On 15th June, the first instalment of advance tax payment is required for FY 2023-24 and by this date, 15% of advance tax liability has to be paid. compute your advance tax liability and before time surely pay the advance tax instalment to avoid penal interest.

Important Points During Advance Tax Payment

15/06/2023 will be the last date to pay for the fourth Installment of the advance tax for FY 2023-24. Thus elaborating the basic definition of an Advance tax.

If the liability of the income tax on any assessee exceeds Rs 10,000 in a fiscal year, he would be responsible to file the same tax in Installment in the year itself as advance tax. The advance tax would be furnished in 4 Installments 15% on or prior to June 15, 45% on or prior to September 15, 75% on or prior to Dec 15, and 100% on or prior to March 15 of the former year.

Under sections 44AD and 44ADA, an assessee who has chosen the scheme of calculating the business income on the grounds of presumption would be responsible to file only the last Installment for the advance tax. Senior citizens, whose age is 60 years or more but have no income through business or profession would be exempted from furnishing the advance tax.

The taxpayer must estimate the income of the fiscal year and the income tax on it. From that income tax, TDS, and TCS credit would need to get deducted and the Installment of the advance tax must be furnished.

Need to Find If Any Details are available on the New Portal for Advance Tax Payment?

In the income tax, the decision of the forthcoming or the current year would be taken on the profit and loss of the former years. Post log in to the new portal the information about the taxable income and the tax liability would be available for the two former fiscal years on the dashboard. Moreover, the information on the advance tax, TDS/TCS, and the self-assessment tax furnished for the two former fiscal years would be available. The assessee could acknowledge that for the computation of the advance tax liability for the present year.

What Comes When No Advance Tax Gets Filed?

If the advance tax would not get filed then the interest would be required to be paid at 1% per month u/s 234B and 234C and one might suffer from the investigation from the council. Moreover, the penalty might be levied on the assessee who would be needed to file the higher amount of advance tax. Because of digitalization, the tax department would obtain much more data, upon which the department furnishes the advance tax notices demanding the tax payment.

What Does a Person Learn Through the Same?

We learn about the amount of tax we had filed in the past and through estimating the growth in the income we must file the advance tax as per that. One must file the tax according to the provision of the act. If not then the assessee will suffer the outcomes in the forthcoming times. Taking prevention would be better than cure.

Given below is the solution to all the questions about the payment of advance tax-

Who Has to Pay Advance Tax for FY 2023-24?

If the total computed tax for the year is more than Rs 10,000 then you have to pay advance tax. Sandeep Sehgal, director, tax & regulatory, Ashok Maheshwary & Associates LLP, chartered accountancy (CA) firm said that “All incomes earned till the date of calculation of advance tax and which are certain to be earned by the person during the relevant financial year are taken on an estimated basis for the payment of advance tax”.

Recommended: Why Paying Tax is a Human Rights and Civil Duty?

Rakesh Nangia, managing partner, Nangia Advisors LLP, a CA firm said: “a resident senior citizen (an individual of age 60 years or above), not having income from business or profession is not liable to pay advance tax”.

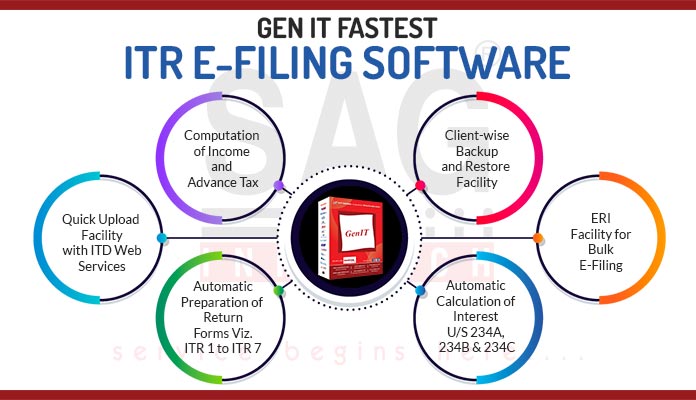

Submit Query for Advance Income Tax Software

If the source of income is salary and has no other sources of income then you do not have to pay advance tax because employers deduct tax at the source before paying salary and deposit it with the IT department every month. But if you also have income from other sources like rent from a property or capital gain or interest from bank deposit and many more which are not yet declared to the employer, then you have to pay the total tax liability if the income from other sources increases from Rs 10,000 a year.

Sehgal said, “Capital gain is considered for advance tax calculation only when it is actually earned”.

When to Pay Advance Tax for FY 2023-24?

Payment of Advance Tax

- First Instalment- by 15th June every year you must pay 15% of tax liability.

- Second Instalment: By 15th September, you must pay 45% of the tax liability.

- Third Instalment- by 15th December you must pay 75% of your tax liability.

- The fourth Instalment- by 15th March you must pay 100% of tax liability.

Business/Professional assessee declaring income under the presumptive income scheme u/s 44AD or 44ADA also has to pay the whole of the advance tax by the 15th of March of the Year. However, any amount deposited by 31st March is treated as advance tax of that financial year.

How to Pay Advance Tax for FY 2023-24?

Advance tax can be paid online as well as offline. For further information, Click here:

To Pay online-

- Login to the income tax website www.incometaxindia.com

- Click on the e-payment of Taxes tab

- Now under the Service tab, select the e-payment option

- To pay advance tax, select Challan 280

- Fill in the required details

- Choose the Netbanking option to pay online

- After successful payment, a challan certificate will be displayed which will contain the information number, payment

- details and bank name via which the e-payment was made.

- This certificate is proof of the payment that has been done

To Pay Advance Tax Offline

You have to visit the designated bank branch and fill out the challan form and then pay the taxes.

Points To Remember While Paying Advance Tax Installment

While paying advance tax, it is not required that the person must submit an estimate or statement of income to the liabilities. Sehgal said, “while calculating tax liability it is allowed to consider deductions under Chapter VI-A for the investments to be made by the taxpayer during the year before calculating advance tax liability”. Deductions under Sections 80C, 80D and so on are included in Chapter VI-A deductions.

After the payment, if there is a change in income then you can update the revenue of advance tax in the next instalments as per the new tax liability estimate.

One has to pay interest on due taxes if one fails to pay taxes on time. Nangia said “Interest under section 234B of the Act shall have to be paid if the total advance tax paid is less than 90% of the assessed tax or if the entire advance tax has not been paid. Interest at the rate of 1% per month from the beginning of the assessment year until the payment thereof shall have to be paid on account of such default”.

If you want to buy advance tax and have not yet paid, do it as soon as possible before the last date.