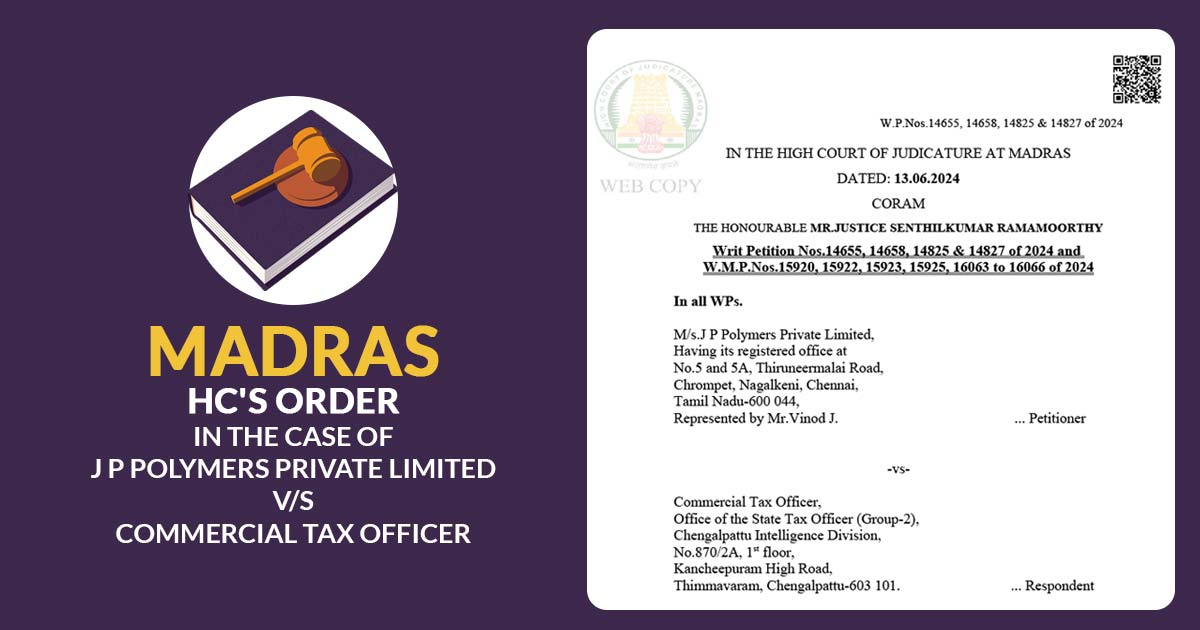

A significant judgment in the case of J P Polymers Private Limited vs Commercial Tax Officer has been rendered by the Madras High Court. The court addressed contentions against orders on 13.03.2024, which kept tax proposals without sufficiently regarding the detailed responses of the applicant to recognized defects during a GST inspection.

The matter revolves around the applicant’s argument that even after submitting replies to each defect pointed out in the inspection, the orders passed via the tax authorities failed to deliver reasons for denying these submissions.

Each defect, such as differences between GSTR 3B and GSTR 1 filings, was answered completely by the applicant, yet the orders only confirmed the tax proposals without concerning or considering these explanations.

It was noted by the court that principles of natural justice, along with the right to be heard and reasoned decisions, were not fully compiled. It remarked that while the replies were recognized, there was no substantive involvement with the explanations given by the applicant. This observation directed the Court to conclude that the impugned orders cannot be sustained in their present form.

the Madras High Court in setting aside the original orders asked for a reconsideration of the case. It allotted the applicant a chance to provide the other documents within 2 weeks and mandated the tax council to perform a new assessment within 3 months from the receipt of such documents. The same decision emphasizes the commitment of the court to assure procedural fairness and compliance with the statutory norms in the tax assessments.

Conclusion

The Madras High Court judgment in J P Polymers Private Limited vs Commercial Tax Officer acts as a reminder of the significance of procedural fairness in administrative decisions, particularly in tax matters.

The court while setting aside the order because of the failure to regard the detailed responses reaffirmed the taxpayer’s rights to fair and reasoned assessment procedures. The same decision seems to have implications for the subsequent tax assessments, stressing the requirement for the tax council to be involved in the submissions inured via the taxpayers at the time of the investigations and the SCN (Show Cause Notice).

Read Also:- An Easy Summary of GST Assessments with Types and Process

The role of the judiciary has been emphasized by the case in keeping the rule of law and assuring that the administrative measures are performed as per the established statutory principles. The same indeed acts as a precedent for identical matters in which the satisfactory reasons furnished in the administrative orders are asked in question.

| Case Title | J P Polymers Private Limited V/S Commercial Tax Officer |

| Case No. | W.P.Nos.14655, 14658, 14825 & 14827 of 2024 |

| Date | 13.06.2024 |

| Counsel For Petitioner | Mr.Anil Bezawada for Ms.Lavanya P.R. |

| Counsel For Respondent | Mr.T.N.C.Kaushik, Addl. Govt. Pleader (T) |

| Madras High Court | Read Order |