Under Section 73 of the Goods and Services Tax (GST) Act, the Madras High Court has set aside an order because the principles of natural justice were violated, as the date and time for a personal hearing were not specified in two successive show cause notices issued four months apart.

The impugned order has been contested by the applicant, M.S. Distributors, on 29.12.2023, passed via the Goods and Services Tax (GST) authorities without furnishing a hearing chance.

Mr. P. Pranav Jain, the applicant’s representative, has said that the first SCN on 12.05.2023 only asked for the response on or before 31.05.2023, though unable to cite date and time for a personal hearing. On 27.09.2023, a second SCN was furnished, which again skipped the hearing details.

More time to furnish a response with supporting documents has been sought by the representative of the applicant. Though the authorities moved to pass the final order on the exact day, by not give the requested adjournment. The same sequence of events as per the court shows a violation of the principles of natural justice.

Important: Delhi HC Quashes GST Cancellation Order Due to Lack of Specifics in Show Cause Notice

As per the Additional Government Pleader, Mr. T.N.C. Kaushik, the impugned order can be set aside if the applicant had complied with the earlier court’s conditional order.

According to the court, the applicant had demonstrated good faith by depositing 10% of the disputed tax and transferring an additional ₹2,51,301 through banking channels. However, Justice C. Saravanan, after examining the records, pointed out critical procedural flaws: the absence of any intimation regarding the date and time for a personal hearing in the Show Cause Notices (SCNs) and the unwarranted speed in issuing the final order on the very day the applicant sought an extension. These actions, the court concluded, amounted to a clear breach of the principles of natural justice.

On 29.12.2023, the court quashed the impugned order and remanded the case back to the adjudicating authority for a fresh acknowledgement. The applicant was asked to submit a response along with the supporting documents within 2 weeks of the order receipt. The authority was asked to issue a fresh notice providing at least 14 days for a personal hearing before passing a new order as per the law.

Read Also: Madras HC Rejects GST Demand on Non-Taxable Receipts, Citing Statutory Remedy

According to the court, as the applicant has submitted more than the required 10% of the disputed tax, they are qualified to deduct the excess amount from future payments. Therefore, the writ petitions were permitted without costs, and various associated petitions were closed.

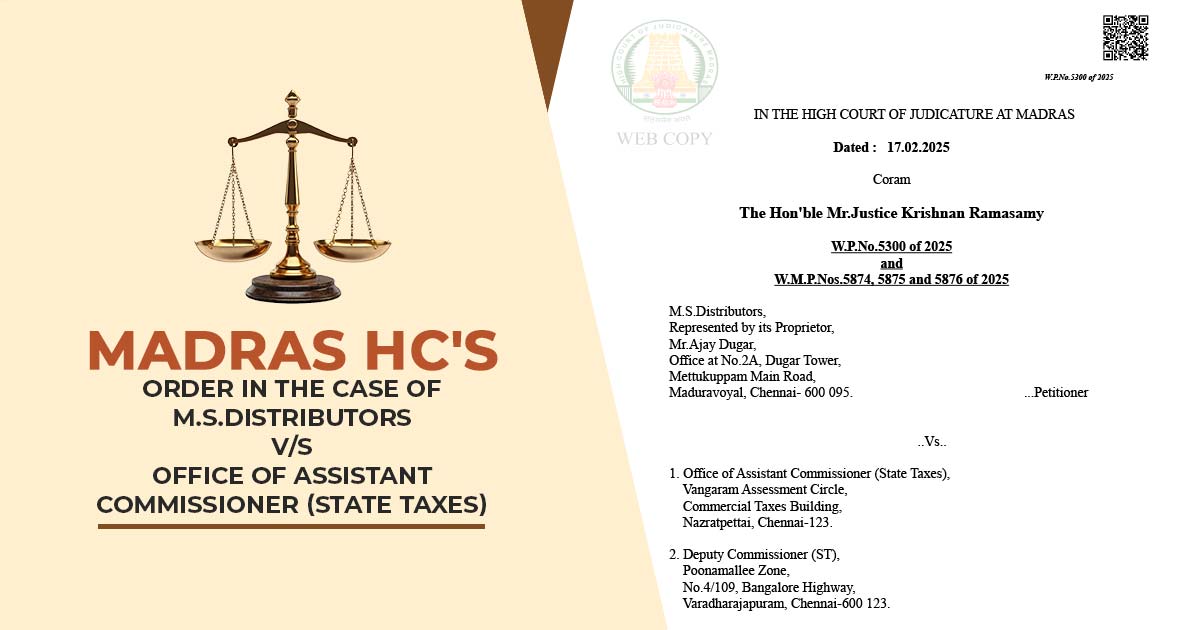

| Case Title | M.S.Distributors vs. Office of Assistant Commissioner (State Taxes) |

| Case No. | W.P.No.5300 of 2025 and W.M.P.Nos.5874, 5875 and 5876 of 2025 |

| For The Petitioner | Mr.Kumarpal Chopra |

| For The Respondents | Mr.T.N.C.Kaushik |

| Madras High Court | Read Order |