The Commissioner of Income Tax(Appeals) order has been set aside by the Kolkata Bench of Income Tax Appellate Tribunal (ITAT) concerning a Scheduled Tribe doctor’s exemption claim u/s 10(26) of the IT Act,1961, due to misinterpretation of eligibility.

Against the order dated 25.08.2023, the Revenue-appellant appealed passed by CIT(A) for the Assessment Year(AY) 2013-14. In this case, Achula Darneichong Sailo, respondent-assessee, did not submit a return of income.

During the year, professional fees of ₹1,70,000 were earned from Novartis Healthcare Pvt. Ltd., with ₹17,000 deducted as Tax Deducted at Source(TDS). Cash deposits of ₹2,43,45,200 and high-value banking transactions of ₹47,29,500 were recorded.

The case was reopened u//s 147, and a notice u/s 148 was issued. A return was filed after that on April 24, 2021, declaring ‘Nil’ income. However, there was no reply to the notice u/s 142(1) or the questionnaire. Due to non-compliance, the assessment was completed by adding all transactions and determining the total income at ₹2,43,45,200.

It was mentioned by the statement of facts that the CIT(A) mentioned that the taxpayer, a Scheduled Tribe member and medical doctor, owned Bethany Hospital in Shillong, with income exempt u/s 10(26). After passing away due to COVID-19 on April 15, 2020, the legal heir, the spouse, took over.

Even after submitting the returns in the earlier years, issues with PAN deactivation in the new tax portal led to non-filing notices. As a result of these complications, the family cannot answer. Post-enhancing the case, the problems were solved on October 7, 2022, allowing access to notices and orders.

No reply was incurred before, as of the portal issues, and the assessment was completed suo moto. Dissatisfied with the same, a plea was submitted to the CIT(A).

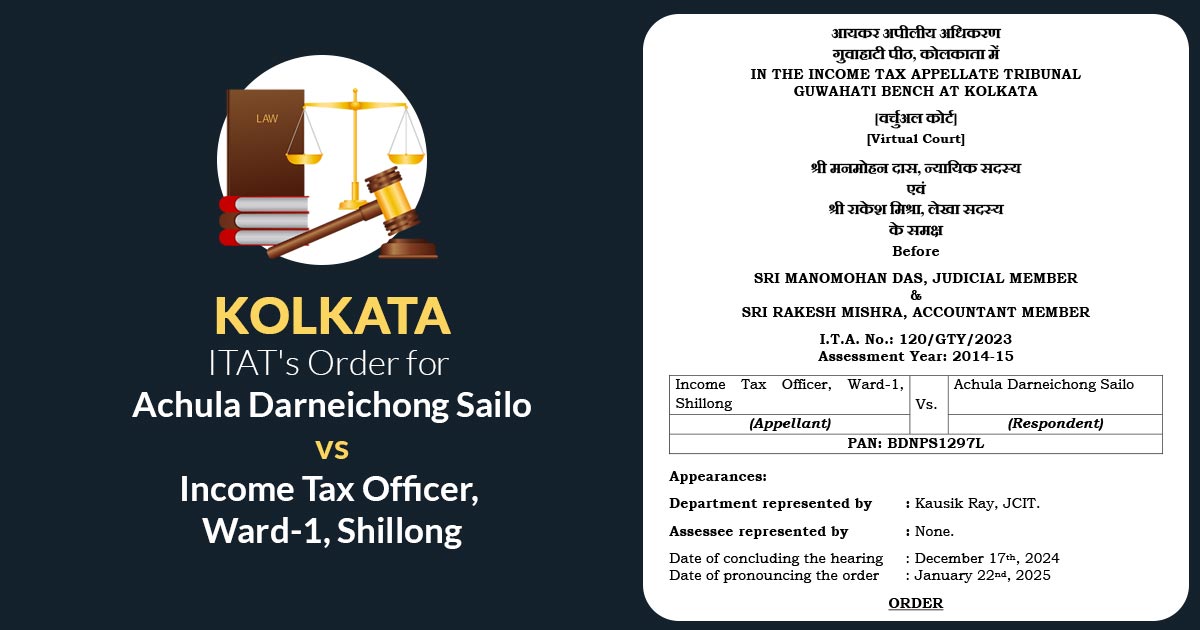

The two-member bench including Manomohan Das (Judicial Member) and Rakesh Mishra (Accountant Member) reviewed the orders of the CIT(A) and AO and discovered that the taxpayer did not explain the cash deposit of ₹2,43,45,200, the technical fee of ₹1,70,000 with TDS deduction, or the source of bank transactions of ₹47,29,500.

Read Also: Ahmedabad ITAT: ITR Filing Must be Done on Time to Claim Tax Benefit U/S 80IB(10)

No reasons were provided by CIT(A) for permitting the exemption or establishing that the cash deposits were associated with the professional income from the cited states u/s 10(26). AO was not provided with a chance to be heard, and the provisions of Section 250(6) were not followed.

As res judicata does not apply to tax proceedings, the ITAT carried that reliance on the assessment order for AY 2017-18 was wrong. It set aside the order of CIT(A) and restored the appeal for fresh adjudication.

The taxpayer was permitted to present submissions on the exemption claim, and the CIT(A) was asked to decide the appeal as per Rule 46A of the IT Rules, 1962.

The plea submitted via the revenue was permitted for the statistical objectives.

| Case Title | Achula Darneichong Sailo vs Income Tax Officer, Ward-1, Shillong |

| Citation | I.T.A. No.: 120/GTY/2023 Assessment Year: 2014-15 |

| Date | 22.01.2025 |

| Assessee by | Kausik Ray |

| Represented by | None |

| Kolkata ITAT | Read Order |