The assessment orders have been quashed by the Kerala HC and remanded the case back on the condition of remitting Rs 10 lakhs for the GST obligations.

It was remarked by the bench of Justice Gopinath P. that the registration of the applicant was cancelled in December 2021 and the applicant has also discontinued the business. The assessment orders were being issued only in September 2022, and thus the applicant did not learn about the orders as it was not checking its portal regularly.

The assessment orders and the summary orders have been contested by the applicant for the years July 2017 and August 2017 under the CGST/SGST Acts. The applicant’s registration has been cancelled dated 12.12.2021 w.e.f. 30.11.2019, and the applicant was thus not aware of the orders passed and did not get a chance to file the returns.

On the portal, the orders were uploaded which do not get accessed via the applicant as the enrollment has been cancelled and the applicant was no more carrying the business.

It was argued by the applicant that the order was issued date 13.09.2022 after the registration of the applicant was cancelled. The applicant has conceded an output tax obligation of nearly Rs 10 lakhs in the GSTR-1 filed for July and August of 2017. As the assessment has been finished now to the best of the ruling, the applicant might be provided a chance to appear to the officer and establish their case.

It was argued by the council that when the applicant was in any case aggrieved from the orders issued in this matter, it was for the applicant to have claimed legal remedies Under Section 107 of the CGST and SGST Acts. the applicant did not access his portal and could not get accepted, since the same has been settled law that the uploading of the orders on the portal is considered to be enough for the objectives of the CGST and SGST acts.

It was ruled by the court that the writ petition will be under the order asking that the applicant remit a sum of Rs 10 lakhs for the GST obligations for July and August of 2017 under a duration of two weeks.

The order shall be set aside and the case will be remanded to the files of the department which will pass the fresh order post having a chance of hearing with the applicant. When the applicant does not remit the amount of Rs 10 lakhs within two weeks, the applicant shall lose the advantage of the ruling.

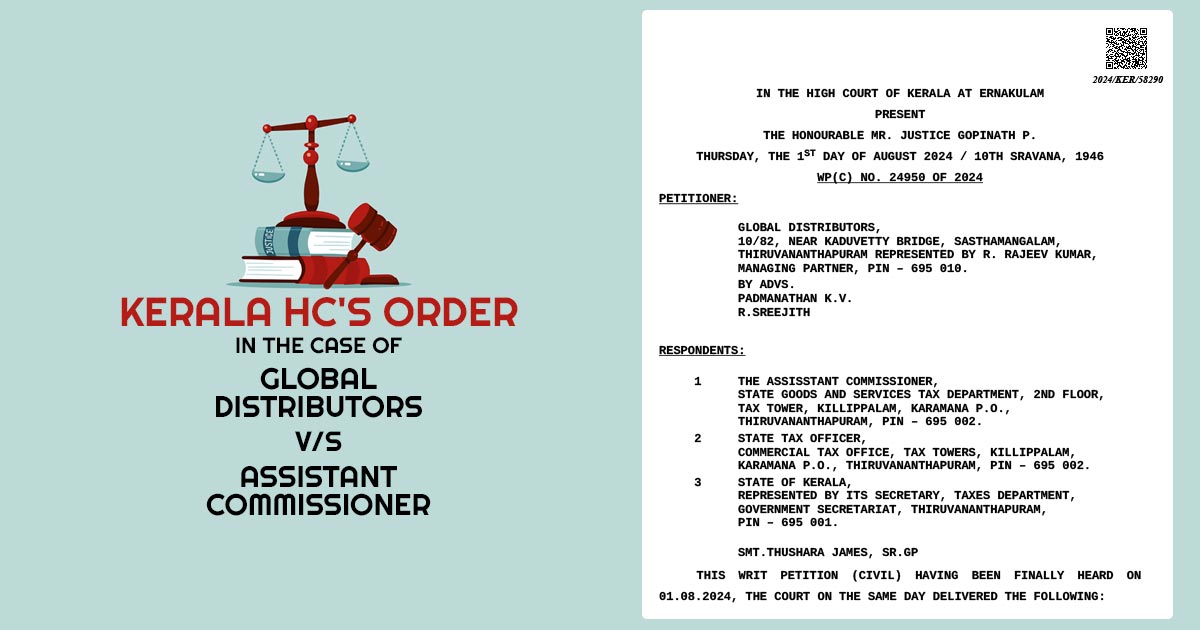

| Case Title | Global Distributors V/S Assistant Commissioner |

| Case No.: | WP(C) NO. 24950 OF 2024 |

| Date | 01-08-2024 |

| Counsel For Appellant | Padmanathan K.V., R.Sreejith |

| Counsel For Respondent | Thushara James |

| Kerala High Court | Read Order |