The latest financial year has introduced a new attestation to be clubbed with the ITR -1 form. Now the taxpayers will have to provide a full break-up of the interest income and income from any other sources received during the year while filing the basic income tax return form 1 for AY 2019-20.

In the same way, FY 2018-19 allows senior citizens to claim deduction up to Rs 50,000 from interest income from bank and post office fixed deposits.

This move of mandatory integration of interest income breakup with ITR-1 will prevent taxpayers from bogusly claiming deduction available under section 80TTA and 80TTB as the income tax department will encounter this swindle easily because of the presence of the details of all savings accounts with them, provided by the taxpayer at the time of filing ITR.

Wadhwa says, “This change has been made in the ITR form so as to verify that taxpayers are claiming deduction under Section 80TTA only in respect of interest on savings accounts. The income tax department can also reconcile that the interest paid to the assessee on income-tax refund has been offered to tax by him in the ITR.”

When the taxpayers were required to give a consolidated interest figure in the tax return, the tax department would find it complicated to ascertain whether the deductions were being claimed correctly, i.e., the interest income is from the specified income source. For instance, in the previous year’s ITR-1 form, the taxpayers had to provide only an aggregate amount of income from other sources received by them without mentioning the nature and source of income, i.e., whether it is an interest income from an income tax refund or from the savings account or fixed deposit. So, in this case, the tax department can not examine whether the claim is fair enough or not.

Chartered Accountant Naveen Wadhwa, DGM, taxmann.com says, “Up to last year, a taxpayer was required to show a consolidated amount in respect of interest income taxable under the head ‘Income from other sources’. The new ITR forms now require a complete break-up of the interest income – interest on savings accounts, interest on fixed deposits, pass-through interest income and even interest on the income-tax refund.”

The earlier ITR forms asking for a declaration of consolidated interest from all sources, evidence that the tax department faces a lot of difficulties in order to verify whether the person had actually earned Rs 10,000 as savings account interest. (Section 80TTA permits a maximum deduction of Rs 10,000 from interest income from savings accounts with banks and post offices to the taxpayers.)

Read Also: How to Save Income Tax Easily?

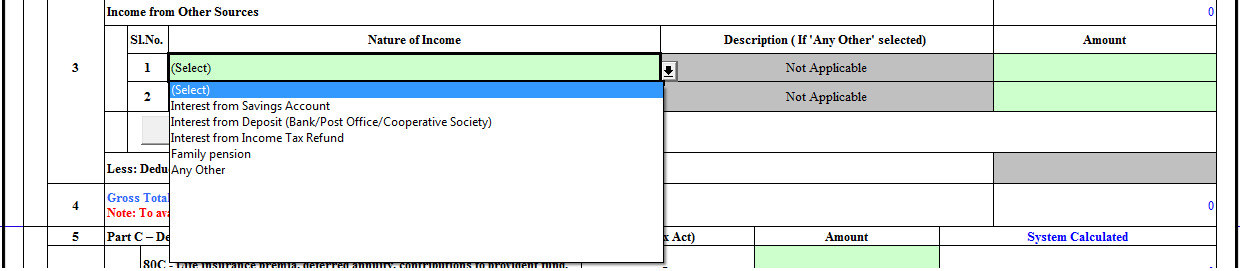

A drop down menu from where a taxpayer shall select and specify the source of interest income will be present in the newest ITR-1 form software utility, available on the income tax e-filing website. This drop-down menu In the ITR-1 will specify five sources of ‘Other income’ namely interest from the savings account, interest from an income tax refund, interest from deposits (Bank/Post office/Cooperative society), family pension and any other. An individual needs to provide complete details of the income received when he/she chooses the ‘other’ option.

The move will make it easy for the department to ascertain whether a person actually earned the amount claimed as a deduction under section 80TTA as interest on a savings account and so will complicate the practice of claiming wrong tax breaks relating to interest income. In general, interest income received by an individual is taxable in his/her hands, unless stated in the Income Tax Act. However, an individual aged below 60 years can claim deduction under section 80TTA.

Recommended: Section-Based (80C, 80CCD, 80TTA, 80GG, 80D, etc.) Income Tax Saving Tips For Employees

From FY 2018-19, senior citizens (aged 60 years and above) can claim deduction under section 80TTB for interest income. The interest income covered under section 80TTB includes interest earned from a savings account, fixed deposits, recurring deposits, or any other deposits held with a bank, post office or cooperative society. Interest received from any other sources such as company FD or interest from a bond, non-convertible debentures is not eligible for deduction.