Towards the issue of the Indian economy, the people who have to earn up to Rs 50 lakh the majority of the salaries shrank in the Fiscal year 2020 despite prior to the pandemic has activated the recession income tax return filing data so far this year had posted.

Towards furnishing the returns for FY 20 income in form ITR-1 people within the income from salaries one house property and farm income up to ₹5,000 the furnishing deadline was 10/01/2021. The information present till January finish mentioned this division of tax filers, the largest group of taxpayers which were 6.6% less than a year earlier.

A 6.5% fall has been seen in this category and overall returns furnished till Jan end through all classes of the assessee which consists of assessee engaging firms, for the income obtained in FY 20. However there is no comprehensive data that have to audit their taxes till 15 February which has directed that the data is not including the last time filing assessees.

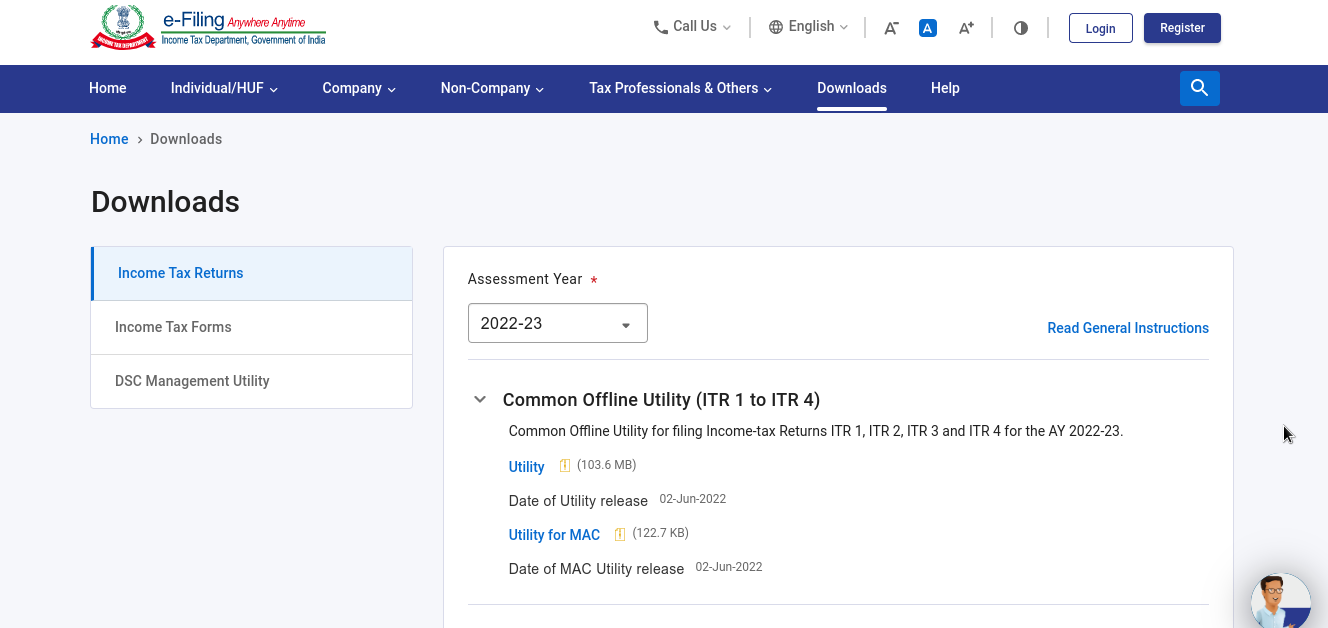

The income tax return

When worrying the shrinkage has happened for the year when the economy had raised through 4%. This year the same is likely to be contracted by 7.7%.

The experts stated that the drop for both ITR-1 and the overall furnishing can be caused by a combination of factors. “Possible confusion around the final due date and expectations of another extension may have played a role in the case of ITR-1 filing moderation. The possibility of employees not getting Form 16 due to closure of businesses, too, could have been a reason,” declared Archit Gupta, founder, and chief executive officer of online tax services provider ClearTax.

“The lack of access to financial consultants in smaller towns, where people have moved to during the pandemic, may have contributed to the overall decline in ITR-1 filings, though it has led to a sharp improvement in filings from such towns through tax e-filing service providers such as ours,”

Sonu Iyer, a tax partner, and national leader-people consulting services at EY, stated the real issue of covid-19 upon incomes will be identified from assessment year (AY) 2021-22 return filings.

The experts indeed direct that if one sees at the returns furnished through all the persons engaging with those who file the tax returns forms the other than ITR-1 because of their income from the trades, capital gains from unlisted shares, or have confirmed up for a known or assumed tax regime, the whole number is relatively steady in AY 2020-21 as in AY2019-20.

The experts have points that if one looks at the returns furnished through all persons, engaging the filing tax return forms

But the individual furnishing the returns has seen an inclination in the high-income division “Considering the impact of covid on cash flows, there could be delayed filings as well, just to manage the cash flow and pay taxes at a later point. A clear picture would arise only when the complete data till the year-end is available,” stated Divakar Vijayasarathy, founder and managing partner of DVS Advisors LLP, a tax consultant.

The email sends to the income tax dept urged comment remained unanswered till the duration of publishing. Explaining the direct tax base has been the priority of the council. Post-Nov 2016 demonetization and the 2017 rollout of GST which provides more clarity into reporting of sales and revenue through the businesses, income tax returns furnishings see the straight prolongation, however, moderated.