As we know, the time for e-filing ITR is running, so every taxpayer must remember the income tax return filing due dates to avoid penalties under the Income Tax Act of 1961. In this post, you can check out all the due dates compulsory for FY 2025-26 (AY 2026-27).

The practising CA, CS and tax professionals can also view advance tax and revised and updated ITR due dates.

What is the Income Tax?

Two types of tax levied on entities are direct tax and indirect tax. Income tax is a direct tax that is directly attributable to the income of the assessee. Income which is generated from the various heads of income, viz. Salary, House Property, Business, Capital Gain and Income from other sources. The assessee has to pay income tax if his total Income after allowing Chapter VI-A Deduction is more than the taxable income limit.

Due Dates of ITR for Different Categories of Taxpayers for FY 2025-26 (AY 2026-27)

| Category of Taxpayer | Due Date (Original Return) |

|---|---|

| Company (whether tax audit applicable or not applicable) | 31st October 2026 |

| Other than a company to which the tax audit is applicable | 31st October 2026 |

| Partner of the firm to whom the tax audit is applicable | 31st October 2026 |

| Assessee includes the partner’s firm or the spouse of such partner, who is needed to be provided report under section 172 | 30th November 2026 |

| Assessees who are not required to get his Accounts Audit | 31st July 2026 |

| Revised Return/ Belated Return | 31st December 2026 |

| Updated Return (ITR-U) | Upto 31st March 2031 |

Filing Income Tax Return Due Dates for FY 2025-26 (AY 2026-27)

There is a different category of taxpayer, viz. Individual, HUF, Firm, LLP, Company, Trust and AOP/BOI. Due Date is different according to audit or non-audit cases of such categories as defined in section 263 of the Income Tax Act, 2025.

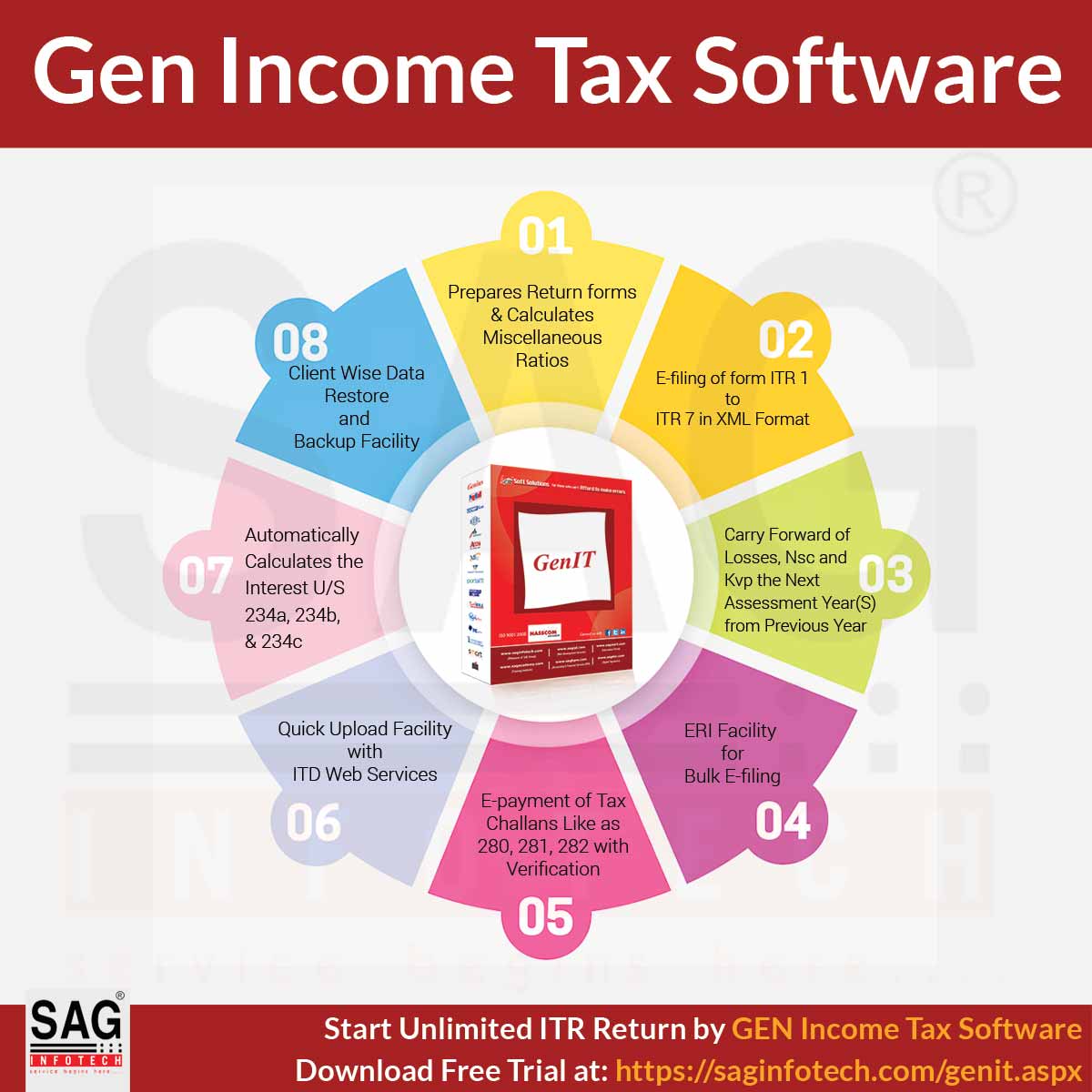

Free Download Gen IT Software for e-Filing Returns

Due Date of Income Tax Return Filing for AY 2026-27 (Non-Audit Cases)

