As we know, the time for e-filing ITR is running, so every taxpayer must remember the income tax return filing due dates to avoid penalties under the Income Tax Act of 1961. In this post, you can check out all the due dates compulsory for FY 2025-26 (AY 2026-27).

The practising CA, CS and tax professionals can also view advance tax and revised and updated ITR due dates.

What is the Income Tax?

Two types of tax levied on entities are direct tax and indirect tax. Income tax is a direct tax that is directly attributable to the income of the assessee. Income which is generated from the various heads of income, viz. Salary, House Property, Business, Capital Gain and Income from other sources. The assessee has to pay income tax if his total Income after allowing Chapter VI-A Deduction is more than the taxable income limit.

Due Dates of ITR for Different Categories of Taxpayers for FY 2025-26 (AY 2026-27)

| Category of Taxpayer | Due Date (Original Return) |

|---|---|

| Company (whether tax audit applicable or not applicable) | 31st October 2026 |

| Other than a company to which the tax audit is applicable | 31st October 2026 |

| Partner of the firm to whom the tax audit is applicable | 31st October 2026 |

| Assessee includes the partner’s firm or the spouse of such partner, who is needed to be provided report under section 172 | 30th November 2026 |

| Assessees who are not required to get his Accounts Audit | 31st July 2026 |

| Revised Return/ Belated Return | 31st December 2026 |

| Updated Return (ITR-U) | Upto 31st March 2031 |

Filing Income Tax Return Due Dates for FY 2025-26 (AY 2026-27)

There is a different category of taxpayer, viz. Individual, HUF, Firm, LLP, Company, Trust and AOP/BOI. Due Date is different according to audit or non-audit cases of such categories as defined in section 263 of the Income Tax Act, 2025.

