The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has removed the addition made by the department since the cash deposits made from the taxpayer’s parents collected savings and income from agricultural activities.

The bench of Suchitra Kamble (Judicial Member) and Makarand V. Mahadeokar (Accountant Member) noted that when the taxpayer furnishes a plausible explanation kept under affidavits, the revenue must conduct appropriate verification before making any adverse conclusion. Neither the AO nor the CIT (A) conducted any verification of the affidavits or the claims incurred by the taxpayer.

The taxpayer furnished their income return, declaring his total taxable income. The matter was selected for set scrutiny via CASS as, in demonetization, the taxpayer made substantial cash deposits in his bank account to Rs. 9,04,000. Out of the total amount, the AO treated Rs. 4,28,000 as unexplained money and added it to the taxpayer’s income u/s 69A of the Income Tax Act.

U/s 69A deals with unexplained money, etc., to be regarded in the practice of aggregation of income under Chapter VI of the Act. Section 69A stresses that if, in any financial year, the taxpayer is discovered to be the owner of any money, jewellery, or another valuable article, and such money, etc., is not recorded in the books of account, if any, maintained by him for any income source, and the taxpayer proposes no explanation for the nature and source of acquisition of the said money, etc., or the explanation proposed under him is not satisfactory in the view of the Assessing Officer, the money may be considered to be the taxpayer income for the financial year.

The cash deposits were from the collected savings and agricultural income of his parents. In support of the argument, the taxpayer filed affidavits from his father and mother to the Assessing Officer (AO). But, with the explanation the AO was not satisfied and proceeded with the addition, the taxpayer argued.

The CIT (A) kept the AO order without giving due consideration to the affidavits and the explanation is given by the taxpayer. The fact is not appreciated by the CIT(A) that the affidavits submitted were from reasonable sources, being the parents of the taxpayer, and did not probe into the case to prove the veracity of the claims.

Read Also: Kerala HC: The Income Tax Exemption Applies to Agricultural Land Yielding Agricultural Income

The tribunal observed that no independent verification or inquiry into the claims made in the affidavits has been performed by AO. AO dismissed the affidavits without assigning any cogent causes. CIT(A) kept the order of AO without addressing the merits of the affidavits or the explanation furnished by the taxpayer.

The Tribunal discovered that the addition incurred u/s 69A is not sustainable. AO and CIT (A) have been unable to release their obligation of conducting a thorough and fair investigation into the source of the cash deposits. The affidavits given by the parents of the taxpayer must be within verification, and the explanation given must have been regarded judiciously.

The order of the CIT (A) has been set aside by the tribunal and asked the AO to remove the addition of Rs. 4,28,000 made u/s 69A of the Income Tax Act.

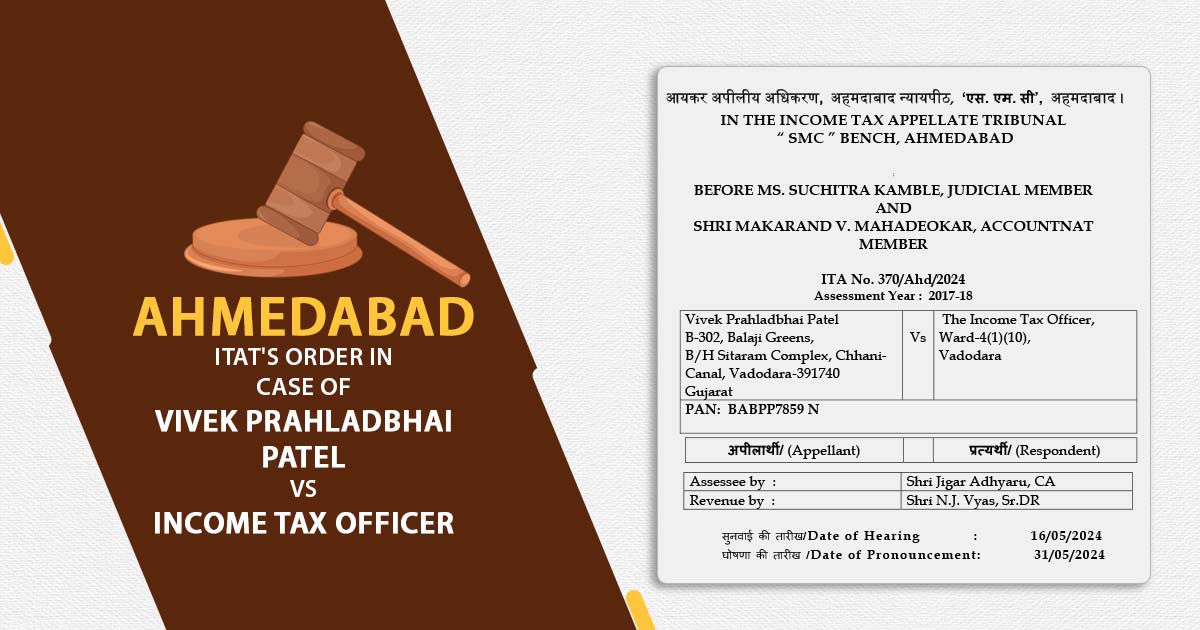

| Case Title | Vivek Prahladbhai Patel Vs. The Income Tax Officer |

| Citation | ITA No. 370/Ahd/2024 |

| Date | 31.05.2024 |

| Assessee by | Shri Jigar Adhyaru, CA |

| Revenue by | Shri N.J. Vyas, Sr.DR |

| Ahmedabad ITAT | Read Order |