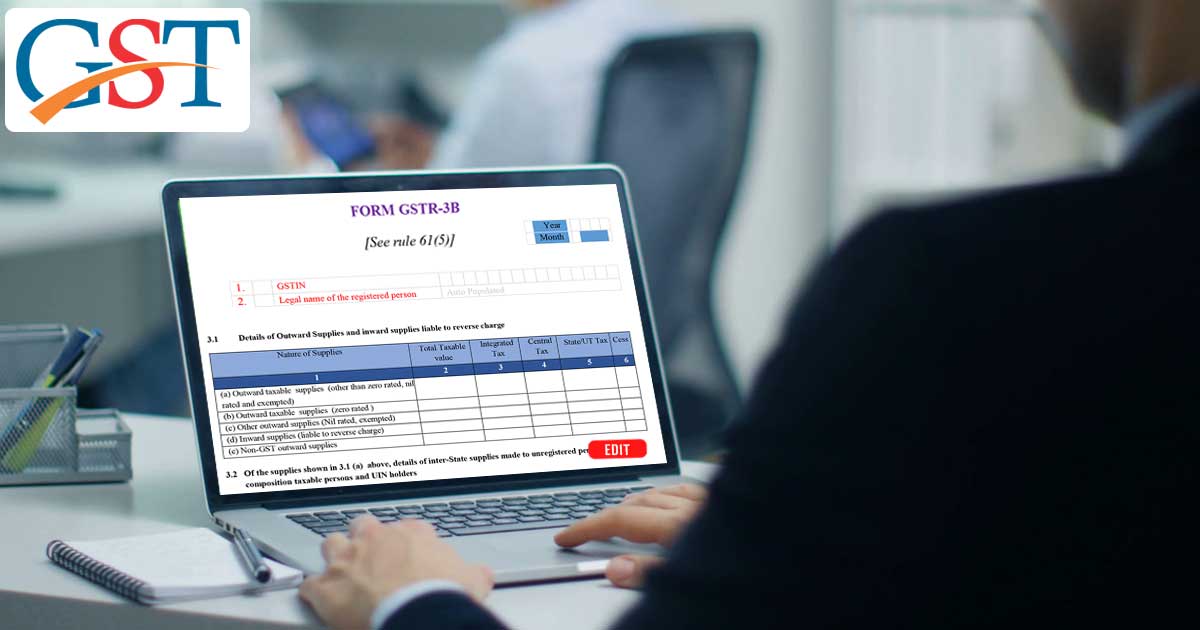

Infosys, which is the developing organization for the GSTN portal has stated that it would be configuring the editing facility in the GST network by the date of November 20 which will be enabling the traders to file 3-page summary return i.e. GSTR 3B. The information was shared by the GST Group of Ministers (GoM) Chairman Sushil Kumar Modi who also stated that “Over 2 lakh taxpayers were unable to file their summary returns (3B) in August and September due to the non-provision of the editing facility in the GST Network. By November 20, the editing facility will be operationalised by the GST Network.”

The firm has begged the project worth 1300 crore in a bid to built the country’s tax system infrastructure online. In the recent meeting, GoM also suggested some methods to inject simple working to improvise the network into more user-friendly and influencing. (GoM) Chairman Sushil Kumar Modi also mentioned that “All forms related to taxpayers will have editing facility for previewing, downloading, printing and displaying specific error messages — to make the portal more user-friendly.”

In the past, Infosys has been doing all sorts of hard work to maintain the efficiency of GSTN network and has been hiring engineers to continuously monitor the situation. Recently Infosys hired more than 100 engineers to work on its GSTN portal which has taken the number of 621 professionals working on the portal. Modi said that “In the first meeting (September), as we told Infosys to deploy a resident engineer in every state, the company has debuted 30 of them in each of the 30 states across the country to address any issue related to the Network.”

And the company did according to the decision and deployed 30 engineers in each state for the redressal of the issues of taxpayers. The GoM is considering to meet Infosys co-founder and Chairman Nandan Nilekani in order to discuss the advancement of GST portal and further actions to be taken into the account of the betterment of the portal.