In the matter of Laxmilal Badolla vs. NFAC (ITAT Bangalore), the issue is concerned with the levying of penalty u/s 271D of the Income Tax Act, 1961, concerning cash receipts in the course of the AY 2016-17. A Detailed summary of the judgment delivered by the ITAT Bangalore has been stated below-

Backdrop: Laxmilal Badolla, an individual, had sold two properties at the time of the pertinent year and received a total of Rs. 8,39,000 in cash from the buyers. Against him, penalty proceedings under section 271D have been initiated by the Income Tax Department. citing that acceptance of cash surpassed the permissible limits under the law. Approximately four years after the filing of his income tax return the penalty notice was issued, which the appellant claimed was an unreasonable delay.

Procedures:

- The penalty has been challenged by the appellant before the NFAC (National Faceless Assessment Centre) and subsequently the CIT(A) (Commissioner of Income Tax – Appeals). He also said that there were true reasons to accept the cash payments, majorly due to the reason that the buyers were not able to furnish the payment through the cheque or demand draft due to banking constraints and problems of timing.

- Even after the explanations of the appellant, both the NFAC and the CIT(A) kept the penalty, directing the appellant to file a petition to ITAT Bangalore.

The Following Arguments were Presented to ITAT:

1. The counsel of the appellant raises distinct key arguments-

- The initiation of the penalty was conducted after an unreasonably long delay of 4 years, which was non-justified as per statutory precedents.

- Against the appellant, no prior assessment proceedings were due which is a requirement to initiate the penalty proceedings under section 271D.

- Other parties engaged in the same property transactions who obtained the cash were not penalized, emphasizing the arbitrary treatment by the tax authorities.

- The revision limiting the cash transactions for the immovable property has been effective recently, and the appellant assumed that he could accept the cash payments in influential faith.

2. ld. DR (learned Deputy Commissioner), representing the department upheld the penalties levied based on the original assessments and the findings of the lower authorities.

The ruling of ITAT – Post acknowledging the contentions from both sides and analyzing pertinent statutory precedents, ITAT Banglore ruled that-

- After such a long delay of four years, the initiation of penalty proceedings was not reasonable. It directed distinct judicial decisions stressing the requirement for the penalties to get executed within a suitable time duration.

- U/s 271D the penalty was considered invalid as there were no due assessment proceedings against the appellant.

- The elaboration of the appellant that he accepted cash because of the genuine constraints suffered by the buyers was accepted as reasonable cause, particularly furnished the newness of the statutory provisions at the time.

- Quoting section 273B of the Income Tax Act which exempts penalties if there is a reasonable cause, the penalty u/s 271D must not be applicable for the same case, ITAT concluded.

- It was stressed by ITAT that some applications selected related to penalties to the appellant while the others engaged in the identical transactions were afforded were biased and opposed the principles of equality under article 14 of the Indian constitution.

Conclusion

ITAT Banglore under these findings permitted the petition filed by Laxmilal Badolla, hence deleting the penalty levied u/s 271D.

Releted:- Mumbai ITAT: Tax Penalty U/S 271D & 271E Can’t Be Charged When Assessment Order Canceled

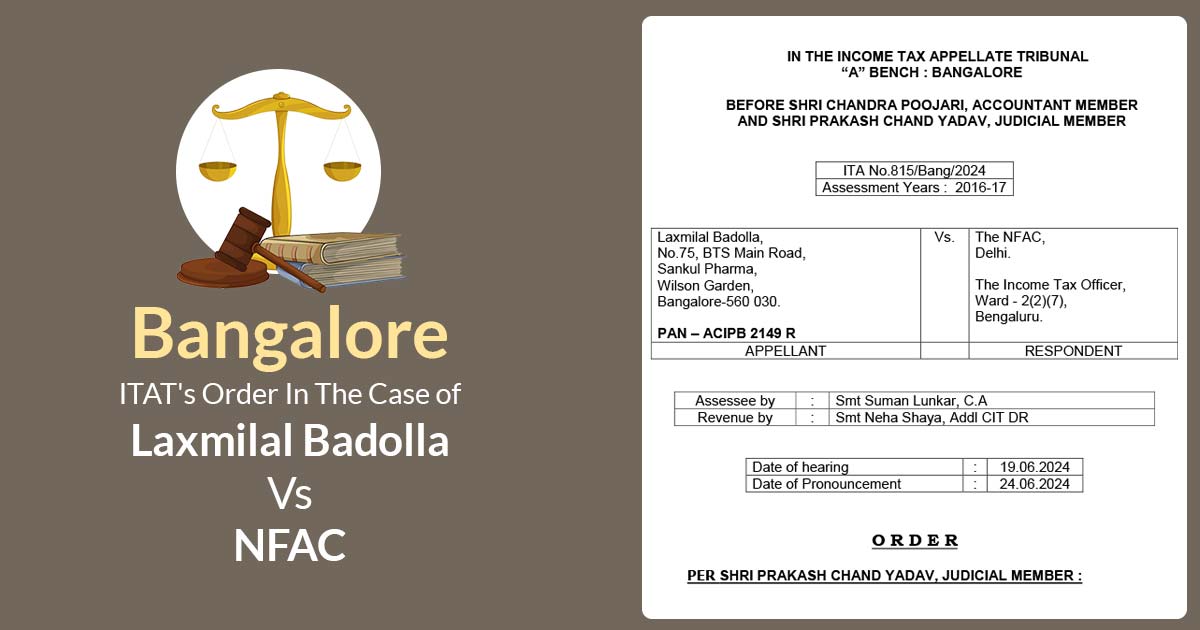

| Case Title | Laxmilal Badolla V/S NFAC |

| Case No.: | ITA No.815/Bang/2024 |

| Date | 24.06.2024 |

| Counsel For Appellant | Smt Suman Lunkar, C.A |

| Counsel For Respondent | Smt Neha Shaya, Addl CIT DR |

| Bangalore ITAT | Read Order |