What is the Simple Meaning of LLP Form 8? (Statement

of Accounts and Solvency)?

LLP Form 8 is a compulsory form which is filed annually by the LLP to ROC. This form is for Statement of Accounts and Solvency. It contains a declaration of solvency by the designated partners as well as a description of the LLP’s assets, liabilities, income and expenditures. Every year, the LLP must file this form.

Due Date for Filing LLP Form 8

An LLP Form 8 is due on the 30th of October of the year following the financial year ending the 31st of March each year.

Who Can File LLP Form 8 Under MCA?

In order to file LLP Form 8, LLPs that are existing or incorporated by 30th September of a financial year are required to file this form.

MCA LLP Form 8 Filing Fees

Form 8 filing fees vary based on the structure of a Limited Liability Partnership’s capital contributions.

Documents Required for LLP 8 Form Filing

- This attachment must be submitted in accordance with the MSME Development Act, 2006

- Statement of Contingent Liability

- Audited Financial Statement

- Other extra documents as required.

Is Gen Complaw ROC Software Right for Your LLP Form 8 Filing?

In the field of integrated software for the solution of ROC and LLP e-Forms, XBRL, Resolutions, Minutes, Registers and various MIS reports, Gen Complaw is one of the leading software companies.XBRL E-filing with our exquisite product takes only a few minutes. The fixed assets register is very helpful for all statutory compliances under the Companies Act, 2013. The software provides fast responses in a short period of time and is credible when it comes to completing tasks.

In accordance with the Companies Act 1956/2013, various electronic forms are filed, including MGT-7, AOC-4, LLP-8, ADT-1, DPT-3, LLP-3, DIR-3, CHG-4, LLP-11, DIR-12, CHG-1, 23ACA, 23AC, etc. Furthermore, you can import forms with others to get faster responses with this software.

Step-by-Step Guide to File LLP Form 8 Using Gen Complaw Software

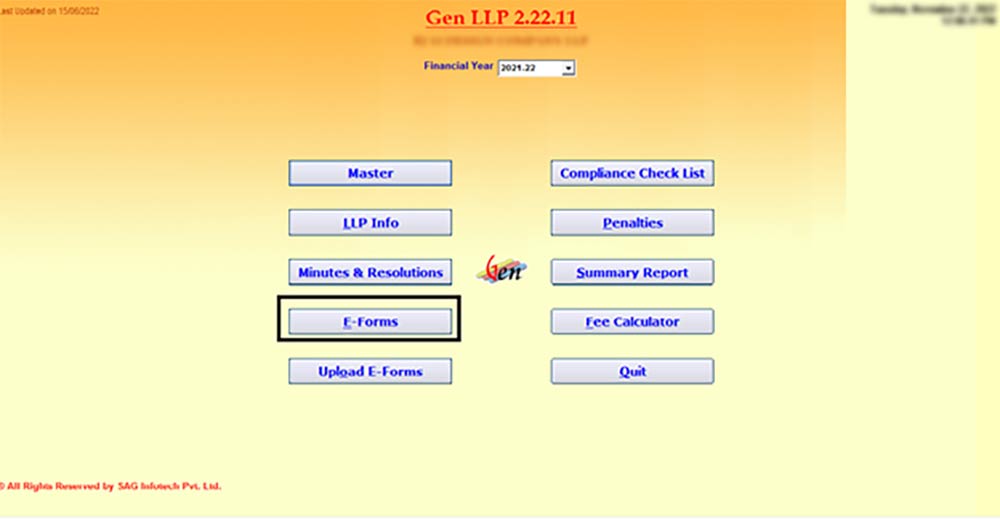

Step 1: Install and Open the Gen CompLaw ROC/ MCA e-filing software on your desktop then select the ‘E-Form’ option from the main screen as shown.