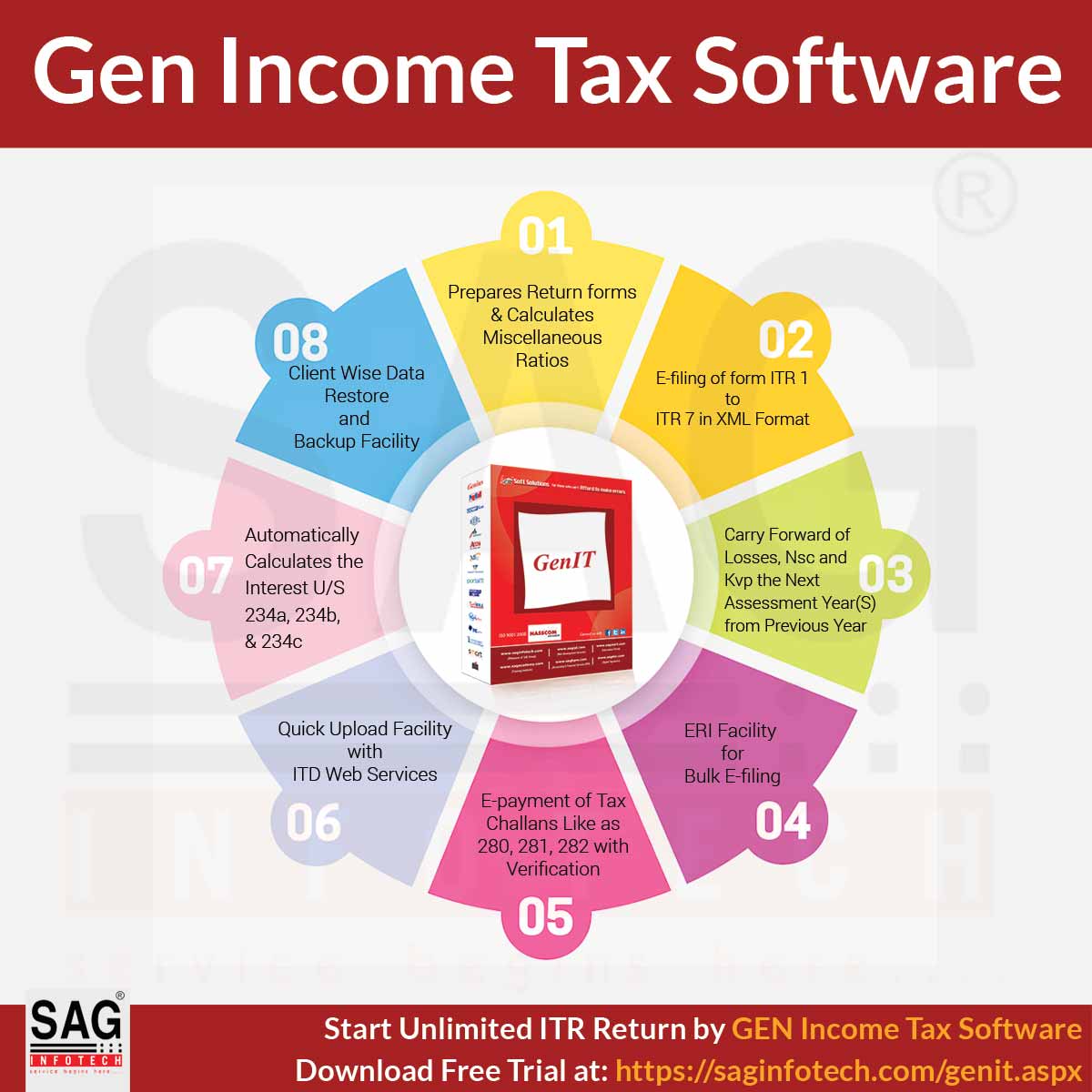

Free Download Gen IT Software for e-Filing Returns

Due Date of Income Tax Return Filing for AY 2026-27 (Non-Audit Cases)

- The common due date for filing the Income Tax Return by Assesse whose Books of Account are not required to be audited is 31st July 2026.

Filing Income Tax Return Due Date for AY 2026-27 (Audit Cases)

- The general due date for filing the Income Tax Return for the audit cases is 31st October 2026.

Due Dates for Tax Audit Report (3CA-3CD/3CB-3CD)

- The due date for filing the Tax Audit Report for all categories of assessees whose accounts are required to be audited is the date one month before the due date for furnishing the return of income under sub-section (1) of section 263, i.e., September 30, 2026.

Revised & Belated ITR Due Dates for AY 2026-27

- The due date for filing a revised and belated income tax return for AY 2026-27 is nine months from the end of the relevant tax year or before the completion of the assessment, whichever is earlier, i.e. 31st Dec 2026.

File Tax Returns for AY 2026-27 Before 31st December with INR 5,000 Penalty

The income tax department notified the taxpayers of the late filing of tax returns for A.Y. 2026-27, along with a penalty of INR 5000. However, if the taxpayer’s total income does not exceed Rs 5 lakh, then the maximum penalty levied for delay will not exceed Rs 1000.

Due Date of Income Tax Return Filing for AY 2026-27

(Assessee who are required to furnish a report under sec 92E)

- The due date for filing the Income Tax Return by an assessee who is required to furnish a report under sec 92E is 30th November 2026.

- The due date for furnishing a Report from an Accountant by persons entering into an international transaction or specified domestic transaction under section 92E of the Act for the Previous Year 2025-26, is at least one month before the due date of filing of return u/s 263(1)

What Would Happen If You Missed the ITR Filing Deadline?

Missing the deadline for filing Income Tax Returns (ITR) for the FY 2025-26 and AY 2026-27 can have some harmful effects. Take a look at what happens if you miss the ITR deadline:

- Potential for Scrutiny: Recognise that if you file your taxes later, it might grab the attention of the I-T department and expand the possibilities of them bringing a closer look at your income tax return. This could suggest they request more records, and it might take longer for you to get your tax refund on time.

- Interest on Unpaid Tax: If you are filing an ITR later and pay taxes, you have to pay additional money in interest on the amount that you owe from the deadline until you pay it.

- Loss of Carry Forward Benefits: Sometimes, you might be able to utilise any financial failures or tax deductions from previous years to reduce the tax amount you owe in the future. But if you have missed the ITR filing deadline, you might not be able to take any benefit.

It is essential to submit your ITR before the due date to avoid difficulties. Filing tax returns on time allows you to make the process much easier, stops you from facing penalties and extra costs, and provides you with all the tax benefits you are entitled to.

Advance Income Taxes Filing Due Dates FY 2025-26

If the tax liability is more than Rs 10,000 in a financial year, then advance tax needs to be paid by the assessee.

| Due Date | Compliance Nature | Tax Paid |

|---|---|---|

| 15th June 2025 | First Instalment | 15% |

| 15th September 2025 | Second Instalment | 45% |

| 15th December 2025 | Third Instalment | 75% |

| 15th March 2026 | Fourth Instalment | 100% |

The assessee who is covered under section 58 (i.e. Presumptive Income) is also required to pay the advance tax on or before the 15th of March of the previous year. However, any tax paid till 31st March will be treated as Advance Tax.

