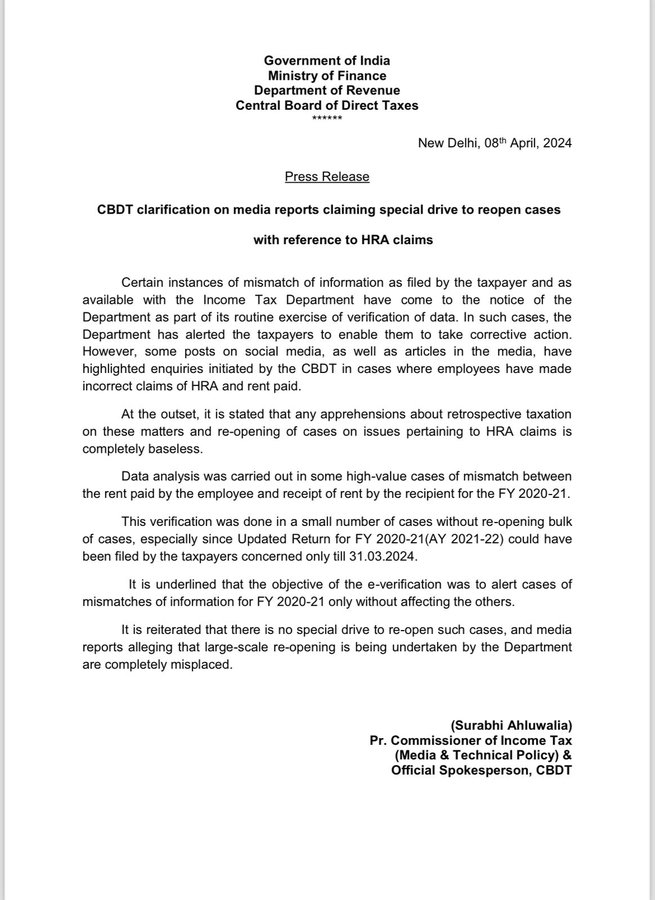

The Tax Department, or the Central Board of Direct Taxes, said that the drive to issue notices and reopen a “small number” of cases with mismatches between the rent paid via a salaried employee and the rent received via the recipient in FY21 was not counted under a special drive for it, as media notified in the public domain.

A data analysis for high-value cases showed the mismatch, the department observed.

As per the department, “It is stated that any apprehensions about retrospective taxation on these matters and re-opening of cases on issues pertaining to HRA claims are completely baseless,”

It said this verification was done in a few cases without re-opening the bulk of cases, especially as the updated return for FY 2020–21 (AY 2021-22) could have been filed via the assessees concerned only until March 31, 2024.

To Alert about the cases of mismatches of information for FY 2020–21 only without affecting the others was the objective of the e-verification, department mentioned.

Specific instances of mismatched data as furnished via taxpayer and as available with the Income Tax Department are required to arrive under the department’s attention as part of its routine exercise of data verification, CBDT mentioned.

Read Also: Specific Conditions for Salary Individuals to Claim HRA U/S 10 (13A)

Regarding these matters, the department has notified the assessee so that they can choose the precise measures.

HRA forms part of salary income, or CTC, and is calculated as taxable income. But when an employee lives in the rented accommodation then he or she could avail the income tax exemption for the HRA obtained in that year via submitting the true receipts of rent.

If taxpayers opt for the new tax regime the tax exemption is not available that does not have any exemptions. From FY25, the new tax regime will be the default tax regime which is the forthcoming assessment year.