The New Delhi bench of the Income Tax Appellate Tribunal (ITAT) carried that unless there is proof to show that the obligation has ceased to exist, no addition under section 41(1) of the Income Tax Act is there and therefore, deleted the addition made by Assessing Officer (AO).

A petition has been filed by Shashi Mittal wife of Late Mahender Kumar Mittal. The taxpayer has filed a return declaring Nil income and his case was selected for investigation. Against the taxpayer, the assessment proceedings were initiated and an order u/s 143(3) came to be passed by making the addition of Rs.1,68,38,416 treating it as undisclosed income. On appeal, the CIT(A) upheld the addition of Rs.1,68,38,416 u/s 41(1) of the act.

AO has invoked the provisions of section 68 by remarking that the taxpayer has not furnished an adequate explanation of the identity of parties, transaction genuineness, and capacity of creditors. Also, it has been learned that Income Tax (Appeals) kept the addition via invoking the provisions of section 41(1) carrying that such credits have been due for a long time.

It was proof that the council had not drawn anything on record to prove that the obligation had ceased to exist and neither of the parties had written off it in their books of accounts.

When the inspector visited the premises, it was noted that no functionality was there within the firm from that address in the year 2015. However, the transaction took place before 01.04.2009 and the non-existence of this firm in 2015 cannot be cause to sustain addition and the report of the inspector cannot be laid on in its entirety as there no basis was there for such information so recorded by him by following the due procedure as specified in Code of Civil Procedure. Therefore, until there is proof to show that these credits have ceased to exist, there cannot be any addition u/s 41 (1) of the Act, the two-member Bench of the ITAT comprising of Yogesh Kumar U.S. (Judicial Member) and Dr. B.R.R. Kumar (Accountant Member) witnessed.

The balance sheet of the assessment year has been duly signed by the taxpayer thereby recognizing the debt and in these cases, the lower authority is precluded in applying the provisions of section 41(1) of the. It was discovered that the AO has not brought anything to show that it ceased to exist in the assessment year under consideration, in such circumstances, it is incomprehensible to hold that debt ceased to exist, Bench discovered.

While directing to the judgment of the Supreme Court in the case of CIT Vs. SI Group India Ltd., the Income Tax Appellate Tribunal (ITAT) dismissed the applicability of section 41(1) of the Income Tax Act, 1961, and addition as per the stated provision and partly permitted the appeal of the taxpayer.

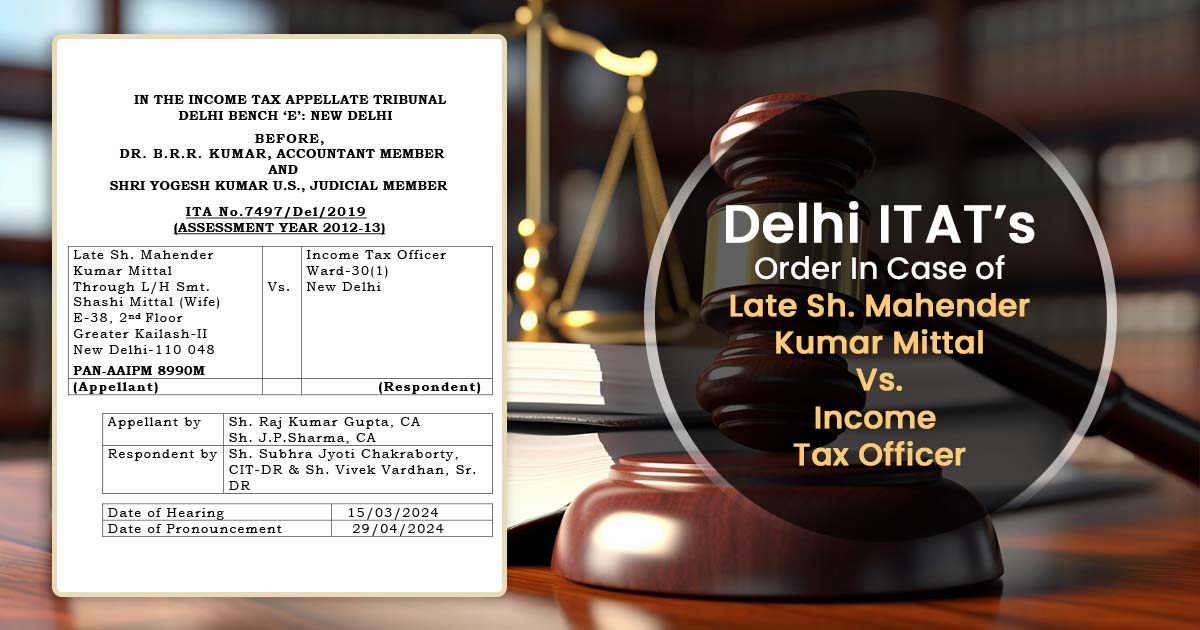

| Case Title | Late Sh. Mahender Kumar Mittal Vs. Income Tax Officer |

| Citation | ITA No.7497/Del/2019 |

| Date | 29.04.2024 |

| Appellant by | Sh. Raj Kumar Gupta, Sh. J.P.Sharma |

| Respondent by | Sh. Subhra Jyoti Chakraborty, Sh. Vivek Vardhan |

| Delhi ITAT | Read Order |