U/s 69A of Income Tax Act,1961 the Bangalore Bench of Income Tax Appellate Tribunal ( ITAT ) deleted a Rs. 14 lakh addition made by the Assessing Officer (AO). The addition was based on wrong information concerning a property transaction, where the AO incorrectly recorded the purchase price as Rs. 45 lakhs instead of the actual Rs. 31 lakhs.

The applicant Prameela Parameshwar, had purchased an immovable property from Shri Madhava Gatti for Rs. 45 lakhs on 07/10/2017. The National e-Assessment Centre, Delhi, discovered that the taxpayer did not file her return for the AY 2018-19.

After getting a notice u/s 148, asserted the purchase price was Rs. 31 lakhs and provided bank loan details. The assessment added Rs. 14 lakhs (Rs. 45 lakhs – Rs. 31 lakhs) as unexplained income u/s 69A read with section 115BBE of the act.

The taxpayer was aggrieved from the assessment order on 16/03/2023 and appealed to the Commissioner of Income Tax(Appeals), who dismissed the appeal dated 21/02/2024 u/s 249(4) for not filing the return and not paying the advance tax.

The counsel of the taxpayer claimed that the assessment was on the grounds of the wrong information, as the Rs 45 lakh sale was not pertinent to the taxpayer. The actual transaction was for Rs 31 lakhs. It was claimed by the counsel that advance tax was not concerned because of the dispute of the addition and tax obligation.

Remarking by the tribunal that the AO added Rs. 14 lakhs under section 69A of the act. The taxpayer disputed the same to the Commissioner of Income Tax(Appeals) claiming that the details were not true and no advance tax was due. The tribunal discovered the CIT(A)’s invocation of section 249(4) to be false and inspected the relevant material and arguments.

It was revealed by the bench that the AO initiated the proceedings u/s 148 based on the wrong details that the taxpayer purchased a property of Rs 45 lakhs. The actual transaction, that the taxpayer documented was Rs 31 lakhs, and the taxpayer is not the owner of the property in question. It indeed remarked that the taxpayer furnished the proof of the loan from Vijaya Bank for the transaction.

The two-member bench Yogesh Kumar U.S(Judicial Member) and Waseem Ahmed(Accountant Member) deleted the AO’s addition of Rs. 14 lakhs under section 69A and permitted the appeal filed by the taxpayer.

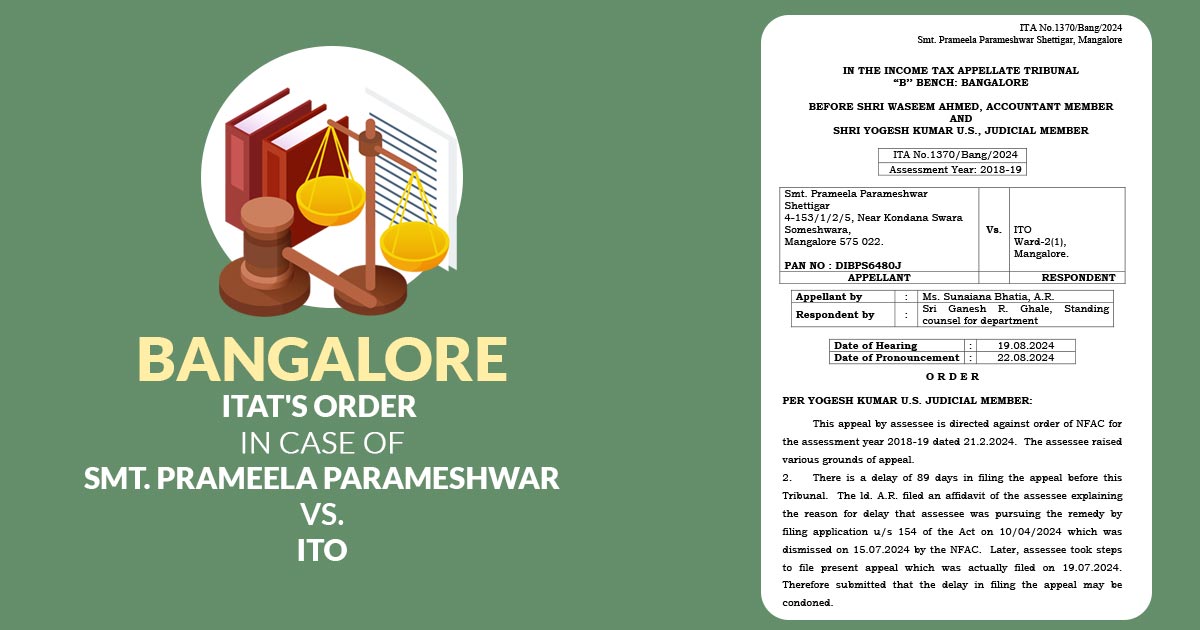

| Case Title | Smt. Prameela Parameshwar Vs. ITO |

| Citation | ITA No.1370/Bang/2024 |

| Date | 22.08.2024 |

| Appellant by | Ms. Sunaiana Bhatia |

| Respondent by | Sri Ganesh R. Ghale |

| Bangalore ITAT | Read Order |