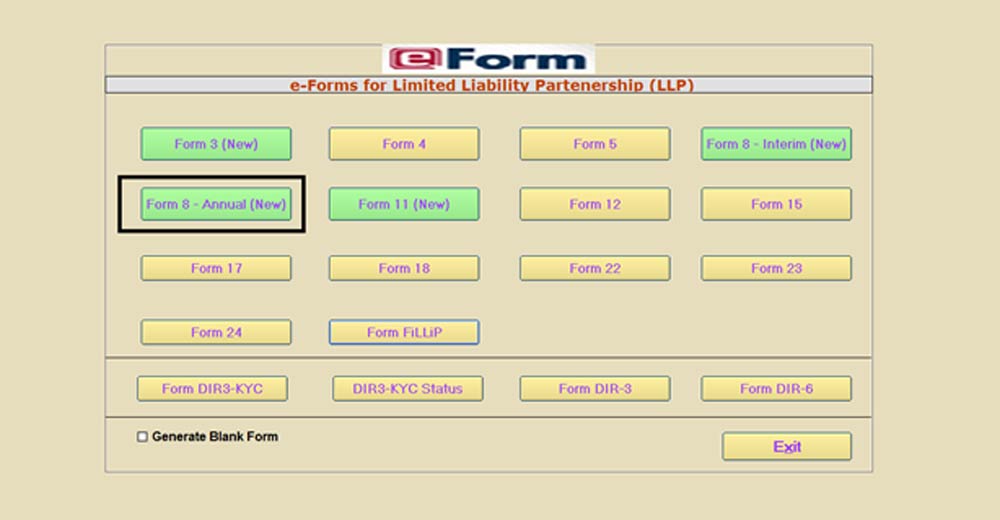

Step 2: Now select ‘E-Form LLP 8 Annual’.

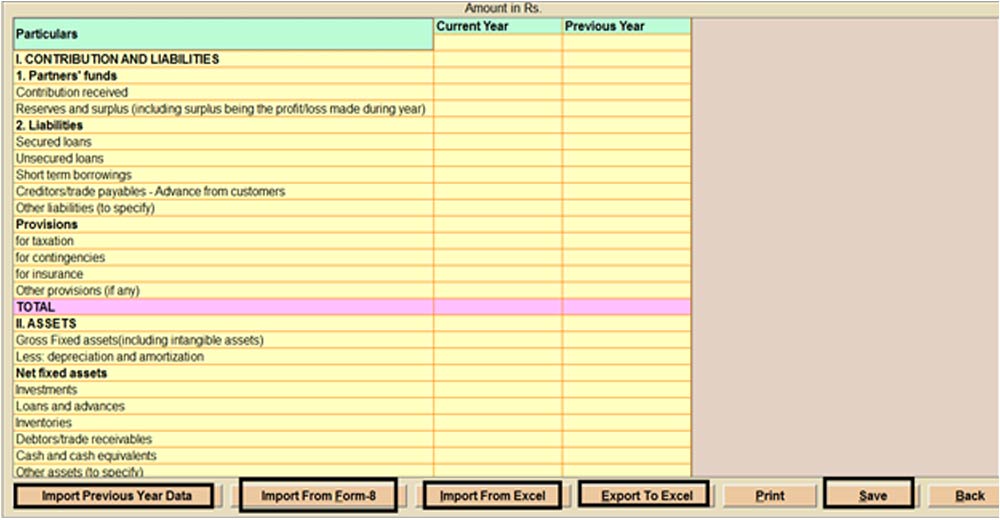

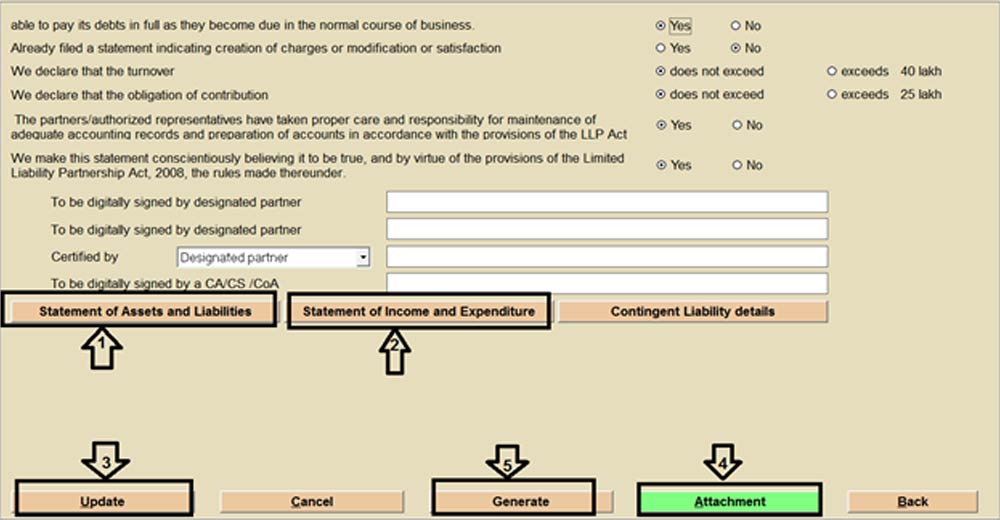

Step 3: After that, provide the details as required and select the statement of assets and liabilities option to give the balance sheet details.

