The Kerala High Court stated that the Commissioner of Income Tax has the authority to review and make changes to tax decisions under Section 263 of the Income Tax Act, 1961.

The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. noted that “The role of the assessing officer under the Income Tax Act, 1961 is not only that of an adjudicator but also of an investigator and he cannot remain oblivious in the face of a claim without any enquiry.”

U/s 263 of The Income-tax Act, 1961, the Principal Commissioner or Commissioner has the power to review any tax-related decision made by an Assessing Officer (AO).

The taxpayer, in this case, is a domestic company that is operating and maintaining the Cochin International Airport. The taxpayer for the AY 2012-13 has declared a total income of Rs 134,43,40,439/- u/s 115-JB of the Income Tax Act, 1961.

As the tax liable to get filed under the regular provisions of the act was lesser and the taxpayer has claimed for the deduction u/s Section 80-IA of the Act concerning the eligible activity of functioning and maintaining the Airport, which is an infrastructure facility, on 4.12.2013 it furnished a revised return specifying the taxable income of Rs 11,88,92,410.

The taxpayer in the said fiscal year debited to the profit and loss account of Rs 1,00,33,280 for the provisions for the poor and dubious debts and the mentioned amount was lessened from the trade receivable amount and the short-term loans and advances.

As the provision debited in the profit and loss account is obliterated from the trade receivable value and the short-term loans and advances, it was considered by the taxpayer as a write-off in the ITR.

But it was discovered by the Principal Commissioner of Income Tax-1, Kochi that the said assessment was not true and prejudicial to the interest of the revenue and wished to invoke the jurisdiction u/s 263 of the Income Tax Act, 1961 and issued a notice proposing to revise the order of assessment.

The taxpayer dissatisfied with the order decided a plea before the Income Tax Appellate Tribunal (ITAT), which was dismissed.

It was furnished by the taxpayer that the Principal Commissioner of Income Tax-1, Kochi had no jurisdiction to invoke Section 263 of the Income Tax Act, 1961 as it was due to a modification of opinion that he chose to revise the order of assessment, which is not authorized under law.

It was noted by the bench that the real purpose of section 263 is to eliminate the prejudice directed to the revenue by the wrong order passed via the assessing officer and it provides the authority to the commissioner to initiate suo motu proceedings, which either the assessing officer take a incorrect decision without acknowledging the available materials on record or directed a decision without the inquiry.

Read Also: Kerala HC Deletes a Tax Order as an IT Officer Didn’t Fulfill Their Responsibility

As per the bench, “We cannot find fault with the Principal Commissioner of Income Tax for having exercised his jurisdiction under Section 263 of the Income Tax Act, 1961. Consequently, the order passed by him after hearing the appellant and directing the assessing officer to re-examine the said issue is perfectly justifiable and legal.”

The bench in the view described above has dismissed the plea.

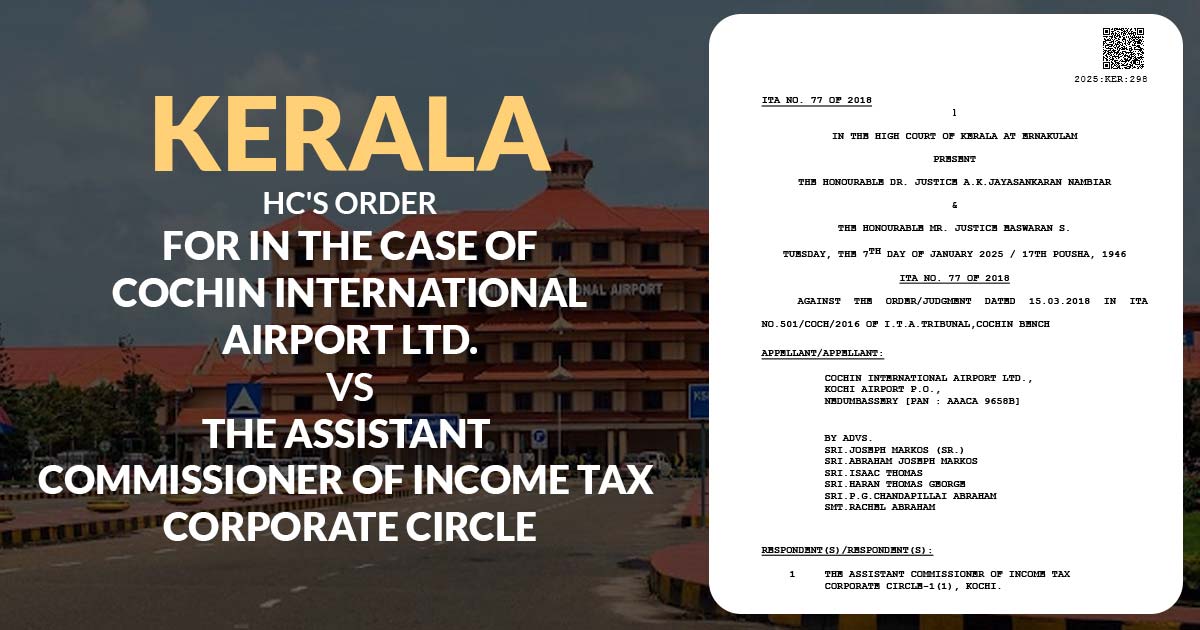

| Case Title | Cochin International Airport Ltd. vs The Assistant Commissioner of Income Tax Corporate Circle |

| Citation | ITA NO. 77 OF 2018 |

| Date | 07.01.2025 |

| Counsel For Appellant | Sri. Joseph Markos, Sri. Abraham Joseph Markos, Sri. Haran Thomas George, Sri.P.G.Chandapillai Abraham |

| Counsel For Respondent | Sri.P.K.R.Menon, Sri. Jose Joseph, Sri. C.E.Unnikrishnan, Sri.Mohammed Rafiq |

| Kerala High Court | Read Order |