirmed the previous allegations without properly considering the company’s reply and issued a demand order dated April 29, 2024, u/s 73(9) of the TNGST/CGST Acts, 2017. The company has filed a writ petition to challenge the order and has asked the respondent to reconsider its submissions.

The counsel of the petitioner, Mr. J. Bharathiraja, mentioned that the respondent had dropped the charges for 2018-2019 after examining the earlier submission. He said that reopening the case without new reasons disregarded principles of natural justice. He highlighted that the respondent is not able to address the detailed reply of the applicant in the updated proceedings. On the other hand, Mrs. K. Vasanthamala, representing the government, sustained the orders of the respondent.

Justice Krishnan Ramaswamy considered that earlier the respondent had dropped the proceedings for FY 2018-2019 and said that the matter had been reopened without particular reasoning. It was remarked by the court that the rejection of the respondent of the applicant’s response citing “not satisfied” without sufficient explanation, was disobedient to legal principles and breaches the natural justice.

Read Also: Best Strategies to Handle GST SCN with Basic Reply Format

On April 29, 2024, the court set aside the order and asked the respondent to pass a fresh order addressing each of the reasons raised by the applicant. The new decision is to be made within 8 weeks with no expense awarded, the court ordered. The related miscellaneous petitions were indeed concluded.

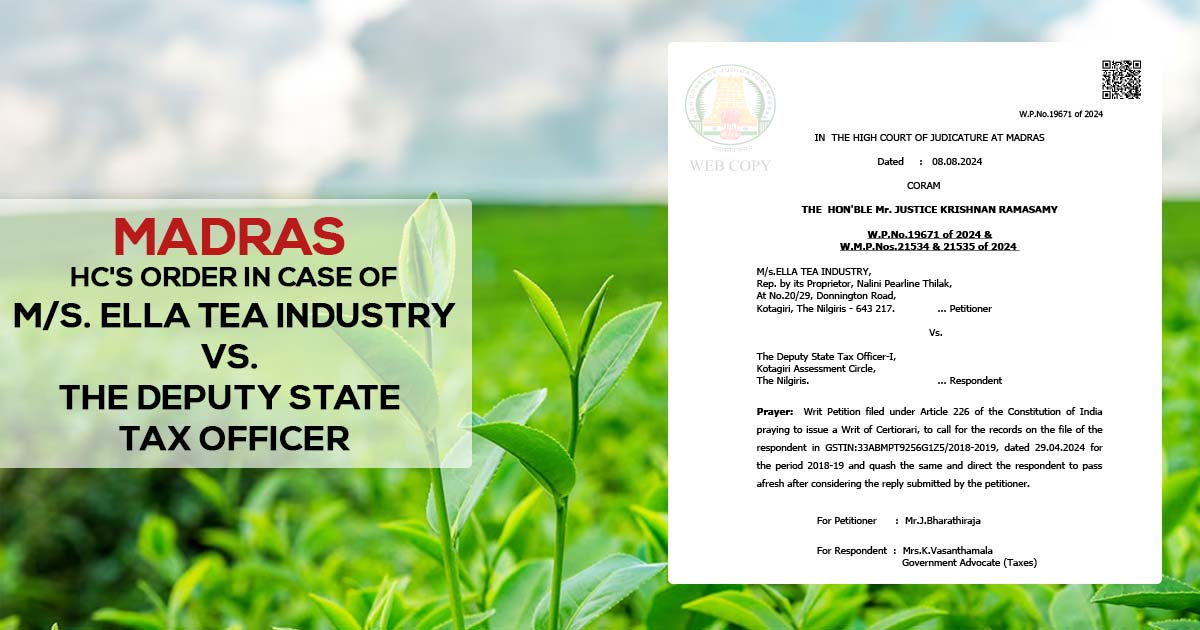

| Case Title | M/s. Ella Tea Industry Vs. The Deputy State Tax Officer |

| Citation | W.P.No.19671 of 2024 & W.M.P.Nos.21534 & 21535 of 2024 |

| Date | 08.08.2024 |

| For Petitioner | Mr.J.Bharathiraja |

| For Respondents | Mrs.K.Vasanthamala |

| Madras High Court | Read Order |