The Mumbai Bench of Income Tax Appellate Tribunal (ITAT) stated that the date of possession of the new property is to be deemed as the date of acquisition and the taxpayer is entitled to deduction u/s 54 of the IT Act on the purchase of the new property.

The bench of Raj Kumar Chauhan (Judicial Member) and Prashant Maharishi (Accountant Member) witnessed that the date of possession of the new property needed to be deemed as the acquisition date of the property. By agreeing to purchase, the taxpayer has acquired the right to purchase the property and did not purchase it as it was under construction.

Under Section 54 of the Income Tax Act, if the taxpayer has, within 1 year before or two years after the date on which the transfer took place, purchased, or constructed, within three years after that date, one residential house in India, then rather than the capital gain being levied to income tax as income of the previous year in which the transfer took place, in this case, it would be waived.

The petitioner is a non-resident individual. The data was received from the Assistant Commissioner of Income Tax that the taxpayer sold the flat jointly owned with his wife for a consideration of Rs. 138 lakhs on 10/2/2011. Thus, notice u/s 148 was issued.

The taxpayer did not follow the notices, and therefore the assessment was completed u/s 144(1), treating the gain of Rs. 4,567,000 as the taxpayer’s share of 50% on the sale of property as short-term capital gain and adding it to the taxpayer’s total income. The addition was confirmed by the CIT confirmed.

An order has been passed by the coordinate bench, setting aside the case and putting it in the assessing officer’s file for de novo adjudication. Thus, notice u/s 142(1) was issued before the taxpayer.

At the time of the assessment proceedings, it was elaborated to the assessing officer that on 31/1/2006 the taxpayer bought the property under the allotment or reservation letter provided via the builder on Rs 1 lakh payment. On January 31, 2006, the taxpayer furnished the provisional allotment letter provided via the builder allotting the flat.

Hence the assessing officer was asked to acknowledge the allotment date as the acquisition date of the property and calculate the capital gain as a long-term capital gain as the duration of holding of the taxpayer property is more than 36 months. AO in the original assessment order deemed the same a short-term capital gain.

U/s 144C(1) the draft assessment order was passed, specifying the total income of the assessee. The taxpayer has approached the dispute resolution panel, which rejected the complaints of the taxpayer under the direction. Consequently, under Section 144C (13) read with Section 147 lead with Section 254 of the Income Tax Act, the final order was passed at the total income of Rs. 3,597,395.

The crux of the case is that for the capital gain originating from the sale of flat number 1802 as per an agreement on 10/2/2011, the taxpayer is eligible for deduction u/s 54 of the Act for the purchase of a new residential flat where the date of agreement to sell the new property is July 25, 2009, though the date of granting possession is February 2, 2011.

The assessing officer asserted that the purchase date of the new property was July 25, 2009. The window available for the taxpayer is one year before the date of sale of the property, i.e., 10/2/2011. The taxpayer cannot be given a deduction under Section 54, as the assessee purchased the property on July 25, 2009,

The taxpayer argued that it got possession of the property dated 02/02/2011; thus, the date of purchase of the property must be considered the date of possession of the property on 02/02/2011, which falls within 1 year before the date of 10/2/2011, and consequently, the taxpayer is qualified for deduction u/s 54.

Recommended: Chennai ITAT: CG is Eligible to Deduct U/S 54F IF Buying Residential Property Before Return Filing

Under Section 54, deductions are permissible if the taxpayer purchases the property. In this case, by agreement on July 25, 2009, 2009, the taxpayer“acquired the right to purchase” a house that was under construction on February 2, 2011. When the house was handed over to the taxpayer, when it was inhabitable, the taxpayer purchased the house.

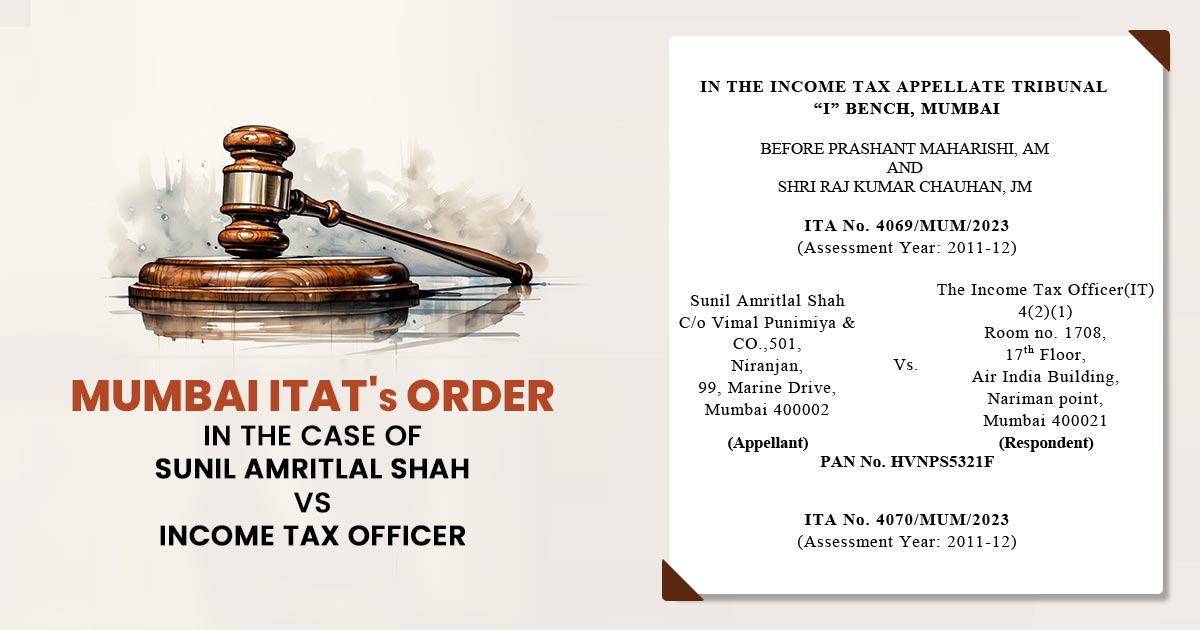

| Case Title | Sunil Amritlal Shah Vs. The Income Tax Officer (IT) |

| Case No. | ITA No. 4069/MUM/2023 |

| Date | 13.05.2024 |

| Counsel For Appellant: | Shri Vimal Punmiya |

| Counsel For Respondent | Soumendu Kumar Dash |

| Mumbai ITAT | Read Order |