Most Important FAQs on the ITR Filing Deadline for AY 2026-27

Q.1 – What is the last date for filing an income tax return (ITR) for non-audit cases?

The due date for filing income tax returns for AY 2026-27 (FY 2025-26) is 31st July 2026

Q.2 – Could I E-file My Return after the due date?

Yes, you can file your late income tax return (ITR) upto 31st of December of that assessment year (AY) after paying extra fees and interest.

Q.3 – What is the due date to E-file income tax return (ITR) for Cos?

The deadline for filing the ITR of domestic companies for the financial year (FY) 2025-26 is 31st October 2026. For all companies, it is essential to e-file their Income Tax Returns (ITR) by a specific date every year.

Q.4 – Is It Possible to File a Revised ITR?

Yes, you can make the particular modification in your ITR after submitting it. It would be best if you changed it on or before 31st of December.

Q.5 – What happens if a person files their ITR after the due date?

If you have missed the particular deadline for filing your income tax return, then you have to pay some additional fees as per section 428 of the Income Tax Act, 2025.

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."

dear Sir,

I missed my ITR to file within due date that is 31.12.2023 for financial year 2022-23 now how can i file my returns for the same Ass.yr-2023-24 kindly guide me.

You can file late return for FY 2022-23 by filling ITR(U) updated return or fille return u/s 119(2)(b)

I am a partner of a Firm which is subject to Tax Audit. What would be the due date to furnish my ITR as Individual being a partner of a firm which is subjected to Tax Audit?

Regards,

Latha

The due date of the partnership Firm will be considered as your due date of filing of return as an Individual.

I have filed TAX Audit for 2021-2022 AY, but this assessment year 2022-2023 I have only salaried Income. But I am getting an SMS and Mail from IT dept every day to ask my CA to do Tax Audit before 30 Sept.

Is this general alert, which I can ignore or do I need to file this year also, even though I only have Salaried Income.

whether a private limited company can file income tax return without approval of its financial statements by board of directors. If so in what circumstances.

best web site good site i have seen today

Hello,

I missed the 31st May 2021 deadline for filing revised ITR for FY 2019-2020 due to illness in the family. I have some additional taxes also to pay from my interest income which was missed in the original return. What should I do now?

Dear Sir

Please update cash details submission of Ay-2020-21

I have invested in a property that gives assured returns. The company gave an assured return amount after deducting TDS. But now my income tax return is not showing the TDS amount. I am not sure whether the company has deposited the same or not. They are not even taking my calls. Kindly suggest what should I do.

Please Check your 26AS related financial year

Check in AIS

Dear sir,

Q1 & Q2 TCS is NIL, for Q3 Online TCS Payment,

On 30/1/2021, At the time Of Online TCS Payment, we took A.Y.-20-21 instead of A.Y.-21-22

what we do now??

Please contact to TDS Portal

You can change the FY through the Traces portal by selecting the “Request for oltas challan correction” in statement/payments.

Please let us know the consequences of non-filing of Form 10B within the due date

I am a Govt Employee and have shifted my department after tendering a technical resignation.

* My pay could not be protected during the FY 2019-20

* I got 59335 as my Total emoluments during the FY.

* I paid Home Loan Intt of approx 1 lakh

*I also paid premiums for insurance policies.

*Now I am to get Pay Arrears in 2021 Jan or so

*Whether I should file ITR 1 with all details or ITR2 Kindly suggest as I shall be filing the revised return and get my salary arrear adjusted.

A prompt reply is appreciated.

Thanks and regards.

To which department we need to reach out to know our refund status?

Income tax ward where your ITR is filed.

Income Tax Extended Date of 30/11/2020 for AY 2019-20 should be 31/03/2020 as earlier law.

The last Date for filing Belated Return of AY 2019-20 is 30th November 2020

Though my returns been e verified successfully on the 6th of July 2020 I am still to get my refund back. can you please give me some advice?

Sir in Case of Concern Registered U/s 12A and 80 G, What is the due date of Audit and ITR Fillings whether it would be 30 September every or vary depending on time to time extend due to respective Assessment Years please reply

FOR AY 2020-21 DUE DATE FOR FILING ITR FOR NON AUDIT CASES ARE 31 DEC 2020 AND FOR AUDIT CASES ARE 31 JAN 2021

Please share any notification or ref. released by CBDT.

