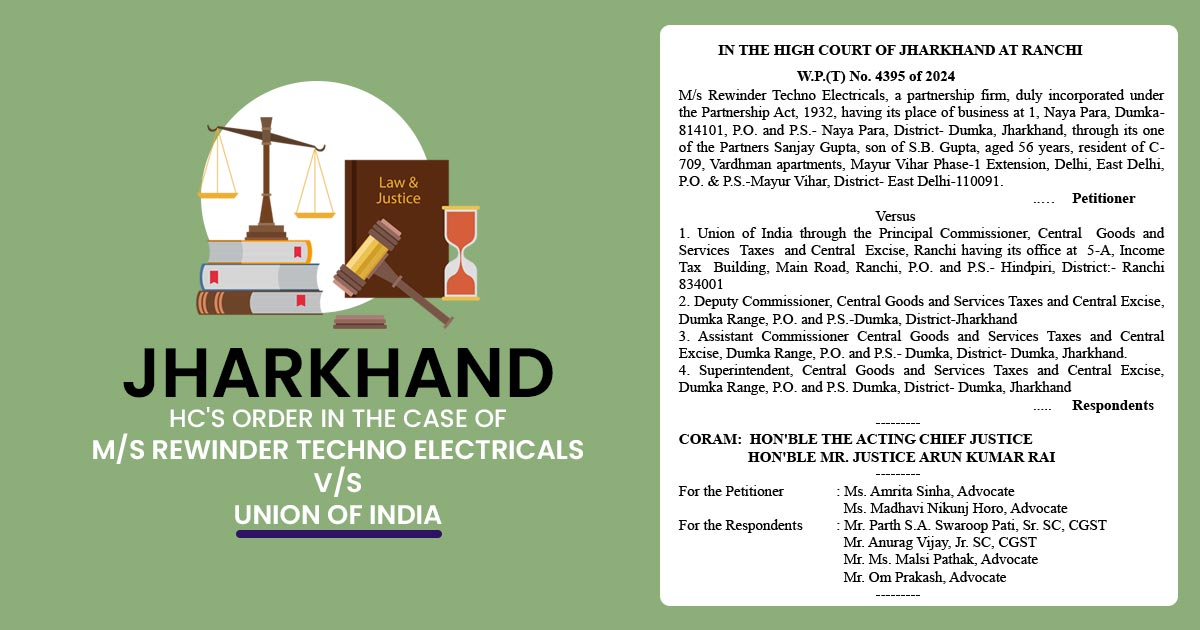

The High Court of Jharkhand has dismissed the petition contesting the provisions of the Central Goods and Services Tax (CGST) Act, 2017 under the 53rd GST Council Meeting’s recommendations. The writ petition has been dismissed by the court filed by M/s Rewinder Techno Electricals, a partnership firm based in Dumka, Jharkhand challenging Section 16(4) and amendment to Rule 61(5) of the CGST Act, 2017, on grounds of ultra vires.

The petitioner wished to declare Section 16(4) of the CGST Act and the amendment to Rule 61(5) of the Central Goods and Services Tax Rules, 2017, as unconstitutional.

Amrita Sinha and Madhavi Nikunj Horo the representative of the petitioner, argued that Section 16(4) of the CGST Act, which charges a time limit for availing Input Tax Credit (ITC), breaches the fundamental rights guaranteed under Articles 14, 19(1)(g), and 300A of the Indian Constitution. It was claimed that the limitation assessed under this section interrupted their granted right to claim ITC.

The petitioner has indeed contended the amendment to Rule 61(5) introduced via Notification 49/2019-CT on October 9, 2019. This modification retrospectively validated GSTR-3B as a valid return u/s 39 of the CGST Act, 2017, effective from July 1, 2017.

The same amendment was not constitutional since it retrospectively modified the legal framework controlling the tax returns and impacted their right to claim the ITC, the petitioner contended.

The respondent revenue, Union of India through the Principal Commissioner, Central Goods and Services Taxes and Central Excise, Ranchi and others, represented by Mr Parth S.A. Swaroop Pati, Mr Anurag Vijay, Ms Malsi Pathak, and Mr Om Prakash, argued that Section 16(4) of the CGST Act and the amendment to Rule 61(5) are legal and valid.

It was indeed claimed that the duration to claim the ITC and the retrospective validation of GSTR-3B are constant with the GST framework and the recommendations of the GST council.

The division bench, Chief Justice Sujit Narayan Prasad and Justice Arun Kumar Rai dismissed the plea, maintaining the constitutionality of Section 16(4) and Rule 61(5) of the CGST Act. It was quoted by the court that the GST council suggestions and confirmed that the provisions and the retrospective validation of the GSTR-3B to be a valid return u/s 39 of the CGST act, 2017 were legal, recommending the applicant to pursue any unresolved issues via the proper legal channels.

This decision has arrived post remarking the GST council in its 53rd meeting held on June 22, 2024, had regarded the issues raised in the petition. The suggestions of the GST council were important in the decision of the court to dismiss the petition. The court regarded the norms of the council and mentioned that any issues left could be sought via the precise legal forums.

Read Also:- GST Council 1st Meeting to 53rd Meeting Updates with PDF

The ruling carries the provisions of section 16(4) and the retrospective validation of GSTR-3B under rule 61(5). The court while dismissing the challenge stressed the suggestions set by the GST council and maintained the legal deadlines and procedural needs to claim the ITC. the applicant was recommended to address any unsolved cases via the proper legal channels under the suggestions of the council.

The ruling stresses the GST Council’s role in shaping tax policy and the judiciary’s reliance on Council proposals in settling legal disputes regarding tax regulations.

| Case Title | M/s Rewinder Techno Electricals V/S Union Of India |

| Citation | W.P.(T) No. 4395 of 2024 |

| Date | 09.08.2024 |

| Counsel For Appellant | Ms. Amrita Sinha, Advocate, Ms. Madhavi Nikunj Horo, Advocate |

| Counsel For Respondent | Mr. Parth S.A. Swaroop Pati, Sr. SC, CGST, Mr. Anurag Vijay, Jr. SC, CGST, Mr. Ms. Malsi Pathak, Advocate, Mr. Om Prakash, Advocate |

| Jharkhand High Court | Read Order |