Step 4: After providing the relevant details, click on the save option to save the details, you can also import the details from the options given at the bottom.

Step 5: After providing the appropriate points go to the main page by selecting back.

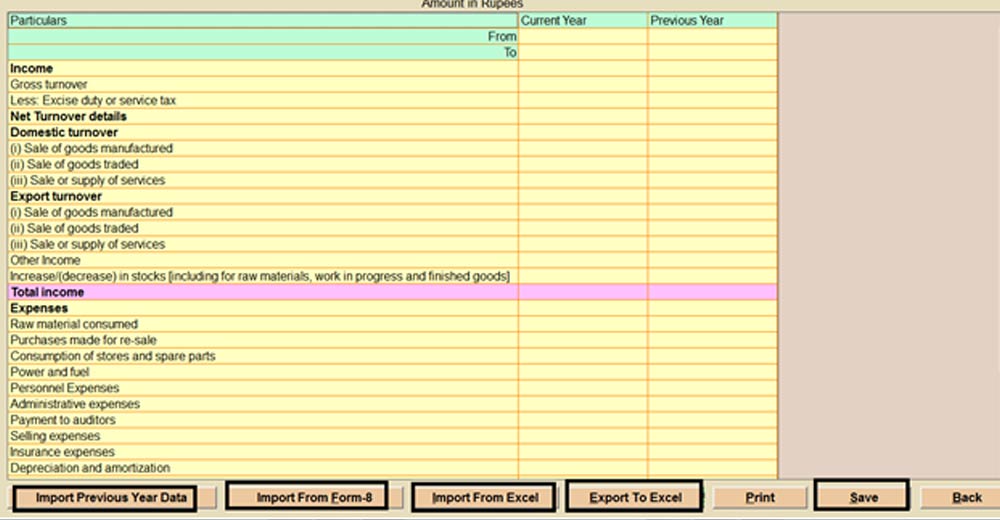

Step 6: Select the statement of income and expenditure option to give the details of income and expenses.

Step 7: After that, you may also import the details from the options at the bottom by providing the proper details and clicking the save option.

Step 8: Once the relevant information has been provided, select the back button to return to the main page.

Step 9: Select the update option to save the details.

Step 10: Select the attachment option in the green tag to attach the required attachment if any.

Step 11: After that select generate option to upload the form details on the MCA portal.

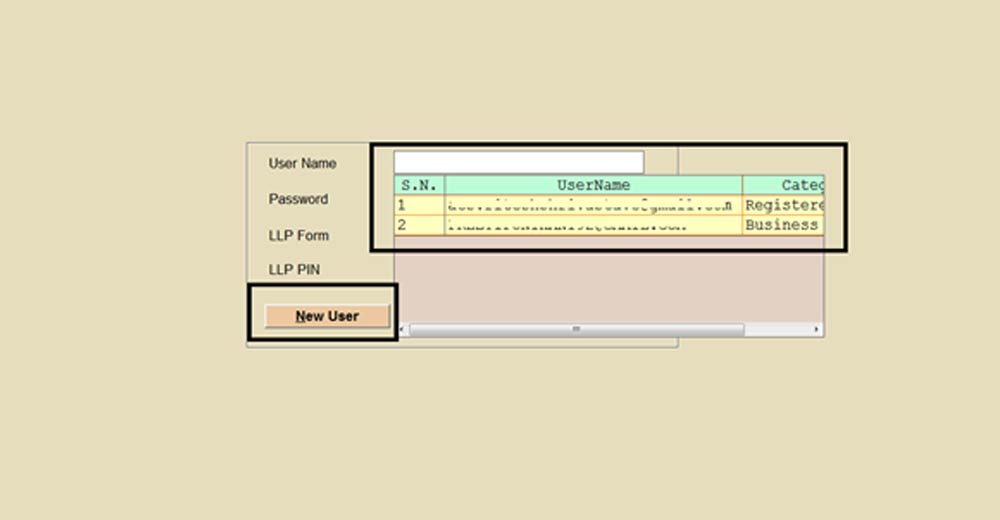

Step 12: Select the ‘MCA login id’ from whom you want to upload the form it will upload all the details of the relevant form on the MCA portal.