Define Job Work?

Job work is defined as the process that is undertaken on goods by a person who belongs to another registered person. The ownership of goods does not shift to the job-worker, but it remains with the main manufacturer. The work of the job worker is to carry out the process that is given by the main manufacturer on the goods that are supplied to him.

- The person who is doing the job work is called a job worker.

For example, a big belt manufacturer (principal) sends out the half-made belts (upper part) to the smaller manufacturers (job workers) to punch the hole. The smaller manufacturers (job workers) send back the belts to the big manufacturer (principal).

56th GST Council Meeting Update for Job Work

| Entry | New GST Rate From 22nd September |

|---|---|

| “Supply of services by way of job work in relation to umbrella” | 5% with ITC |

| “Supply of job work services or any treatment or process in relation to printing of all goods falling under Chapter 48 or 49, which attract GST | 5% with ITC |

| “Supply of job work in relation to bricks which attract GST at the rate of 5%” | 5% with ITC |

| “Supply of job-work services in relation goods falling under Chapter 30 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975) (pharmaceutical products)” | 5% with ITC |

| “Supply of job-work not elsewhere covered (residual entry)” | 18% with ITC |

File Returns by Gen GST Software

GST ITC-04 Filing Related Relaxation on 45th GST Meeting

- “Requirement of filing FORM GST ITC-04 under rule 45 (3) of the CGST Rules has been relaxed as under:”

- “a. Taxpayers whose annual aggregate turnover in the preceding financial year is above Rs. 5 crores shall furnish ITC-04 once in six months.”

- “b. Taxpayers whose annual aggregate turnover in the preceding financial year is up to Rs. 5 crores shall furnish ITC-04 annually.”

Input Tax Credit (ITC) on Job Work

The principal manufacturer can avail the ITC paid on the purchase of goods sent on job work.

But there are also certain conditions which are given below-

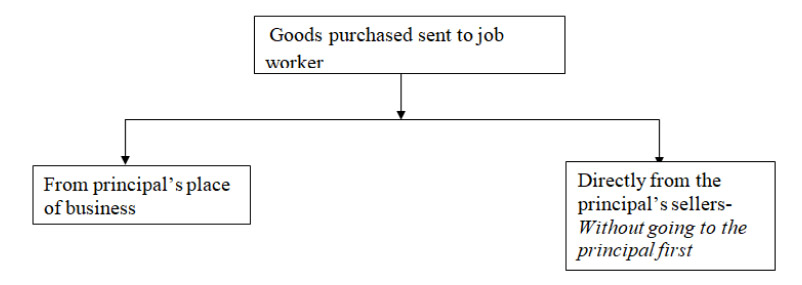

- Place of business

ITC (Input Tax Product) will be allowed in both the cases

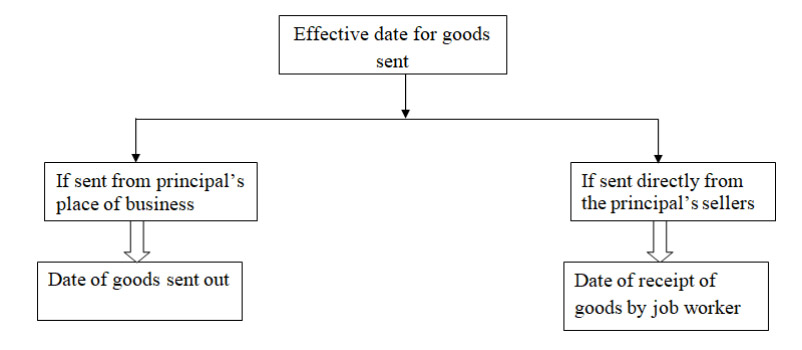

- Effective date

To receive back the goods, is there any time limit for the manufacturer?

Yes, the principal manufacturer must receive the goods back within the period given below:

- Capital Goods – three years from the effective date

- Input Goods – one year from the effective date

Summary of Conditions to Get the ITC on Goods Sent for Job Work

A. The goods can be sent to the job worker:

- From the place of business of the principal

- Directly from the supplier’s place of supply of such goods

ITC will be allowed in both cases.

B. The effective date for goods sent depends on the place of business:

- Sent from the place of business of the principal- Date of goods sent out

- Sent directly from the supplier’s place of supply of such goods- Date of receipt by job worker

C. The time duration in which the goods sent to the principal manufacturer must be received is:

- Capital Goods for 3 years

- Input Goods for 1 year

D. If in any case, the goods are not received within the period which is mentioned above will be considered as the supply from the effective date and tax will be charged.

