The Kerala High Court ruled that when contract rates are fixed, including GST and other applicable taxes, the contractor cannot claim GST in addition to the fixed rates. Consequently, the writ petition was dismissed.

The applicant is a partnership firm involved in undertaking contracts for the construction of roads and bridges and is cited to be a registered A-class contractor with the Kerala Public Works Department. It is in the agreements with the Kerala Road Fund Board for specific works.

Read Also: Kerala Releases GST Instruction No. 5/2025 for Centralized Refund Processing

The engaged issue in the present petition is that a person who enters into a contract with the government or its agencies that has a particular clause that the rate cited will be inclusive of ‘GST & other taxes’ turns around and claims that he is entitled to Goods & Services Tax (GST) over and above the rate quoted by him?

It ruled that if the claim of the applicant were to be accepted, then the sanctity of the tendering procedure itself shall be affected merely.

The same could be specified via the means of an example. When the tender document/agreement reflected that the rates cited would be considered to be inclusive of GST and the successful bidder quotes Rs.100 for a certain item of work, he cannot be allowed to, subsequently, turn around and claim that he should be provided Rs.100/- including 18% GST (total of Rs.118) since there may have been situations where another bidder, after noticing the prerequisites in the tender document would have quoted Rs.105/- inclusive of GST and shall not have become successful on the fact that the successful bidder has quoted only Rs.100/-.

Recommended: Kerala GST Dept Issues Guidelines for Amnesty Scheme on Tax Demands for FY 2017-18 to FY 2019-20

In a case, if the successful bidder is permitted to claim 18% GST over and above the rate of Rs.100/- quoted by him, the Government/its agencies would end up paying Rs.118/-which apparently, cannot be accepted.

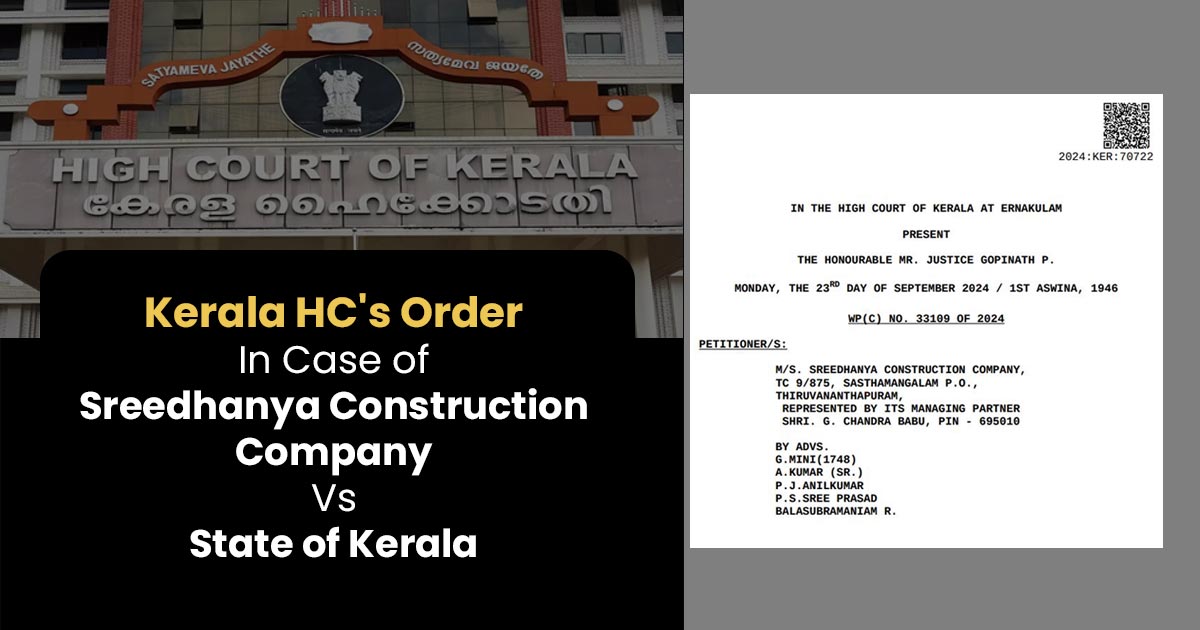

| Case Title | Sreedhanya Construction Company Vs State of Kerala |

| Citation | WP(C) NO. 33109 OF 2024 |

| Date | 23.09.2024 |

| Counsel For Appellant | By Advs. G.mini(1748) A.Kumar (Sr.) P.J.anilkumar P.s.sree Prasad Balasubramaniam R |

| Counsel For Respondent | SMT. Jasmine M M (GP), SRI E C Bineesh (SC KRFB) |

| Kerala High Court | Read Order |