The Raipur Bench of the Income Tax Appellate Tribunal (ITAT) sets aside income tax reassessment completed without furnishing a copy of the reasons.

The Tribunal found that the Commissioner of Income Tax (Appeals)[ CIT(A) ] had not regarded the adjournment request of the taxpayer as neither additional submission nor legal grounds / additional grounds assailed by the taxpayer.

The taxpayer Rajesh Kumar Tiwari, filed an original income return declaring a total income of Rs. 1,57,520/- and notice u/s 148 was issued by the Income Tax Assessing Officer (AO) against which the appellant filed a return declaring the same income as declared in the original return. U/s 147 of the Income Tax Act the AO passed an order assessing the income at Rs. 1,44,48,972 making certain additions/disallowances.

The appellant at the time of the year under consideration, sold a property for a consideration of Rs. 22,5000. It was noted by the AO that though the appellant sold the property dated 22.12.2012 and the amount of the sale consideration has been obtained via the appellant on the identical date the enrollment was incurred via the Registrar dated 17.02.2014.

Earlier AO passed an order of A.Y. 2014-15 u/s 147 vide order on 30.12.2018, making substantive addition in the hands of the appellant being value adopted by Stamp Valuation Authority on the property sale.

It was remarked by the AO that in the course of calculating the capital gain, the appellant has demonstrated a sale consideration of Rs. 22,50,000 rather than Rs. 1,54,19,500 i.e. value adopted via Stamp Valuation Authority. During the assessment proceedings, the appellant specifically requested before AO to refer the case to DVO for valuation of property but AO did not accept the appellant’s submission.

A deduction of Rs. 10,33,252 has been disallowed via AO being the indexed cost of improvement claimed by the appellant concerning property sold. He made the disallowance following that the appellant has not filed particulars of such expenses. Before the first appellate authority CIT(A), the taxpayer files the petition wherein the opinion of the taxpayer has partly been accepted.

The taxpayer’s Authorized Representative furnished that the taxpayer has contested the reassessment validity order before the CIT(A), however, the stated statutory foundation including the other basis furnished via the taxpayer was not adjudicated by the CIT(A).

The Assessing Officer (AO) finished the reassessment without furnishing a copy of the reasons recorded. AO was needed to provide a copy of the reasons to the appellant, whether or not they were asked. when the AO reopened the assessment and when the return was filed through the appellant.

The resulting reassessment order becomes illegal, ab initio void, and is accountable to be struck down as the reassessment has been completed without furnishing a copy of reasons, as per the ratio laid down in the subsequent cases.

Income Tax Appeal Commissioner had not regarded the adjournment request of the taxpayer neither other submission nor legal grounds / additional grounds assailed by the taxpayer, as revealed by the income tax Appellate Tribunal.

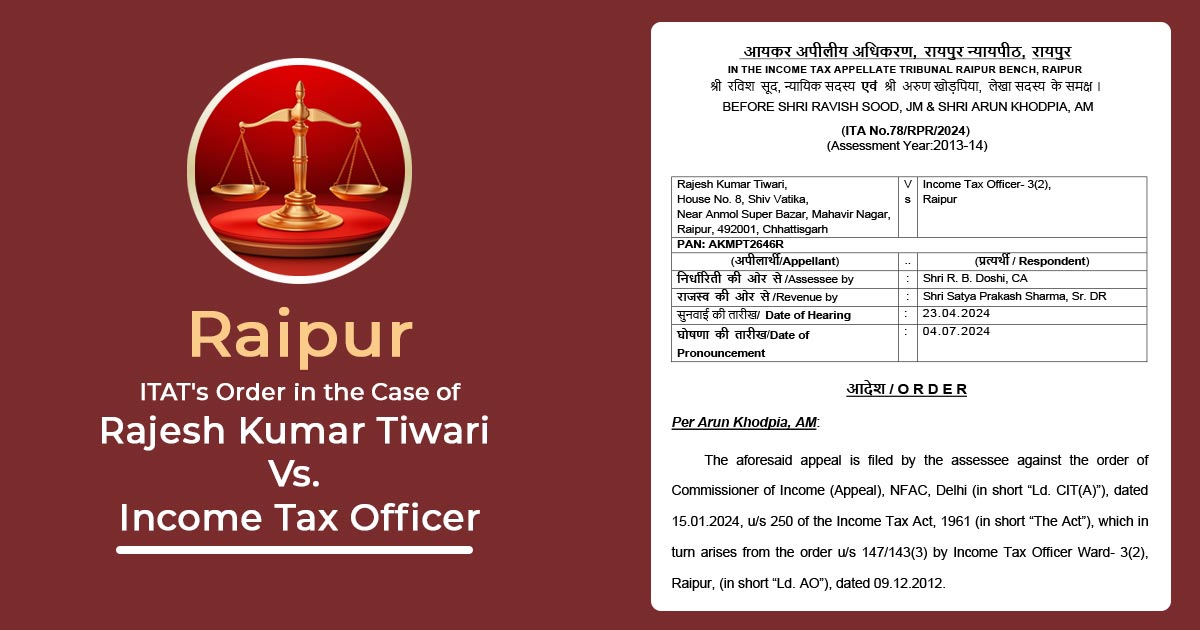

A two-member bench of Shri Ravish Sood, JM & Shri Arun Khodpia, AM set aside the CIT(A) order to his file for fresh adjudication and partly permitted the appeal.

| Case Title | Rajesh Kumar Tiwari Vs. Income Tax Officer |

| Citation | ITA No.78/RPR/2024 |

| Date | 04.07.2024 |

| Assessee by | Shri R. B. Doshi |

| Revenue by | Shri Satya Prakash Sharma |

| ITAT Raipur | Read Order |