Read Here – https://www.incometaxindia.gov.in/communications/notification/notification_88_2020.pdf

I am a salaried employee and I had submitted my ITR for AY 2020-21 on 21st September 2020. I had e-verified the same day. The status is still showing as E-verified, by when can I expect my refund to be credited to my account?

It depends upon the department regarding the processing of return. Please contact to the department regarding this matter.

This year I filed ITR 1 in the month of July 2020, but still, the ITR is not processed. Can anyone tell me how much time does it takes for processing the same? as in earlier years, it hardly took 30-45 days.

Please contact to the department

Sir, When I filled ITR 1 but error show (Invalid content was found starting with element ‘ExemptincAgrioth Us10’

Sir, What is the last date of the income tax return? NIL tax payer for student and housewife.

I’m trying to file ITR 2 for AY 2020-21 as of 13th Oct 2020 (today). However, the ITR 2 form is showing a penalty for late filing even though the due date is 30th Nov 2020. Could you please help me understand why this could be happening?

Thank you in advance.

Melin

when I was trying to file ITR for the AY 19-20 in the portal it is reflecting as the due date is over but the due date is Sept 30, can I know why this is happening?

Please File your return under section 139(4).

I HAVE MISSED TO FILE AUDITED INCOME TAX RETURN WITH AUDIT REPORT FOR F. Y. 2018 19 WHAT SHOULD I DO TO FILE IT

You can revise it till 30th September 2020

Is Schedule AL-1 is compulsory for all companies whether tax audit is applicable or not?

Yes, Schedule AL-1 is compulsory for all companies

I have missed to file a return for last FY 18-19 – can I file it now though there are no taxes due as I am a salaried employee with only one source of income.

If yes am I still liable to pay 10000

You can file your ITR for AY 19-20 up to 30 Sep 2020

Last date Kiya h balance sheet income tax file krne ki

30th November 2020 for AY 2020-21

Upto 30th November you can file.

Hi,

how can we pay additional salary or payments corresponding to the Financial Year ending on March 30, 2019, to the Directors after March 30 and before the ITR Closure of the FY 2019?

The above is needed so as to take out more funds from the company which can be shown as the cost of the company

Currently, as Director I have taken a certain amount until March 30, 2019, for which I have received Form 16 showing the TDS payments done till March 30.

Now if I take out additional amount “Y” as Salary in the month of August from the company and I would like to show it as my earnings for FY 2019, so total earnings will be :

X (for which TDS has been paid and Form 16 received)

Y – Additional fund to be taken out in August – How can we manage it from the TDS point of view. I am ok to pay the TDS penalty if needed. But then will I need a modification in Form 16 again

Best Regards

Rajat

With regard to the latest amendments in section 12A for Ayr 20-21, which is the due date for filing of Form 10B?

31st OCT 2020

Sir,

I have to file self-assessment return for AY 2020-21 with share investment capital loss. Can I file the loss return before November 2020 and carry forward the loss?

Yes, for AY 20-21 you can file your ITR on or before 30 Nov 2020

If IT returns are not claimed already, will investments made in July 2020 be considered for tax exemption for FY 19-20 now?

The payments of f.y 19-20 are paid in july 20 can be taken for tax exemptions

please tell me,

what are the documents to be given to CA for doing GST and INCOME TAX audit for the fy 2019-20

The documents which shall be required is details of the transactions entered during the financial year along with the supporting documents, GST Returns filed and copies of last year audited financials, if any.

Sir Due date of filing of TDS return for F.y. 2020-2021 1st Qtr. is 31-07-2020. Is this date extended to 31-03-2021 if yes kindly Provide Notification/Circular

Here is the notification – https://blog.saginfotech.com/wp-content/uploads/2020/07/notification_35_2020-1.pdf

I have filed my ITR on July 7th, 2020 assessment year 2020-2021. When till we can get my refund

It depends upon the processing of Income-tax return by the department

In which I have to file ITR as my income is below the exemption limit.

Type of ITR depends upon your nature of income. Please specify your nature of Income.

I need form 16 now for a loan but the govt office says that the form will be generated in July. How I manage form 16?

The last date to file the TDS return has been extended to 30th June 2020 for 4th quarter. You will get form 16 after TDS return has been filed by your employer.

