In the matter of Shamanna Reddy vs. ITO, the Income Tax Appellate Tribunal (ITAT) Bangalore addressed a petition against the order of CIT(A) for the AY 2018-19. The petitioner, an individual, challenged the dismissal of their petition via the CIT(A) on technical foundations, and the following assessment order passed u/s 147 read with section 144 of the Income Tax Act.

The petitioner does not furnish the income return for the pertinent assessment year however, it was found via the department as having sold an immovable property. The proceedings were executed and the notices were furnished before the appellant. No reply was there from the appellant directing to the finishing of the assessment under section 147 read with section 144 of the Act.

On appeal before the CIT(A) the petition of the appellant was dismissed on the grounds of the non-payment of admitted tax and failure to the opposite data furnished via the appellant for the payment of advance tax.

The appellant before ITAT claimed that they were a senior citizen who faced issues in learning and participating in the proceedings of the income tax because of health problems and restricted education. It was claimed that the total income of the appellant for the related assessment year was minimal and hence no question of payment of the admitted tax was there.

ITAT regarded the submissions of the appellant and learned that the assessment was finished ex-parte, and the notices issued at the time of the assessment proceedings were not served under the prescribed mode. Thus, the ITAT condoned the ex-parte order.

ITAT for the dismissal of the CIT(A) petition on the technical foundations ruled that since the total income of the appellant was minimal, no need for the payment of admitted tax was there. Hence the provision of section 249(4) of the Act can not be invoked to dismiss the plea.

ITAT stressed that the stipulation for the tax payment before furnishing the initial petition is a directory and is not obligatory. If without tax payment the petition is being furnished however the needed amount of tax is paid nextly then the petition will get considered and brought up for hearing on the ground of merits.

ITAT acknowledging such factors permitted the petition for statistical purposes and rendered the problems raised to be restored to the files of the Assessing Officer (AO) for fresh analysis, with the appellant asked to cooperate with the revenue.

ITAT in summary furnished the relief to the appellant, acknowledging their situations and the procedural facts of the matters.

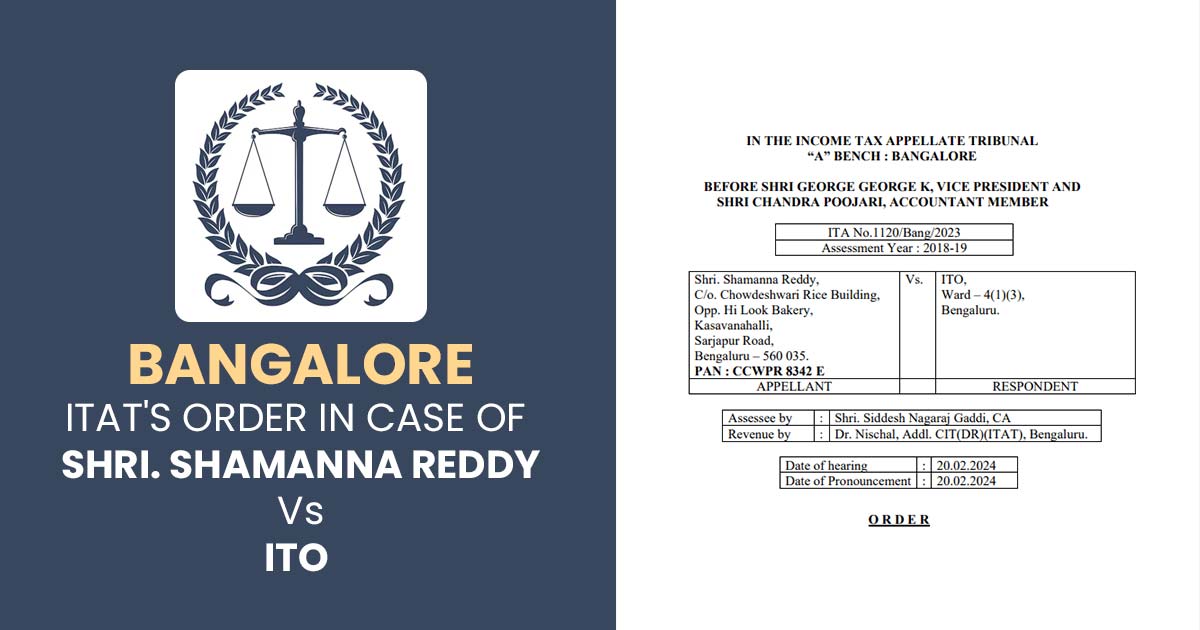

| Case Title | Shri. Shamanna Reddy Vs. ITO |

| Citation | ITA No.1120/Bang/2023 |

| Date | 20.02.2024 |

| Appellant by | Shri. Siddesh Nagaraj Gaddi, CA |

| Respondent by | Dr. Nischal, Addl. CIT(DR)(ITAT) |

| Bangalore ITAT | Read Order |