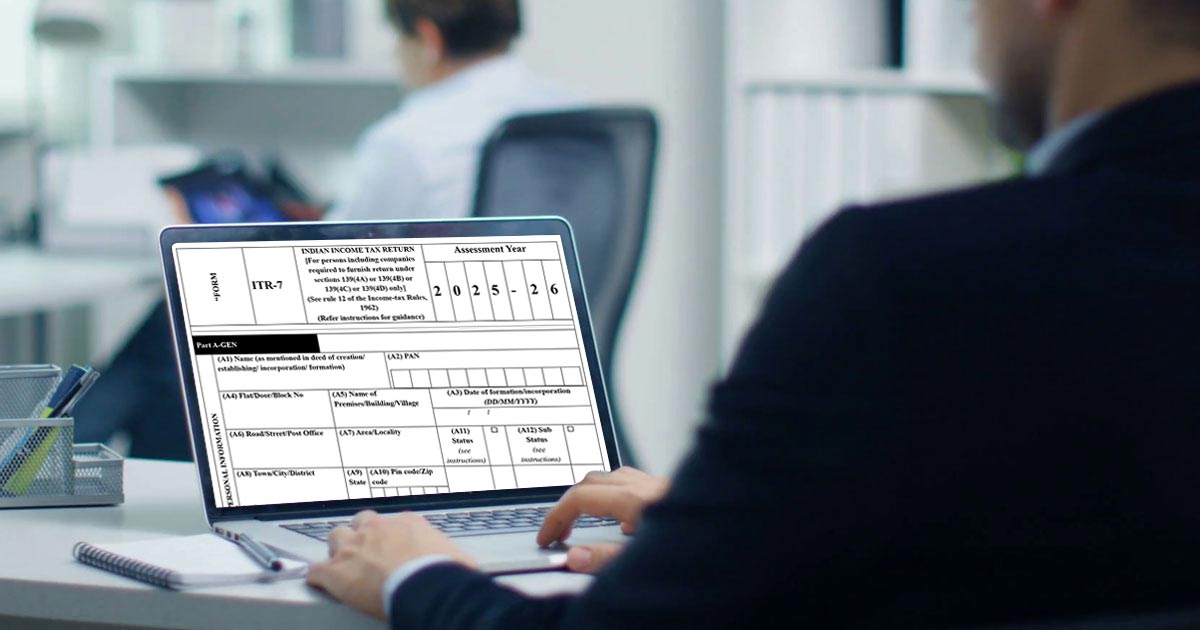

The Central Board of Direct Taxation (CBDT) released a checklist for taxpayers to avoid common mistakes in preparation and filing ITR-7 for Assessment Year 2020-21 as these common mistakes can interrupt the filing and uploading of the Income-tax return

There are separate clauses that govern compliance to be followed when filing ITR-7 named as Section 1; Section 10 (23C)(iv)/10(2 3C)(v)/10(23C) (vi)/10(23C)(vi a); Section 10(23C) (iiiab)/(iiiac); Section 10(23C) (iiiad)/(iiiae); Section 13A; Section 13B ; Section 10(21), 10(22B), 10(23AAA), 10(23B), 10(23D), 10(23DA), 10(23EC), 10(23ED), 10(23EE), 10(29A), 10(46), 10(47); Section 10(23AAA) and Section 10(23A), 10(24).

Some mandatory compliances under Section 11 and Section 10 23C)(iv)/10(2 3C)(v)/10(23C) (vi)/10(23C)(vi a) require registration or approval under section 12/12AA and Section 10 (23C)(iv)/10(2 3C)(v)/10(23C) (vi)/10(23C)(vi a), respectively along with details submission under “Details of registration under the Income Tax Act

Get to know complete guide of TDS provisions under income tax act 1961 at here. Also, we include several topics as TDS returns, TDS due dates” in Part A General.

Section 139(4A) and Section 139(4C) are known as the Return filing section for the previous and the latter one, respectively.

Whereas, Schedule VC and AI are known for giving the contribution and income under section 11 while under section 10 (23C)(iv)/10(2 3C)(v)/10(23C) (vi)/10(23C)(vi a), the contribution and income are offered in schedule VC and AI.

Under Section 11 and Section 10 (23C)(iv)/10(2 3C)(v)/10(23C) (vi)/10(23C)(vi a) there are still various other compliances.

- First, the amount spent in charity to furnish schedule ER, EC

- Secondly, the taxpayer claiming exemption through the deemed application has to submit the details in part 4 of BTI and in Form 9A before the last date

- Thirdly, the taxpayer claiming exemption through accumulation has to provide details in point 4 of Schedule part BTI and Form 10 before the due date

- Fourthly, Other taxable income needs to be filled up in schedule HP, BP, CG, and OS

- Fifthly, non-adherence to Section 11 and section 12 or non-eligible to claim exemption need to furnish Sl.No. 5 of schedule Part-BTI

- Lastly, the assessee needs to furnish Form 10B and Form 10BB with the return of income before along with the audit report before the deadline, respectively, under Section 11 and others

Read Also: Easy Guide to File Online ITR 7 Form for AY 2020-21

Some mandatory compliances under section10(23C) (iiiab)/(iiiac) requires details of the contribution or income in schedule VC and IE-3. Exemptions claimed u/s 10(23C) and u/s 10(23C) (iiiac) must be furnished in point 9a of schedule part BTI and 9b of schedule part BTI, respectively. Any other taxable income details need to be provided in schedule HP, BP, CG, and OS. Whereas total receipts will be filled in Schedule IE-3 and grants received from Government will be filled up in Schedule VC.