The Madras High Court in a ruling, set aside the demand order on Rs. 2 lakhs pre-deposit condition. The court witnessed that GST (Goods and Services Tax) returns were not filed and the taxes were not filed at the time of the COVID period due to numerous reasons.

The applicant, Nagoorar Enterprises claimed that he was not able to furnish the returns and file the taxes within the said time during the assessment periods based on numerous reasons, along with bereavements in the family, nonpayment by suppliers, and the onset of the COVID-19 pandemic. The GST returns were filed and requisite taxes were paid, eventually. Orders assessing interest liability are contested in these cases.

The applicant’s counsel furnished that a personal hearing was not furnished before the issuance of the impugned orders. He furnished that the applicant has asked the respondents to allow the applicant to make the payments in instalments by considering the financial situation of the applicant.

It furnished that these requests can be positioned to the pertinent authority u/s 80 of the applicable GST legislation. In the last submission, a circular was provided for the levying of interest at lower rates in particular months in the Covid-19 pandemic.

Post figuring that the applicant has filed nearly Rs 2 lakhs for the aggregate demand of about Rs.12 lakhs, the counsel asks for another opportunity to put such opinions before the respondents.

On guidelines, he furnishes that the applicant agrees to remit another sum of Rs 2 lakhs as a condition for remand and as a condition for raising the garnishee orders.

Mr V. Prashanth Kiran, a Government Advocate on behalf of the respondents, claimed that interest levying follows legal mandates, leaving no room for discretion by assessing officers. He argued that the Assessing Officer (AO) has no discretion in the case and that no objective shall be served by remanding the case.

Analyzing the challenged orders, the bench of Justice Senthilkumar Ramamoorthy, observed that orders pertain only to interest. In the affidavit in assistance of such writ petitions, the applicant has designated the information of payment of requisite taxes concerning the related assessment durations.

As per the court, the applicant has placed on record payment proof of nearly Rs 2 lakhs for interest. A personal hearing is obligatory if requested for or if an order adverse to the taxpayer is proposed to be issued, in sub-section 4 of Section 75 of the applicable GST legislation.

Read Also: Bombay HC: Order Without Personal Hearing Violates GST Section 75(4)

Under Circular No.13/2020-TNGST dated 17.08.2020, assessees had the advantage of reduced rate of interest during specific months of the COVID-19 pandemic period. By considering all the aforementioned factors, the court discovered it crucial to interfere with the order on conditions.

Therefore, the court set aside the interest orders, within the condition that the applicant remit an additional sum of Rs. 2 lakhs within three weeks. On receiving the aggregate sum of Rs. 4 lakhs, the first respondent was asked to afford the applicant a reasonable chance, including a personal hearing, and issue fresh orders within three months. Also, the garnishee orders were cancelled on receipt of the aggregate sum of Rs. 4 lakhs.

Accordingly writ petition was disposed of Mr K.A.Parthasarathy and Mr.N.Chandirasekar appeared for the petitioner. The respondents were represented by Mr. V. Prashanth Kiran Government Advocate.

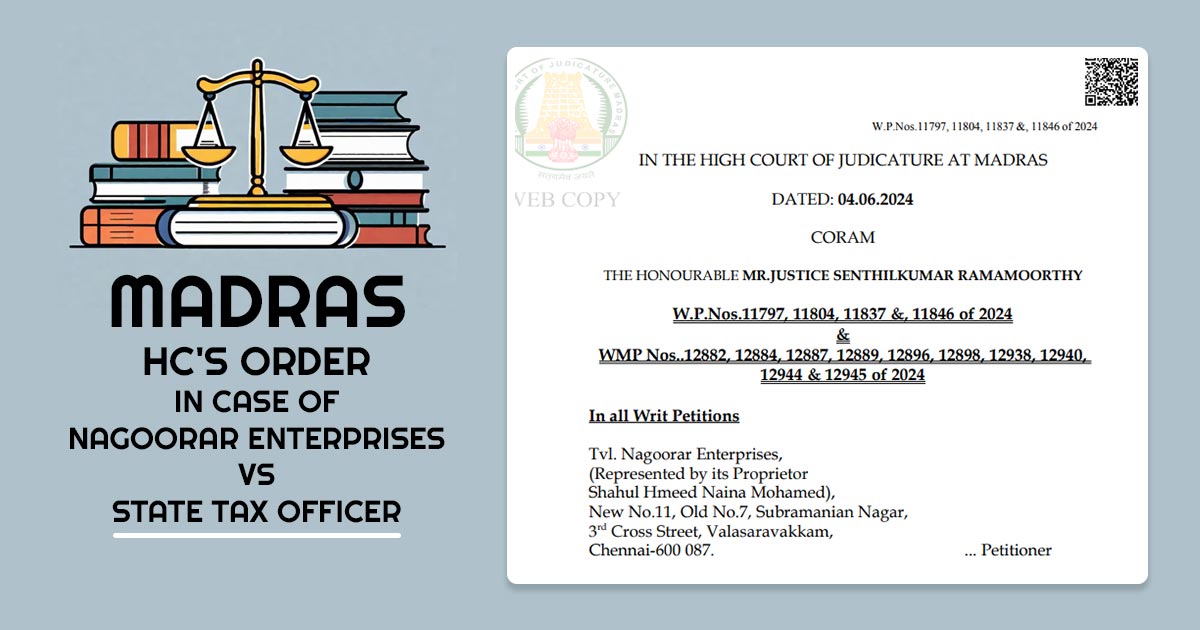

| Case Title | Nagoorar Enterprises Vs State Tax Officer |

| Order No | W.P.Nos.11797, 11804, 11837 &, 11846 of 2024 |

| Date | 04.06.2024 |

| For Petitioner | Mr K.A.Parthasarathy, Mr N.Chandirasekar |

| For Respondent | Mr V.Prashanth Kiran Government Advocate |

| Madras High Court | Read Order |