The Kerala High Court in a case ruled that the advantages of Income tax, 1961 deduction u/s 80(P) were refused because of not furnishing the ITR on the said time.

The applicant Muvattupuzha Agricultural Co-Operative Bank Ltd., has furnished the writ petition contesting the assessment order under section 148A(d) of the Income Tax Act and notice Section 148, asking the applicant to furnish the ITRs for the AY 2020 -2021.

As per the applicant, under Section 80P(2)(a)(i) and Section 80P(2)(d) of the Income Tax Act the applicant is qualified for the deduction. When the deduction u/s 80P of the Income Tax Act is refused, the application will suffer huge financial obligations.

Concerning the income or gains of cooperative societies, the available deductions are furnished u/s 80P of the Income Tax Act. Only up to the extent of the actual profit made by the taxpayer from the quoted activities of the co-operative society, a deduction is permitted.

The Standing Counsel for the Income Tax Department Adv. Jose Joseph mentioned that the duration to furnish the returns will lapse just on 29.06.2024 and that when the applicant furnishes an income return before the course, the assessing authority will deem it under the statute.

Read Also:- Kerala HC: The Income Tax Exemption Applies to Agricultural Land Yielding Agricultural Income

Section 80P is not made applicable to any cooperative bank (including Regional Rural Banks) excluding a primary agricultural credit society (as described in the Banking Regulation Act) or a primary cooperative agricultural and rural development bank (a society retaining its area of operation bounded to a taluk and the principal object of which is to furnish long-term credit for agricultural and rural development activities).

The Writ Petition has been disposed of by a single bench of Justice Murali Purushothaman with the direction to the applicant to furnish their income return before 29.06.2024. When the applicant furnishes their income return within the cited duration then the assessing authority will acknowledge it under the regulation.

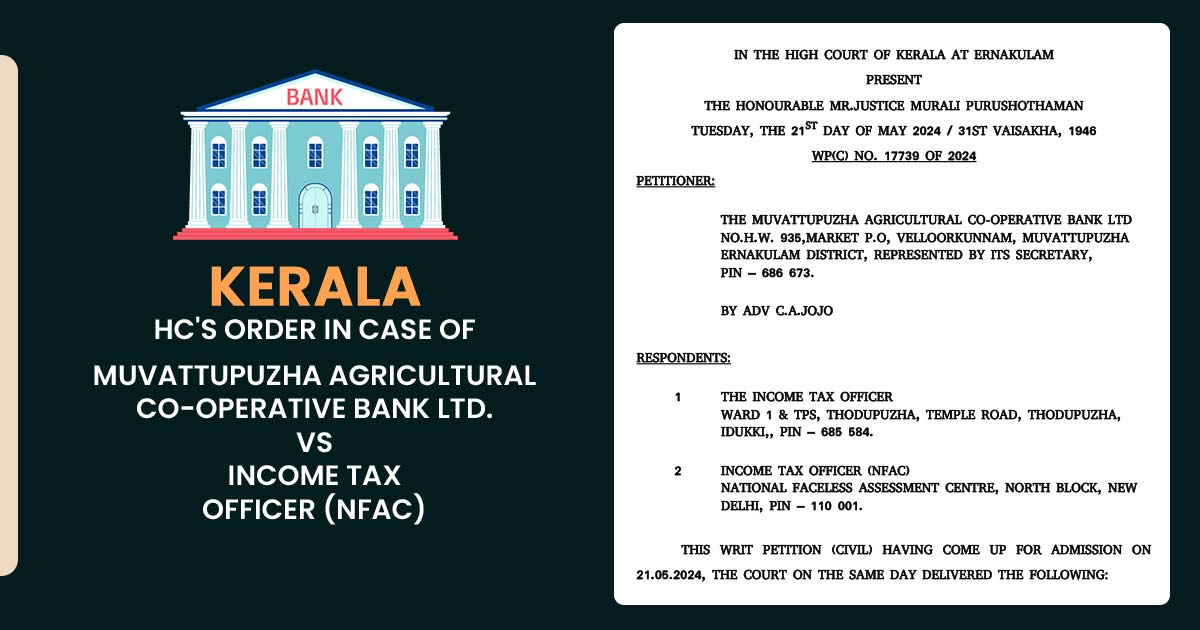

| Case Title | Muvattupuzha Agricultural Co-Operative Bank Ltd. v/s Income Tax Officer (NFAC) |

| Case No.: | WP(C) NO. 17739 OF 2024 |

| Date | 21.05.2024 |

| Counsel For Appellant | ADV C.A.JOJO |

| Kerala High Court | Read Order |