The Kolkata ITAT carried that delayed deposit of amount collected for employees’ contribution to PF renders claim of deduction u/s 36(1)(va) ineligible.

Section 36(1)(va) of the Income Tax Act remarks that if the amount received towards employees’ contribution to PF is not deposited by the employer in the respective welfare account within the deadline, then it will be deemed as income from a business/profession.

Deduction u/s 36(1)(va) concerning delayed deposit of amount collected towards employees’ contribution to PF cannot be claimed despite being deposited within the said timelines of filing of return even when read with Section 43B. (Para 5), the Bench of Sanjay Garg (Judicial Member) and Sanjay Awasthi (Accountant Member) repeated.

The taxpayer company filed an appeal asserting that despite the deposits towards PF and ESI totalling Rs.85,23,450 consisting of employees’ contribution and employer’s contribution, the AO considered the whole amount as employees’ contribution for Provident Fund and Employees State Insurance and disallowed the complete amount under section 36(1)(va) r.w.s 2(24)(x) of the Act based on delayed deposit of employees’ contribution to PF/ESI i.e. after the due date as given under the respective welfare legislation.

From the AR’s submission, the Bench discovered that the contribution of the employer was duly deposited within the ITR filing deadline and it was permissible as a deduction under section 43B of the Act.

Consequently, the Bench asked the AO to permit deduction u/s 43B read with Sec 36 if it is verified that the employer’s contribution has been deposited before the filing deadline of the income tax return.

Till now as the delayed deposit of employees’ contribution to PF/ESI is concerned, the Bench directed the Supreme Court’s decision in Checkmate Services Pvt. Ltd. Vs. CIT [(2022) 143 taxmann.com 178], to repeat that deduction u/s 36(1)(va) concerning the delayed deposit of amount collected for employees’ contribution to PF cannot be availed despite deposited within the last date of filing of return even when read with Section 43B.

Consequently, the ITAT partly permitted the appeal of the taxpayer.

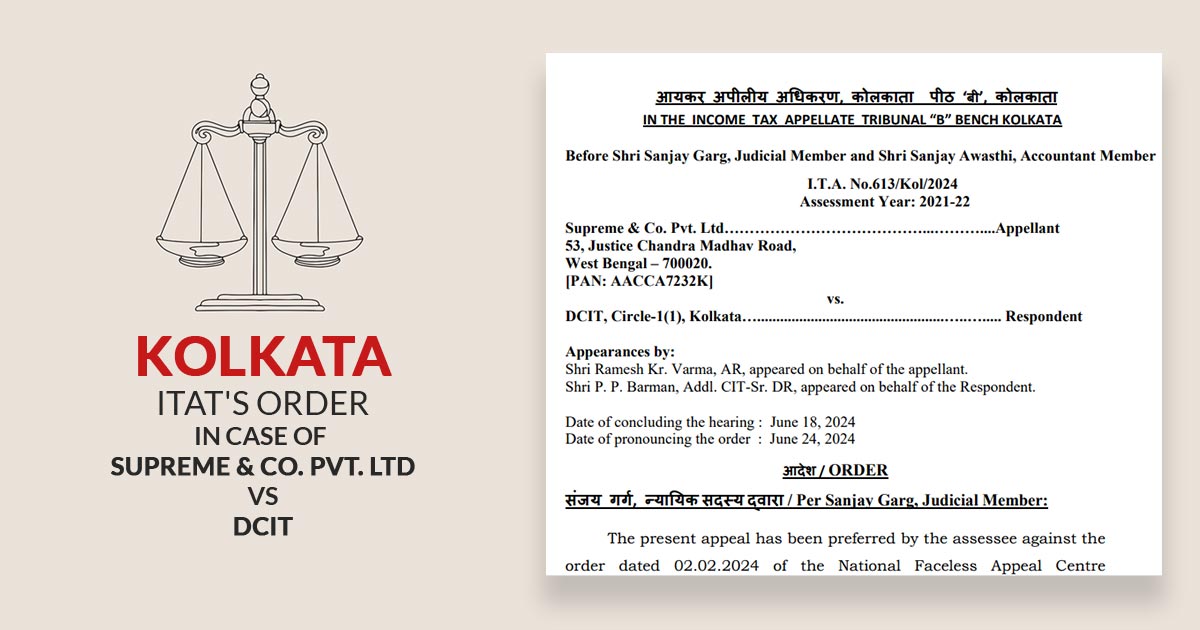

| Case Title | Supreme & Co. Pvt. Ltd Vs DCIT |

| Case No. | I.T.A. No.613/Kol/2024 |

| Date | 24.06.2024 |

| Appellant by | Shri Ramesh Kr. Varma, AR |

| Respondent by | Shri P. P. Barman, Addl. CIT-Sr. DR |

| Kolkata ITAT | Read Order |