It was mentioned by the Kerala High Court that the taxpayer could not avail of the Input tax credit for the transportation services if the costs of it are not comprised in the assessable value of goods for the payment of central excise duty. It was marked by the Division Bench of Justices A.K. Jayasankaran Nambiar and Syam Kumar V.M. that the taxpayer does not comprise the costs of transportation in the assessable value

It was mentioned by the Kerala HC that the taxpayer does not claim the ITC towards the services of transportation if its costs are not added to the assessable value of goods to the payment of central excise duty.

It was marked by the Division Bench of Justices A.K. Jayasankaran Nambiar and Syam Kumar V.M. that the taxpayer does not comprise the costs of transportation in the assessable value of the goods for the objective of payment of central excise duty.

The taxpayer in such a situation could not claim the ITC for the transportation services taken through it for the goal of transporting the goods from the place of removal to the premises of the buyer.

The taxpayer/petitioner is in the manufacturer and sale of electrical transformers entered in the contracts for the supply, installation, and commissioning of transformers.

Based on FOR (Free on Road) terms, the contracts needed the taxpayer to transport the goods from the manufacturing site to the premises of the buyer.

Read Also: How to Maintain Input Tax Credit Ledger By Gen GST Software

It was claimed by the taxpayer that sales under the contracts were concluded at the premises of the buyer since the buyer needed to search and accept the goods based on satisfaction. Hence the taxpayer is not included in freight and insurance charges from the assessable value for the central excise duty.

It was argued by the taxpayer that as the sale was finished at the location of the buyer these transportation services were entitled as input services under the CENVAT credit rules.

The bench examined the case of Commissioner of Customs and Central Excise, Aurangabad v. Roofit Industries Ltd. [2015 (319) E.L.T. 221 (SC)], which was laid on by the taxpayer, where it was remarked that “in circumstances where a manufacturer enters into a contract with his buyer on FOR basis, the place of removal for the purposes of payment of Central Excise duty has to be seen as the buyer’s premises and not the manufacturer’s factory, the upshot of the said finding was that the manufacturer, in that case, was legally obligated to include the cost of transportation of the goods from his factory to the premises of the buyer in the assessable value of the goods for the purposes of payment of Central Excise duty.”

The court, in reference to the case of Commissioner of Customs and Central Excise, Aurangabad v. Roofit Industries Ltd., suggested that in a similar factual situation, the taxpayer would be justified in arguing that the cost of transportation included in the assessable value of the goods for Central Excise duty should be considered as incurred in connection with an input service. This would allow the taxpayer to claim the input tax credit for the tax paid in relation to the services provided by the goods transport agencies.

The bench further stated that “..it is the admitted case that the assessee did not include the transportation costs in the assessable value of the goods for the purposes of payment of Central Excise duty. Under such circumstances, the assessee cannot claim the input tax credit in respect of the transportation services availed by it for the purposes of transporting the goods from the place of removal to the buyer’s premises..”

It was concluded by the bench that allowing the taxpayer to claim the ITC for the same situation shall militate against the very scheme of CENVAT credit, which has been made to prevent the cascading effect of tax and an ultimate load on a consumer.

The bench towards the abovesaid dismissed the appeal.

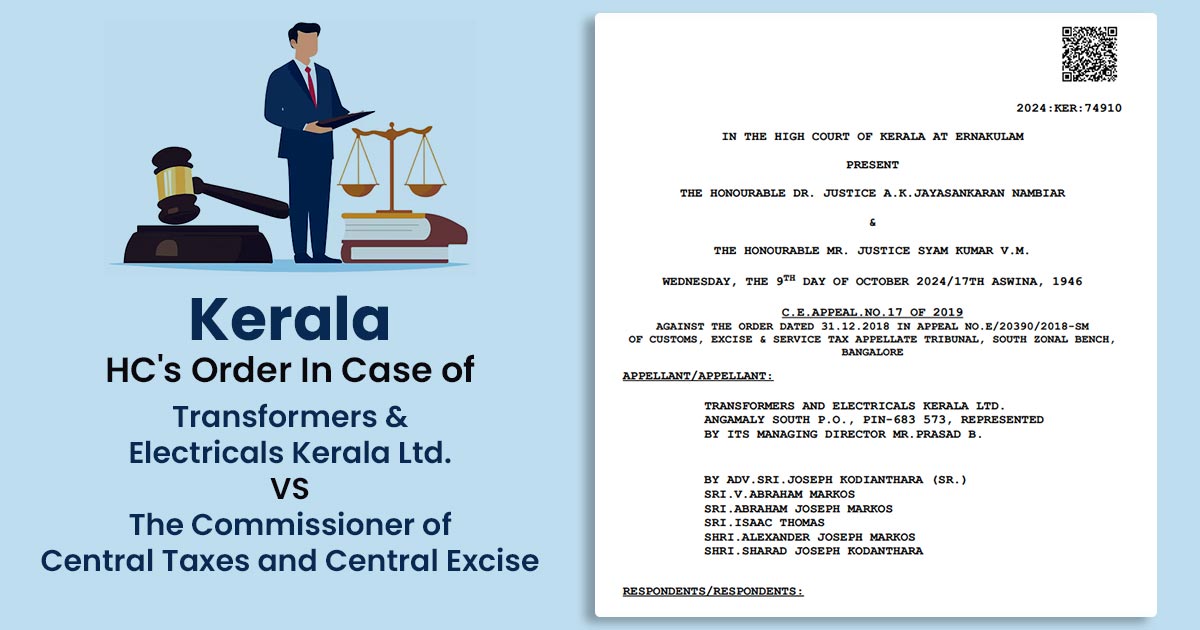

| Case Title | Transformers & Electricals Kerala Ltd. VS The Commissioner of Central Taxes and Central Excise |

| C.E.Appeal.No | 17 OF 2019 |

| Date | 09.10.2024 |

| Appellant | By Advs.Joseph Kodianthara (Sr.) Abraham Joseph Markos Isaac Thomas Alexander Joseph Markos Sharad Joseph Kodanthara V.abraham Markos |

| Counsel For Respondent | By Sri.Sreelal N. Warrior, Standing Counsel |

| Kerala High Court | Read Order |