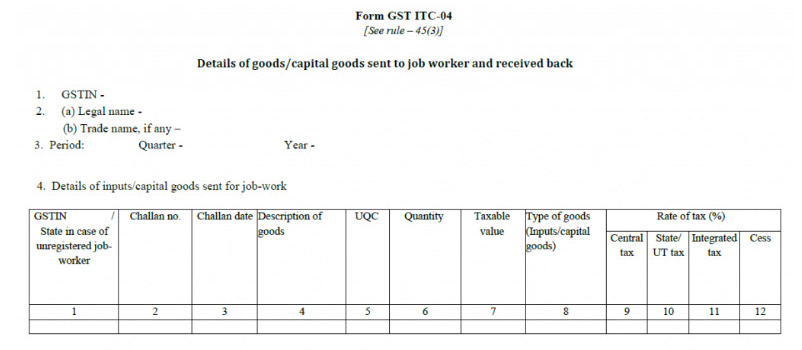

Form GST ITC 04

The principal manufacturer must submit the form GST ITC-04 every quarter. Given below are the details that the principal manufacturer must include in the challans:

- The goods which are dispatched to a job worker or

- The goods received from a job worker or

- The goods are sent from one job worker to another.

GST ITC 04 Offline Utility

ITC 04 offline tool is a utility to discover all the details when the manufacturer has sent any goods(capital or input type) to a Job Worker and relevant dealings. The offline utility will help the manufacturer in preparing ITC 04 even when there is no internet. Also, it would assist in the bulk upload of the invoice to the GST portal.

Also, one has to remember this system requirement:

Operating system Windows 7 or above. Does not operate on Linux and Mac Browser:

- Internet Explorer 10+

- Google Chrome 49+

- Firefox 45+

- Microsoft Excel 2007 & above

Due date of Form GST ITC-04

Since the ITC-04 is a quarterly form, it must be given on or before the 25th day of the month following the quarter.

| Aggregate Annual Turnover (AATO) | Period | Due Date |

|---|---|---|

| Above ₹5 Crore | Half-yearly | 25th October (April to September) 25th April (October to March) |

| Up to ₹5 Crore | Annually | 25th April |

How to Create ITC 04 Challan Offline?

There are 2 parts in which it can be provided:

- The goods are sent to a job worker and

- The goods received from the job worker

1. Details of capital/input goods sent to job-work

The details like challan number, GSTIN, tax amount, etc. must be mentioned and all these details are available in challans.

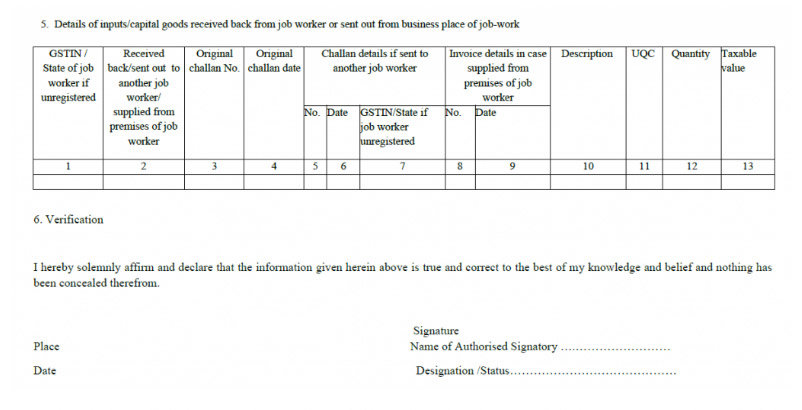

2. Goods received from the job worker or goods sent out from the business place of job-work

The details of goods that are received back from the job worker will be mentioned here. The goods might be received by the principal manufacturer or the goods can be sent directly to another job worker from the place of business of the job worker.

All the details of the original and new challans must be mentioned.

Guide for Filing ITC-04 Form on GST portal

Given below is the step-by-step guide for filing the ITC-04 form on the GST portal.