- The common due date for filing the Income Tax Return by Assesse whose Books of Account are not required to be audited is 31st July 2026.

Filing Income Tax Return Due Date for AY 2026-27 (Audit Cases)

- The general due date for filing the Income Tax Return for the audit cases is 31st October 2026.

Due Dates for Tax Audit Report (3CA-3CD/3CB-3CD)

- The due date for filing the Tax Audit Report for all categories of assessees whose accounts are required to be audited is the date one month before the due date for furnishing the return of income under sub-section (1) of section 263, i.e., September 30, 2026.

Revised & Belated ITR Due Dates for AY 2026-27

- The due date for filing a revised and belated income tax return for AY 2026-27 is nine months from the end of the relevant tax year or before the completion of the assessment, whichever is earlier, i.e. 31st Dec 2026.

File Tax Returns for AY 2026-27 Before 31st December with INR 5,000 Penalty

The income tax department notified the taxpayers of the late filing of tax returns for A.Y. 2026-27, along with a penalty of INR 5000. However, if the taxpayer’s total income does not exceed Rs 5 lakh, then the maximum penalty levied for delay will not exceed Rs 1000.

Due Date of Income Tax Return Filing for AY 2026-27

(Assessee who are required to furnish a report under sec 92E)

- The due date for filing the Income Tax Return by an assessee who is required to furnish a report under sec 92E is 30th November 2026.

- The due date for furnishing a Report from an Accountant by persons entering into an international transaction or specified domestic transaction under section 92E of the Act for the Previous Year 2025-26, is at least one month before the due date of filing of return u/s 263(1)

What Would Happen If You Missed the ITR Filing Deadline?

Missing the deadline for filing Income Tax Returns (ITR) for the FY 2025-26 and AY 2026-27 can have some harmful effects. Take a look at what happens if you miss the ITR deadline:

- Potential for Scrutiny: Recognise that if you file your taxes later, it might grab the attention of the I-T department and expand the possibilities of them bringing a closer look at your income tax return. This could suggest they request more records, and it might take longer for you to get your tax refund on time.

- Interest on Unpaid Tax: If you are filing an ITR later and pay taxes, you have to pay additional money in interest on the amount that you owe from the deadline until you pay it.

- Loss of Carry Forward Benefits: Sometimes, you might be able to utilise any financial failures or tax deductions from previous years to reduce the tax amount you owe in the future. But if you have missed the ITR filing deadline, you might not be able to take any benefit.

It is essential to submit your ITR before the due date to avoid difficulties. Filing tax returns on time allows you to make the process much easier, stops you from facing penalties and extra costs, and provides you with all the tax benefits you are entitled to.

Advance Income Taxes Filing Due Dates FY 2025-26

If the tax liability is more than Rs 10,000 in a financial year, then advance tax needs to be paid by the assessee.

| Due Date | Compliance Nature | Tax Paid |

|---|---|---|

| 15th June 2025 | First Instalment | 15% |

| 15th September 2025 | Second Instalment | 45% |

| 15th December 2025 | Third Instalment | 75% |

| 15th March 2026 | Fourth Instalment | 100% |

The assessee who is covered under section 58 (i.e. Presumptive Income) is also required to pay the advance tax on or before the 15th of March of the previous year. However, any tax paid till 31st March will be treated as Advance Tax.

Most Important FAQs on the ITR Filing Deadline for AY 2026-27

Q.1 – What is the last date for filing an income tax return (ITR) for non-audit cases?

The due date for filing income tax returns for AY 2026-27 (FY 2025-26) is 31st July 2026

Q.2 – Could I E-file My Return after the due date?

Yes, you can file your late income tax return (ITR) upto 31st of December of that assessment year (AY) after paying extra fees and interest.

Q.3 – What is the due date to E-file income tax return (ITR) for Cos?

The deadline for filing the ITR of domestic companies for the financial year (FY) 2025-26 is 31st October 2026. For all companies, it is essential to e-file their Income Tax Returns (ITR) by a specific date every year.

Q.4 – Is It Possible to File a Revised ITR?

Yes, you can make the particular modification in your ITR after submitting it. It would be best if you changed it on or before 31st of December.

Q.5 – What happens if a person files their ITR after the due date?

If you have missed the particular deadline for filing your income tax return, then you have to pay some additional fees as per section 428 of the Income Tax Act, 2025.