Exemption u/s 54 of the Income Tax Act,1961 can be permitted based on the amount utilized out of the sale consideration towards the construction of the property even if the construction is not complete, the Bangalore Bench of the Income Tax Appellate Tribunal (ITAT) carried.

The taxpayer, Bagalur Krishnaiah Shetty Vijay Shanker, submitted his Income Tax Returns for the assessment year (AY) 2016-17 reporting a total income of Rs.98,43,820.

The assessing officer (AO) in the assessment proceedings marked that the taxpayer has sold a property for Rs 18.7 crore, resulting in a long-term capital gain of Rs. 12.81 crore after deductions.

an exemption of Rs. 12.06 crore under Section 54 of the Income Tax Act, 1961 has been claimed by the taxpayer for investing in an under-construction house and proposed the long-term capital gain of Rs 74.6 lakhs to tax. The taxpayer has furnished a valuation report and the bank statement specifying the costs of construction of Rs 6.66 crore and cash withdrawals of Rs. 4.78 crore.

AO has disallowed the taxpayer’s claim as the construction was not complete. The taxpayer has appealed to the Commissioner of Income Tax (Appeals).

The plea of the taxpayer was permitted by the CIT(A) and carried that concerning the usage of the capital gains, the appellant has satisfied the conditions u/s 54 of the Income Tax Act 1961 and quashes the disallowance of AO.

The revenue aggrieved by the order of CIT (A), appealed before the ITAT.

As the construction of the property is not finished, the taxpayer cannot be provided with the exemption u/s 54 of the Income Tax Statute, the counsel on behalf of the Revenue argued.

The counsel on behalf of the taxpayer laying on a ruling by the Karnataka High Court, argued that the CIT(A) has granted the taxpayer’s claim u/s 54 of the Income Tax Act.

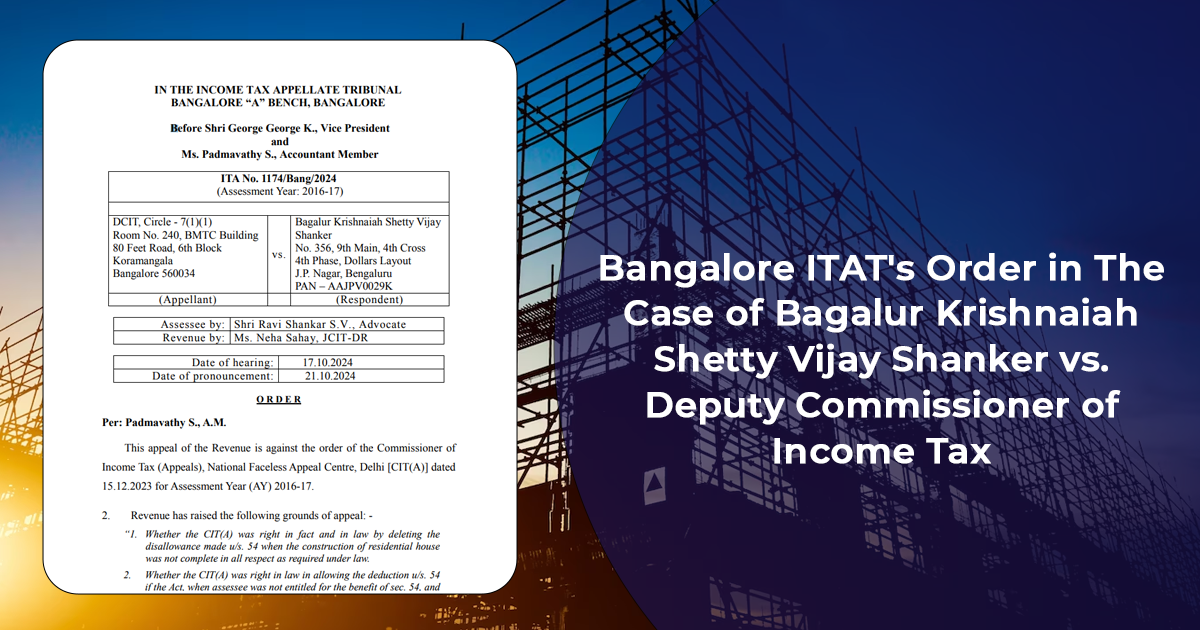

The ITAT bench kept the CIT ( A ) decision and permitted the exemption of taxpayers. The revenue’s appeal has been dismissed by the ITAT bench including Mr George George K (Vice President) and Ms Padmavathy S. (Accountant Member).

| Case Title | Bagalur Krishnaiah Shetty Vijay Shanker vs. Deputy Commissioner of Income Tax |

| Citation | ITA No. 1174/Bang/2024 |

| Date | 21.10.2024 |

| Assessee by: | Shri Ravi Shankar S.V. |

| Revenue by: | Ms. Neha Sahay |

| Bangalore High Court | Read Order |