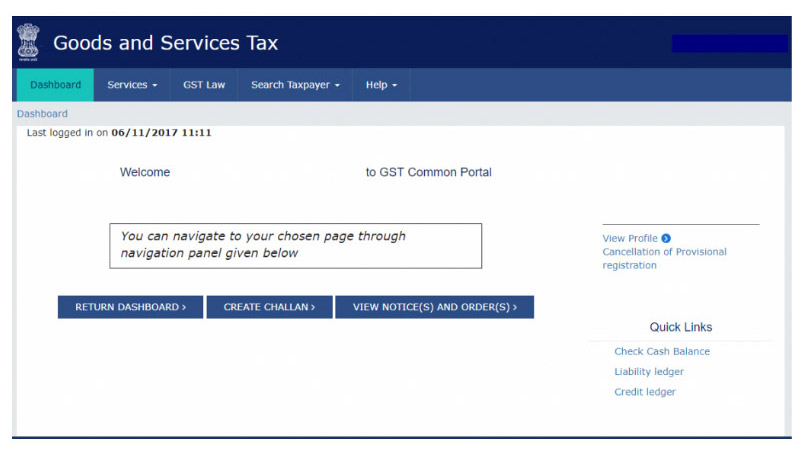

Step 1: Log in to the GST Portal

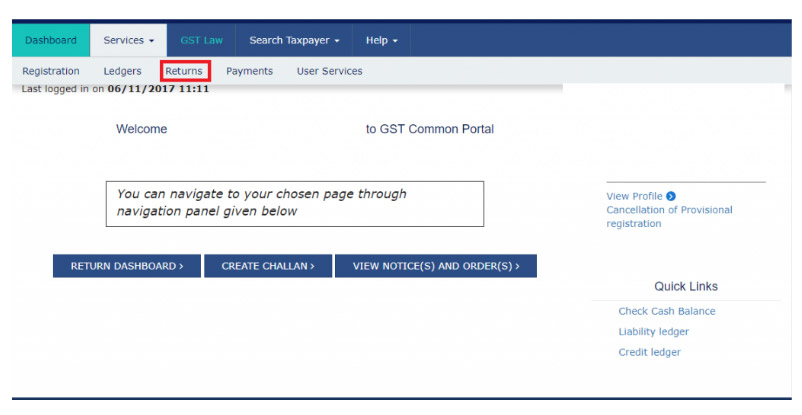

Step 2: Go to the Services -> Returns -> ITC Forms

Step 3 & 4: Go to “Prepare Offline” -> Upload invoices | After the upload of invoices click ‘Initiate Filing’

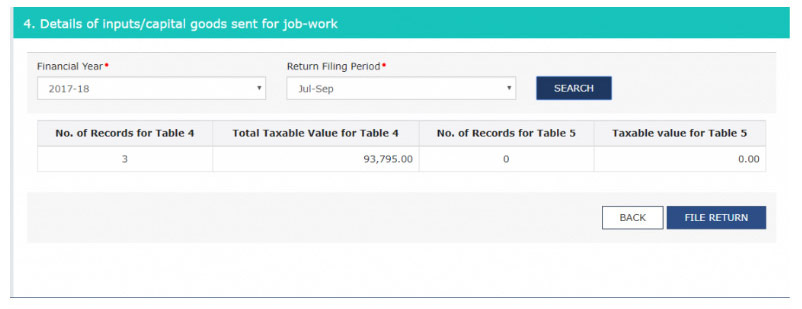

Steps 5 & 6: Select the tax period, Check the taxable amount and other details

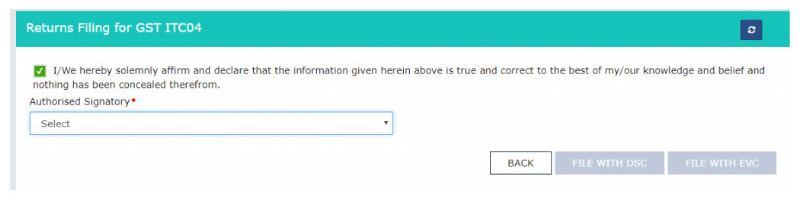

Step 7: At last, file the return with DSC or EVC as applicable

The government has given ample time to the job workers to return the goods back to the principal manufacturer. With the help of GST, there will be transparency in the details of ITC on goods sent for job work.

ITC FAQs on Job Work

Q.1 What are the circumstances if goods are not received within the given time?

- If in any case, goods are not received within the given time then such goods will be considered as the supply from the effective date. Then on such supply, the manufacturer will have to pay tax.

- The challan which will be issued will be considered as an invoice for such supply.

Q.2 – Can the principal manufacturer directly sell from the job worker’s place?

- Yes, it can happen only if the principal declares the job worker’s place as his additional place of business. This rule is not applied for the following-

- The job worker is registered,

- The principal manufacturer supplies goods which are specifically declared by the Commissioner to be allowed to sell directly from the place of the job worker.

Q.3 – Machinery that is sent to the job worker to carry out the job work

The time limit will not be applied on the items like jigs and fixtures, moulds and dies, or tools which are sent to the job worker for carrying out the job work.