The decision of the Kerala High Court in the case of Faizal Traders Pvt Ltd vs Deputy Commissioner revolves around denying a GST input tax credit (ITC) claim and pertinent penalties under the CGST/SGST Act. Faizal Traders, a registered dealer in furnishing services to Southern Railway and distributing BSNL top-up and recharge coupons, contested an Order-in-Original that denied their ITC claim of Rs. 1,16,75,250 for the period from July to September 2017. The dispute is towards procedural timelines and the applicability of certain notifications issued under the GST framework.

Context

From October 2017 Faizal Traders started filing GST returns and continued doing it in the following months. However, they were not able to report inward and outward supplies for July to September 2017 in their GSTR-1 and GSTR-3B forms but subsequently included these in their annual return (GSTR-9) for 2017-18. A notice was issued by the tax authorities in February 2023, emphasizing the non-payment of GST on outward supplies at the time of the prescribed period, and demanding the corresponding tax, interest, and penalty. Faizal Traders answered by pointing out the claimed ITC in their annual return and paid the shortfall amount of Rs. 88,386 under both CGST and KGST.

Even after their answer, an additional SCN was issued in March 2023, repeating the demand of Rs. 1,16,75,250 including interest and penalty. The company contended that the ITC claim was valid, though omitted initially, was rejected, leading to the passing of the contested Order-in-Original.

Legal Contentions: Limitation and Validity of Notifications: The applicant contested the assessment order as being time-barred. Under Section 73(10) of the GST Act, any proceedings must be concluded within 3 years from the filing of the annual return. For FY 2017-18, the deadline was February 7, 2023, but the order was issued on June 21, 2023. The applicant argued the notifications extending this deadline (No. 13/2022-Central Tax and No. 09/2023-Central Tax) were beyond the legal powers conferred under Section 168A, which allows extensions only in the event of force majeure.

Force Majeure and Time Limit Extensions: The applicant contended that the conditions for invoking force majeure were not present when the notifications were issued. They said that previous extensions due to COVID-19 had already addressed the disruptions, and extensions were unwarranted.

GST Circular No. 183/15/2022: Faizal Traders said that a government circular has the objective to manage discrepancies between ITC claimed in GSTR-3B and reflected in GSTR-2A for 2017-18 and 2018-19. The circular drafted a method for reconciling these discrepancies, including the provision of certificates from suppliers or chartered accountants to validate the supplies and tax payments. The applicant contended that the assessing officer did not regard this circular at the time of issuing the order.

Analysis and Judgment of Court

Regarding Limitation and Notification Validity: As per the court, the notifications extending the due date were valid. It considered that COVID-19 comprises a force majeure case that justified the extending legal timelines u/s 168A. The court discovered that the decision of the executive to extend the due date was on the grounds of the recommendation of the GST council and was within its authority, provided the impact of a pandemic on the procedure of administrative.

Implementation of GST Circular No. 183/15/2022 on 27.12.2022: The court acknowledged the right of the applicant to benefit from the circular, which furnished a framework for reconciling ITC differences because of the initial teething troubles of GST enactment. The assessing officer was unable to furnish the applicant a chance to follow the provision of the circular.

Read Also: Kerala HC Allows Writ Withdrawal Due to Extension of Time Limit for GST Appeal

Final Thoughts and Orders

Partially the court has permitted the petition-

Verification of Notifications: The challenge to the notifications has been dismissed by the court extending the due date, affirming their validity under the force majeure provision.

Reassessment on Remand: The impugned assessment order has been set aside by the court and remanded the case back to the assessing authority. It directed the applicant be allowed to present pertinent documents and comply with Circular No.183/15/2022-GST dated 27.12.2022.

Instruction for Reassessment: The applicant was asked to appear to the assessing authority will all the needed documents dated 26th February 2024. The authority was asked to regard the submissions and issue a fresh assessment order as per the circular.

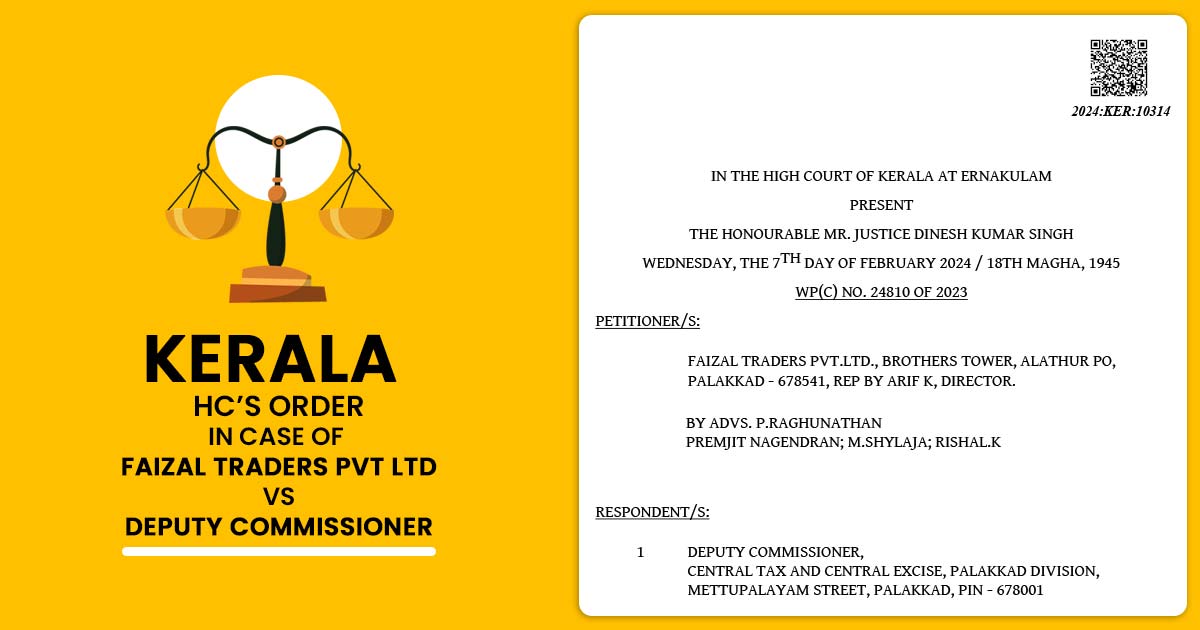

| Case Title | Faizal Traders Pvt Ltd Vs Deputy Commissioner |

| Citation | WP(C) NO. 24810 OF 2023 |

| Date | 07.02.2024 |

| Assessee by | P.Raghunathan, Premjit Nagendran, M.shylaja, Rishal.k |

| Revenue by | Smt.Preetha, S. Nair |

| Kerala High Court | Read Order |