It was ruled by ITAT Jaipur that provisions of 68 or such are not been applied on the transaction sale recorded in the books of accounts as the sale transactions are part of the income which is credited in the statement of profit & loss account.

Case Facts

AO in the assessment proceedings noted that for the year under assessment, the taxpayer company has deposited Rs 2,79,00,000 in its distinct bank accounts at the time of the demonetization period.

After acknowledging the explanation an amount of Rs.2,64,00,000/-(2,79,00,000/- – 15,00,000/-) was added to the taxpayer’s total income treated as unexplained money under the provision of section 69A of the IT Act, 1961 and tax is assessed under section 115BBE of the IT Act.

Before the appellant, CIT(A) granted the partial relief. Dissatisfied with that the present appeal has been filed.

Closure

It was carried that the revenue could not accept the part of the sales as elaborated and part of the sales is not explained on the proof. As a result, the cash deposited from the demonetized currency was included as income for the assessee by utilizing the provisions of section 68 of the Act.

However, these provisions do not apply to the sale transactions recorded in the financial records, as those transactions are already considered part of the income reflected in the profit and loss statement. Hence no reason is there to regard it as an unexplained credit entry of the taxpayer by applying the provisions of section 68 of the act.

For the matter of Smt. Harshila Chordia vs Income-tax Officer Rajasthan HC ruled that no addition can be made for the amount standing in the books of the taxpayer, which was discovered to be the cash receipts from the clients and against which the delivery of the vehicle was made to them.

The assertion that this cash resembles part of the sales recognized by the revenue is misleading; thus, we maintain that the cash deposited by the assessee from the sales revenue of stones cannot be deemed related to the stipulations of section 68 or 69A of the Act.

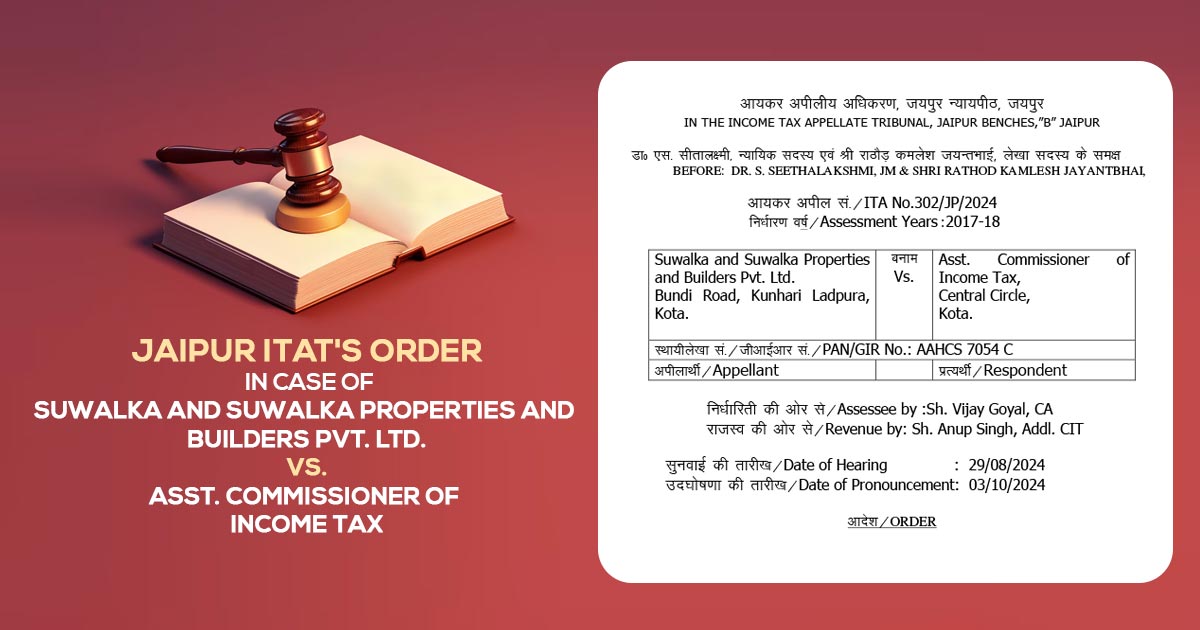

| Case Title | Suwalka and Suwalka Properties and Builders Pvt. Ltd. vs. Asst. Commissioner of Income Tax |

| Citation | ITA No.302/JP/2024 |

| Date | 03.10.2024 |

| Assessee by | Sh. Vijay Goyal |

| Revenue by | Sh. Anup Singh |

| Jaipur ITAT | Read Order |