The other alternative will be to get a certificate from Chartered Accountant certifying your salary for the Financial Year……..This will be accepted by the banks as an alternative to Form 16

You can also show 26 AS to the bank, that can also work as a provision Certificate. Final form 16 can be submitted later.

Hello. I am a senior citizen aged 62. My self-assessment tax works out to more than Rs 1 lakh as of now(1 Jul). Itr2 does not work out any interest. Do we have to calculate the interest and pay? Thanks in advance for your guidance.

I AM UMAID SINGH BHANDARI I AM EX BANKER RETIRED MANAGER AGED 73 YEARS AND NOT HAVING ANY BUSINESS INCOME

I HAVE SOLD MY OWN HOUSE PROPERTY AND TAX IS TO BE DEPOSITED WHEN THE RETURN IS FILLED ON OR BEFORE 30TH NOVEMBER 2020

KINDLY LET ME KNOW WHEN THE TAX CAN BE DEPOSITED ALONG WITH RETURN FILED OR BEFORE THE TAX LIABILITY IS ABOVE 1.00 LAKH.

PREVIOUSLY THE TAX was DEPOSITED WHEN THE RETURN IS FILLED IN JULY.

NOW WHEN THE TAX IS TO BE DEPOSITED AGAINST THE SALE OF MY OWN PROPERTY WHICH IS ABOVE 1.00 LAKH

KINDLY CLARIFY.

THE NOTIFICATION IS NOT CLEAR FOR THE SENIOR CITIZEN AND NOT HAVING ANY BUSINESS INCOME.

In the case of a senior citizen also if the tax liability is less then rs 1,00,000 then you can deposit the tax by 30th Nov without 234A interest liability. In case liability is more than Rs 1,00,000 then 234 A interest will be applicable from 31st July.

Hello, pls anyone of u gives reply….if is there any possibility to extend the date of IT return for the F.Y: 2018-19

It has been extended for J & K and Ladakh assessees up to 30th Nov 2019.

Last Date 31st March 2020 with late fee+Interest of Payble Income Tax of A.Y 2019-20

I could not file my return AY 2019-20. It comes error for the due date is over. I think the due date is extended up to July 31 2020. please guide me

You can file your income tax return u/s 139(4)/139(5) for AY 19-20 up to 31st July

For firms (audit purpose) …. is there any extension period to file the income tax return for the F.Y: 2018-19?

You can apply for condonation of delay.

Dear all,

I am working as an account in a construction company, as we have to deduct TDS for labours. I need clarification about TDS payment that after completing all work, shall we pay the amount.

Please kindly confirm the status

Thanking you,

subramanian.Al

Chennai

Sir, I got my Pvt Ltd Company registered on 25th May 2018 and Company Account opened in Aug 2018 with a deposit of Rs. 1 Lakh, Now business is running very slow. Only two transactions are there in the account of Rs. 5k and 8k. Please clarify whether should my account required an audit and when I have to file the ITR as the business is in the loss. Thanks.

As all the companies need to conduct an audit as per Companies Act, you have to also file form 3ca according to the income tax act.

Sir pls confirm what is the due date of tds return filling f. Y. 2019-20 .

30th November 2020

T d s last date

Trust not registered U/s12AA of the Act, what will be the due date for filing return of income of AY18-19?

If trust is covered under audit, then the due date is 15/10/2018 otherwise 31/07/2018.

My trust has 12A and 80G applicable for Tax Audit and last date

Due date is 15.10.2018

Practising since 1984 and now getting some trusts/societies which were registered long back and not they are coming for 12AA Registration, it seems while going for 12AA, have to file 3 years Returns, at present we can file only one year Return. please clarify and give possibilities to get 12AA Registration

Dear Sir, Last date of the audit and return filling of the year 2017-18

15th October 2018

IS EXTEND LAST DATE OF FILING OF RETURN FOR IN CASE AUDITED PROPRIETARY AND PARTNERSHIP FIRMS

Extended to 15th Oct 2018

What is the last date of audit case for the Assessment year 2018-19

Due date of audits for the AY 2018-19 is 30th Sep 2018.

SIR PARTNERSHIP FIRM (company)

FINANCIAL YEAR 2017-18

LOST DATE OF FILING RETURN

ANY CHANCE ARE THERE EXTEND

No such notification regarding extension has been issued as of now.

NIL KA RETURN HAM KAB TAK FILE KAR SAKTE HAI

For individuals/HUF/Firm (other than audit assesses), the due date is 31st August. In Kerala, the due date is 15th September 2018.