It was carried that the Income Tax Appellate Tribunal (ITAT) carried the provisions of section 80P of the Income Tax Act, confirming its role in boosting the growth of cooperative societies.

The ruling was created in the appeal related to the AY 2015-16 in which the Principal Commissioner of Income Tax (PCIT) had modified an earlier assessment order u/s 263.

Mainly the cooperative society is in ginning and pressing raw cotton, has filed a return specifying nil income which was accepted without adjustments in the initial assessment. However, on analyzing the matter, the PCIT considered the original assessment wrong and prejudicial for the interests of revenue, quoting insufficient scrutiny via the Assessing officer (AO).

It was marked by PCIT that the operations of the society which comprises ginning and pressing for private entities and the usage of automatic machinery do not satisfy the same standard.

The society challenged the same amendment claiming that their activities were integral to the marketing of members’ produce and that deductions u/s 80P were applicable. An alternative claim has been asserted by them u/s 80P(2)(e) for the income derived from letting godowns be used in processing, focusing on the interconnectedness of these activities.

The Income Tax Appellate Tribunal (ITAT) in its ruling considered the legislative objective behind Section 80P, stressing its objective to foster the growth of cooperative societies. The PCIT decision has been affirmed via tribunal mentioning that the AO has not undertaken an inquiry for the significant aspects of the case.

It comes to an eye that “Therefore, looking into the bare language of the statutory provisions and in light of the activities carried out by the assessee, the PCIT held that the assessee did not specify the requirements of Section 80P(2)(a)(v) of the Act and hence the assessee is not eligible for claim of deduction under such section.

Since the Assessing Officer, during the course of assessment processing did not inquire into the crucial aspect, the order passed by the AO was erroneous and prejudicial to the interest of the Revenue.

Further, the Principal Commissioner of Income Tax (PCIT) also observed that the assessee vide submissions dated 12.12.2019 has contended that if it is held that the assessee is not eligible for deduction under Section 80P(2)(a)(v), in the alternative, the deduction may be allowed under Section 80P(2)(e) of the Act”, the bench observed.

Concerning the other claim of the taxpayer, the PCIT was held with the opinion that this taxpayer’s contention requires re-verification of the case in its entirety by the AO.

Read Also: Kerala High Court Ruling: An Assessee Can Claim Deduction U/S 80P By Filing ITR on Time

Opposite to that it was carried against the taxpayer that, under such facts discussed aforesaid the PCIT set aside the assessment order is being incorrect and prejudicial to the Revenue interest.

Passing via the contents of the assessment order, the activities of the taxpayer in the impugned year under consideration, and the claim of the taxpayer for the claim deduction under IT section 80P(2)(e), we with the opinion that no infirmity in the order of the Ld. PCIT, to call for any interference.

It was marked by the tribunal bench that a need for re-verification of claims to ensure compliance with the legal provisions.

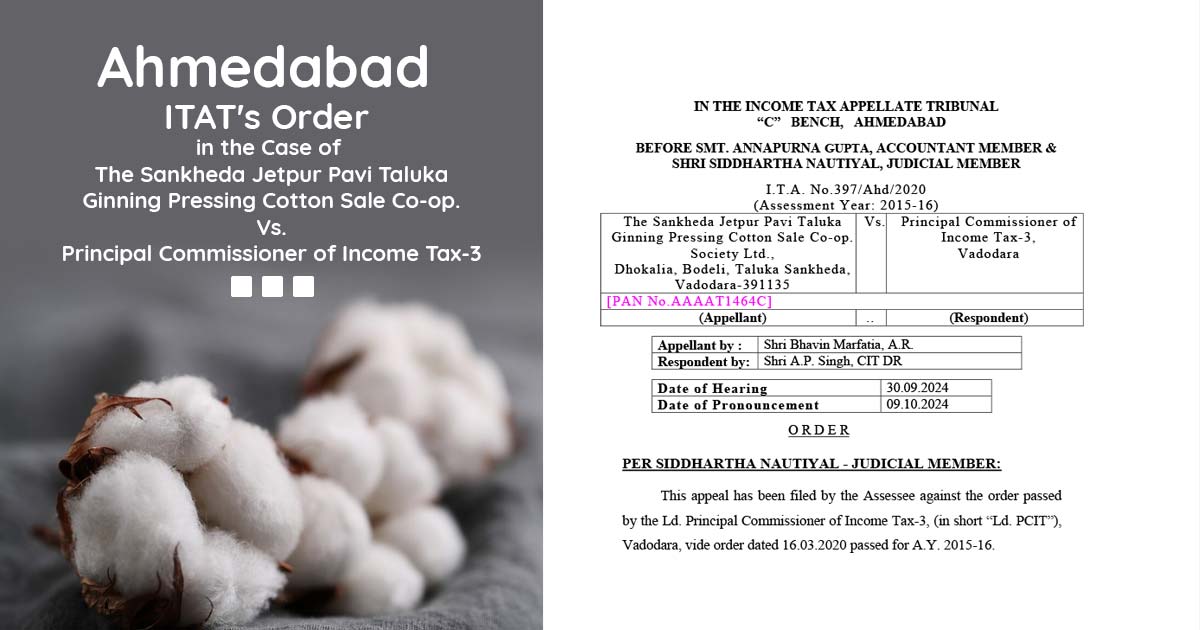

| Case Title | The Sankheda Jetpur Pavi Taluka Ginning Pressing Cotton Sale Co-op. Vs. Principal Commissioner of Income Tax-3 |

| Citation | I.T.A. No.397/Ahd/2020 |

| Date | 09.10.2024 |

| Appellant by | Shri Bhavin Marfatia |

| Respondent by: | Shri A.P. Singh |

| Ahmedabad ITAT | Read Order |