The Income Tax Appellate Tribunal (ITAT) Mumbai in the recent case analyzed the petition furnished by the taxpayer against an order via the Commissioner of Income Tax (Appeals), National Faceless Appeal Centre, Delhi. From the addition of Rs 11,33,000 as undisclosed income by the Assessing Officer the dispute emerged.

U/s 148 of the Income Tax Act, the assessing officer has initiated the proceedings based on the data obtained from the Directorate of Income Tax, Central Circle-1(3), Mumbai. The taxpayer had made a cash payment of Rs 11,33,000 to M/s. Bhagwati Developers for the purchase of a flat, which was not revealed in the income return.

The taxpayer at the time of the assessment proceedings has refused to make any cash payment before the builder and asked for a chance to validate the witnesses and access to the opposite proof utilised against him. But only on the statement of Shri Kulin Shantilal Vora, a key person of M/s. Bhagwati Developers, the assessing officer has relied on, allegedly verified the cash payment via the taxpayer.

ITAT notified that no chance for the cross-examination was furnished to the taxpayer and the assessment was only on the grounds of the unverified statement of a third party. The tribunal stresses that the principles of natural justice need a chance for cross-examination when laying on the testimony of the witnesses.

As the taxpayer was not furnished the same chance and no additional corroborative proof was shown, the Income Tax Appellate Tribunal (ITAT) considered the assessment order as bad in law and permitted the petition partly.

The same matter underscores the importance of complying with the principles of natural justice, along with furnishing a chance for cross-examination, prior to laying on third-party statements to make additions to the income of taxpayer.

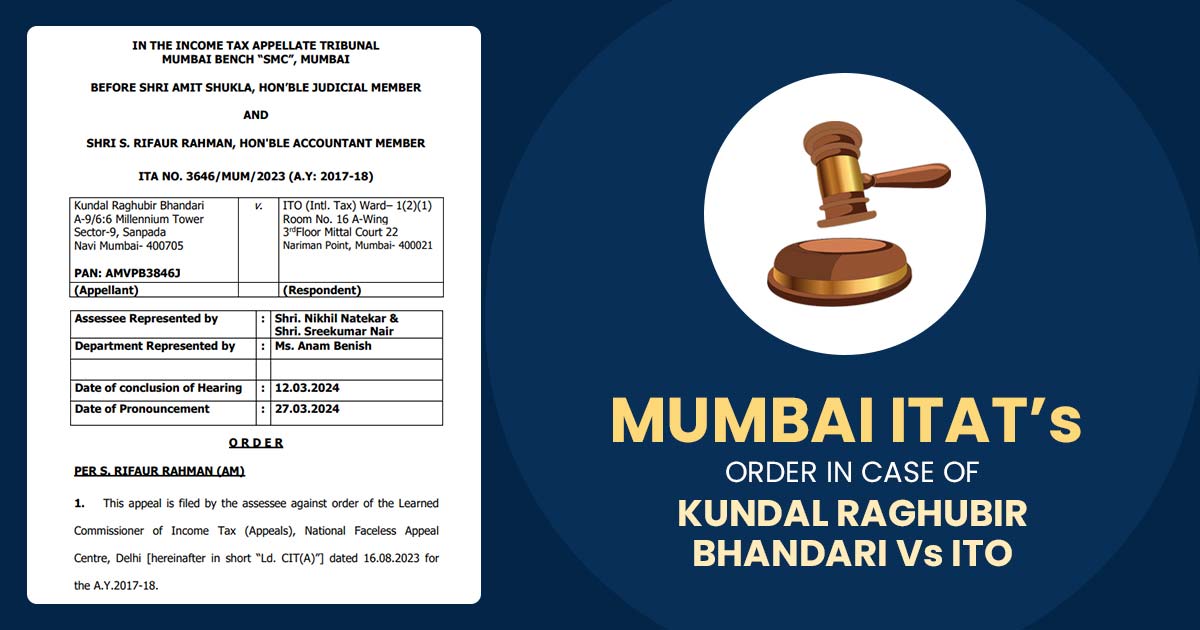

| Case Title | Kundal Raghubir Bhandari Vs ITO |

| Citation | ITA NO. 3646/MUM/2023 (A.Y: 2017-18) |

| Date | 27.03.2024 |

| Assessee Represented by | Shri. Nikhil Natekar & Shri. Sreekumar Nair |

| Department Represented by | Ms. Anam Benish |

| Mumbai ITAT | Read Order |